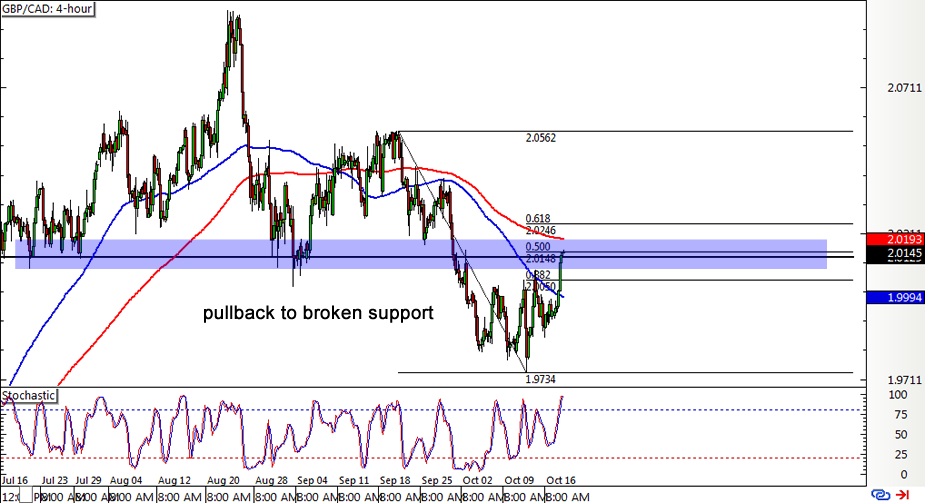

GBP/CAD: 4-hour

For the fans of break-and-retest setups out there, y’all didn’t think I’d miss this one on GBP/CAD’s 4-hour forex chart, did ya? After breaking below the head and shoulders neckline around 2.0150, the pair dipped to a low of 1.9735 before bouncing back up. Using the Fib tool on the latest swing high and low shows that the broken neckline support coincides with the 50% Fibonacci retracement level, which might hold as resistance. This is also close to the dynamic inflection point at the 200 SMA. Stochastic just reached the overbought zone so the bullish momentum might fade soon, allowing sellers to take over and push the pair back to the previous lows or much lower. A higher pullback to the 61.8% Fib could be possible, but a break above that level might mean that an uptrend is brewing.

BabyPips.com does not warrant or guarantee the accuracy, timeliness or completeness to its service or information it provides. BabyPips.com does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading at their own risk and BabyPips.com shall not be responsible under any circumstances for the consequences of such activities. Babypips.com and its affiliates will not, in any event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for 0.7000 kicks in

AUD/USD finally cleared the key 0.6800 barrier, up for the fourth session in a row on the back of the persistent downward momentum in the Greenback in the wake of the Fed’s rate cut.

EUR/USD maintains its constructive tone and targets 1.1200

EUR/USD managed to add to Wednesday’s gains and climbed to the area of weekly tops around 1.1180 following further weakness in the US Dollar as investors continued to factor in the likelihood of extra rate cuts in the next few months.

Gold maintains the upward pressure near $2,600

Following a pullback in the early American session, Gold regains its traction and trades decisively higher on the day at around $2,580. The 10-year US Treasury bond yield retreats toward 3.7%, supporting XAU/USD in the Fed aftermath.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

BoE expected to keep interest rate unchanged at 5% as price pressures persist

After a close call in August, the Bank of England’s September interest rate decision is keenly awaited for fresh cues on the bank’s future policy action and the pace of its bond sales.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.