Market Brief

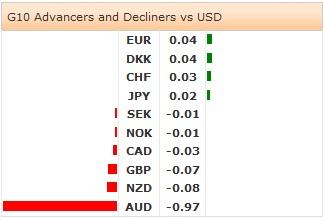

The Australian CPI y-o-y accelerated at the pace of 2.9% in Q1, faster than last quarter’s 2.7% yet still in RBA’s 2-3% target band. AUD/USD fell from 0.9377 to 0.9273, breaking below the 21-dma (0.9316). The downside move was intensified by weak data out of China. Offers trail below 0.9350/75, the sentiment turns negative as RBA hawks lose field. The next support is placed at 0.9209 (Fib 50% on Oct’13 – Jan’14 fall). AUD/NZD aggressively sold-off to 1.0792 (slightly below the 21-dma), a daily close below 1.0770 (100-dma & MACD pivot) should confirm the short-term bearish trend. We expect the antipodean pair back in the broad bearish trend as RBNZ is expected to hike its OCR from 2.75% to 3.0% on April 24th policy meeting.

In China, HSBC preliminary manufacturing PMI printed 48.3 as expected (vs. 48.0 last month). The contraction in new orders and the slowdown in China’s factory output sent USD/CNY to 6.2466, highest since February 2013. The key resistance sits at 6.2500, offers eyed above.

EUR/USD remained well bid in Asia, decent EUR demand versus Aussie and Yuan helped. EUR/USD spiked to 1.3837 as Europe walked in this morning. The April preliminary manufacturing PMI readings are in focus across the Euro-zone today. Trend and momentum indicators are to remain marginally bullish as long as the Fibonacci support at 1.3781 holds. EUR/GBP hit our mid-term target of 0.82042 (March 5th low) yesterday and rebounded from the support zone at 0.81828/0.82000 (30-day lower BB (yday)/psychological support). Trend momentum remains negative.

The BoE releases the April meeting minutes today. As reminder, the 3-month unemployment fell below BoE’s former 7.0% threshold in February ILO report. We will be looking for any hint on improvement in jobs market and relation to BoE’s future policy outlook yet no surprises are expected. GBP/USD consolidated gains above 1.6820 in Asia. Technicals are steadily bullish. Option bids are placed at 1.6775/1.6840/50/75 and 1.6900 for today’s expiry.

USD/JPY and JPY crosses traded mixed in Tokyo. US President Obama’s visit in Japan is in traders’ focus. Will there be any reference to currency rates? There is little probability in our view yet the event risk is to be taken into account. USD/JPY continues seeing resistance at 102.96/103.05 (100-dma & daily Ichimoku cloud top). Stops are eyed above.

Today, the focus is on French, German, Euro-Zone, UK and US April (Prelim) Manufacturing and Services PMIs, the BoE meeting minutes, UK March Public Finances, Euro-Zone Debt-to-GDP Ratio, UK March CBI Trends Total Orders, Selling Prices and Business Optimism, US April 18th MBA Mortgage Applications, Canadian February Retail Sales m/m and US March New Home Sales m/m.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.