Market Brief

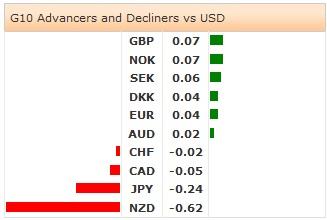

The Chinese GDP growth slowed from 7.7% to 7.4% in the first quarter, slightly higher than 7.3% expected. The expansion in China’s industrial production missed market expectations in March, the retail sales printed slightly better performance. The urban investments increased by 17.6% (vs. 18% exp. & 17.9% last). The FDI is due today. The overall Chinese picture lifted the risk appetite in the emerging Asia; stock markets traded mostly in green. USD/JPY advanced to 102.29 as Nikkei stocks gained 3.01%.

In New Zealand, the CPI accelerated 0.3% q-o-q (vs. 0.5% exp. & 0.1% last) and 1.5% y-o-y (vs. 1.7% exp. & 1.6%). NZD/USD traded with negative bias on softer NZ inflation and China concerns. Better-than-expected Chinese data failed to reverse the intra-day bearish momentum, NZD/USD traded down to 0.8579. Bearish techs suggest deeper correction in NZD; however the inflation data is unlikely to impact expectations on RBNZ rate hike on April 24th. The bias remains on the upside.

AUD/USD fell to 0.9332 on slower Chinese growth concerns. The relief rally post data (slightly better-than-exp.) sent AUD/USD to 0.9380 walking into the European opening. The MACD (12, 26) is to step in the red zone for a daily close below 0.9315. Option related bids trail above 0.9375, offers are to be tipped below 0.9340. AUD/NZD extends gains to 1.0912, highest since February 4th. Decent option bids are placed at 1.0900 for today’s expiry.

Released yesterday the UK headline inflation retreated from 1.7% to 1.6% in March as expected. GBP/USD spiked to 1.6661, before quickly bouncing to daily averages. The UK jobs data is due today and the average weekly earnings may have increased to 1.8% annually (vs. 1.4% in February). GBP/USD rallies to 1.6746 as Europe walks in. Technicals are bullish, resistance pre-1.6750 is being tested this morning, stops are eyed above. On the downside, the first line of support stands at 1.6632/35 (50 & 21 dma).

The Euro-zone inflation figures are due today (at 09:00 GMT) and should confirm the further softness in preliminary headline and core CPI readings: CPI y/y expected at 0.5%, CPI core at 0.8%. EUR/USD advances to 1.3831, demand in EUR/JPY helped. The 21-dma (1.3796) remains the key short-term support.

The US inflation accelerated faster than expected in March. The CPI m-o-m advanced from 0.1% to 0.2%, pulling CPI y-o-y up from 1.1% to 1.5% (vs. 1.4% expected). The CPI y-o-y excluding food and energy hit 1.7% (form 1.6% expected & last). The numbers are USD-supportive although the market reaction remained limited. We are only half a percentage point lower from some Fed participants’ 2% inflation threshold to keep rates at the current lows. DXY advance to 79.904, yet couldn’t make it higher than the 21-dma (79.972).

Today, the Bank of Canada will give policy verdict and is expected to keep the policy rate unchanged at 1.0%. Traders also watch the Norwegian March Trade Balance, Italian February Trade & Current Account Balance, UK March Claimant Count Rate and Jobless Claims Change, UK February 3 months ILO Unemployment Rate and 3 months Average Weekly Earnings, Euro-Zone March (Final) CPI m/m & y/y, Credit Swiss ZEW Survey on April Expectations in Switzerland, US April 11th MBA Mortgage Applications, Canadian February International Securities transactions, Us March housing starts and Building Permits, US March Industrial Production & Capacity Utilization, US March Manufacturing (SIC) Production and US Fed Beige Book.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.