Market Brief

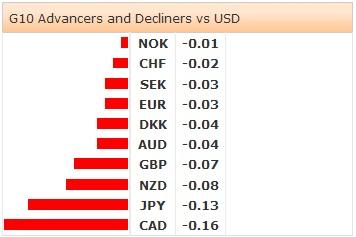

Markets were looking for a reason to sell-off and used the culmination of all the current macro events to rationalize a cut and run strategy. Between the Fed shifting slightly hawkish, EU heading towards deflation, corporates voicing worries over growth in the Ukraine and Russia, Argentines basic default and Ebola spreading, investors just had enough. Almost out for nowhere a modest sell-off became a collapse. Today risk appetite has only slightly less negative in Asia, after yesterday's sudden 2.0% collapse in the S&P 500. Risky assets found salvation in the better than expected China PMI. The Nikkei is lower by 0.28%, the Hang Seng down by 0.5%while Shanghai is just above fair value. Interestingly, G10 FX remained stable suggesting to us that this correction in risk should be short term. USDJPY and EURUSD were virtually unchanged drifting around 102.90 and 1.3390 respectively.

China's official manufacturing PMI rose to a two year high of 51.7 last month verse consensus of 51.4. This number was also higher then the prior read of 51.0 in June. The improvement was seen across all components except the employment index. Especially, positive was the advancement in new export orders which hit the highest level since 2009. This is a good reinforcement of our core view that global growth is improving.

In the European session traders will be watching PMI reads from the EU, UK, Norway and Sweden. Yet the primary focus will be on the US payroll report this afternoon. We anticipate a strong read across the report with NFP coming in at 265 vs 230k consensus and unemployment rate unchanged at 6.1%. Wages should be contained up 0.2%, and expected income and spending at 0.4%. what could grab a lot of attention headline PCE is expected to rise 0.2% m/m while core increase 0.1% in June. Should today's numbers come in as we expect this should reinforce the FOMC less dovish language, specifically change in inflation, and favor further USD buying.

Recommended Content

Editors’ Picks

USD/JPY trades below two-week top set on Thursday; looks to BoJ for fresh impetus

USD/JPY trades with a positive bias below the 143.00 mark as traders await the BoJ policy update before placing fresh directional bets. In the meantime, data published this Friday showed that Japan's Core CPI rose to a 10-month high in August and reaffirmed bets that the BoJ will hike interest rates again in 2024.

AUD/USD strengthens above 0.6800 on RBA-Fed policy divergence, eyes on PBoC rate decision

The AUD/USD pair trades on a stronger note near 0.6810 during the early Asian session on Friday. The uptick of the pair is bolstered by the softer US Dollar amid the prospects of further rate cuts by the US Federal Reserve this year. Later on Friday, the Fed’s Patrick Harker is set to speak.

Gold price holds steady near record peak amid bets for more Fed rate cuts

Gold price hovers near the all-time peak touched earlier this week amid a bearish USD and rising bets for more upcoming rate cuts by the Fed. Moreover, concerns about an economic downturn in the US and China further underpin the safe-haven XAU/USD.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.