Thinking of trading the Loonie this week? Take a quick look at Canada’s main economic components and see if you can find any forex trade opportunities!

Growth

-

Canada’s economy grew by 1.2% in 2015, half of the pace recorded in 2014.

-

Weak business investment and lower exports have weighed on Q4 2015’s GDP but…

-

The economy has now grown for four consecutive months, the longest stretch since the oil shock in 2014.

-

The Bank of Canada (BOC)’s low interest rates, a weak Canadian dollar, and slight recoveries in oil prices are translating to improvements in Canada’s trade, housing, and manufacturing sectors.

Employment

-

The net job gains in March (+40.6K) was the largest since October last year.

-

Increases were mostly from full-time and private sector jobs, which is good for the consumers’ spending capability.

-

Unemployment in energy-rich Alberta fell from 7.9% to 7.1% in March thanks to retail and wholesale trade-related jobs.

-

The health care and social assistance as well as accommodation and food services industries are the biggest job providers while the manufacturing sector continued to shed jobs.

Inflation

-

Annualized inflation grew at a slower pace for the second month in a row to its lowest rate since October 2015.

-

Low gas prices (-13.6% y/y) offset increases in food (+3.6%) and shelter (+1.1%) prices in March.

-

Prices for 6 out of 8 components of the consumer price index (CPI) went up in March.

-

The BOC is targeting an inflation range of 1.0% to 3.0% and is expecting headline inflation to return to 2.0% by the end of 2016.

Businesses

-

Reading the PMI reports: A reading above 50.0 indicates industry expansion while sub-50.0 results hint at contraction in the industry.

-

The IVEY PMI reports are reputed to show volatile results.

-

The RBC manufacturing PMI printed above the 50.0 mark for the first time in eight months and is the strongest reading since December 2014.

-

CAD depreciation and steady demand from the U.S. helped in boosting export orders for autos, consumer goods, machinery, equipment, and lumber.

Consumers

-

Retail sales rose to an all-time high of 44.2B CAD in February, as 9 out of 11 sub-sectors registered sales increases.

-

Clothing and accessories (+2.7%) and sporting goods, hobby, book and music stores (+2.0%) led the increases while gasoline sales (-4.9%) dragged the headline figures.

-

The continued increases in consumer spending support arguments for a strong Q1 2016 growth.

Trade

-

Canada’s trade deficit widened to a four-month high in February, as exports showed its biggest decline since 2009 after rising to a record high in January.

-

Exports of consumer goods and energy products as well as a decline in U.S. demand weighed on the trade data.

-

The 2.2% drop in export volumes was exacerbated by the 3.2% decrease in export prices.

-

Imports also showed weaknesses with its volume drop of 1.2% and 9 out of 11 subsectors showing declines.

-

Exports can still contribute to Q1 2016 GDP. January and February’s volumes are still 3.6% above Q4 2015 levels.

-

Investors aren’t too worried. The drop was expected after three months of gains for exports and stagnating indicators from the U.S.

Housing

-

Building permits jumped by its fastest pace since January 2014, as oil-dependent provinces like Alberta saw more demand for commercial buildings and institutional structures.

-

The current building pace suggests that residential investment would contribute to growth in H1 2016.

-

The BOC’s low interest rates has always helped the housing market, but this time its growth is not as suppressed by low oil prices as before.

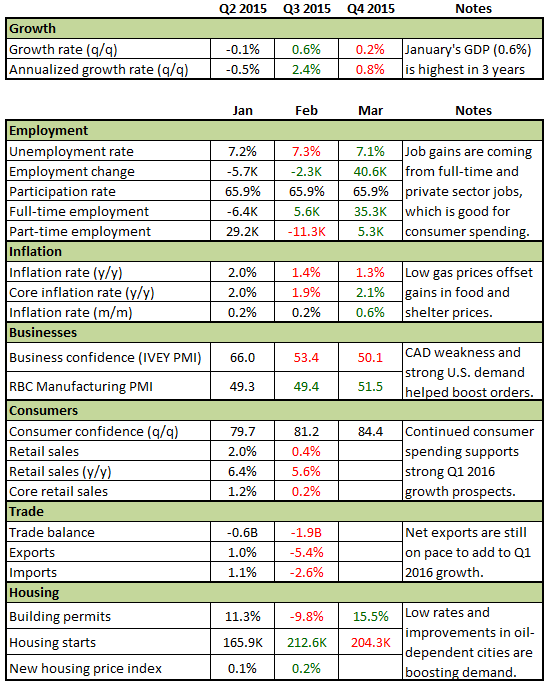

TL;DR? Check out the economic snapshot that I made for you!

Putting it all together

Canada’s economy had a shaky start thanks to the sharp decline in oil prices and worries over China’s economic prospects. However, the spurts of growth are starting to gain momentum.

A weaker domestic currency and relatively steady demand from the U.S. translated to increases in orders for Canada’s non-mining-related goods.

The increased business activity then led to more demand for employment and building permits and eventually more consumer spending. The BOC’s low interest rate environment has also helped, as it made it easy for businesses to fund their operations and potential homeowners to seek new housing.

For now it looks like Canada’s economy is making progress at developing growth outside of its mining sector. Until Stephen Poloz and his team see significant deterioration in the leading indicators or oil prices once again drop to threatening levels, it looks like there isn’t much incentive for the BOC to cut its interest rates lower.

BabyPips.com does not warrant or guarantee the accuracy, timeliness or completeness to its service or information it provides. BabyPips.com does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading at their own risk and BabyPips.com shall not be responsible under any circumstances for the consequences of such activities. Babypips.com and its affiliates will not, in any event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.