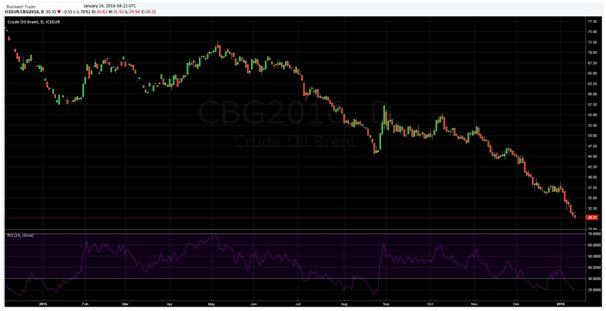

The looming spectre of Iranian oil shipments has spooked world oil markets as the price of Brent crude has declined below $30 a barrel for the first time since 2004. Speculation is mounting that world oil markets could be in for a rough year as global demand continues to sag.

Despite US domestic concerns over the viability of an Iranian nuclear deal, it appears that an agreement is close to being achieved. Such a monumental step would allow Iranian crude oil to flow freely following the lifting of sanctions. Subsequently a nuclear deal could have a significant impact on world crude markets as Iranian exports could further depress a sector already mired in over-supply.

Subsequently, as the parties appear close to reaching a resolution, the increasing risks of the additional supply are being priced into global oil prices. In fact, crude oil prices in London have slumped over 1.8 percent whilst WTI desperately clings to the $30.00 handle. The widening gulf between Brent and WTI prices continues largely due to the risk that the additional seaborne supply poses to Brent.

The return of Iran to the oil exporting fold has the potential to significantly impact global oil prices. The beleaguered state is likely to exacerbate the current global oversupply by an additional 500,000 barrels per day. This level of supply could potentially rise to 1 million barrels a day, within 6 months, following the lifting of sanctions.

Subsequently, Brent crude oil prices are likely to remain under pressure until some certainty is obtained regarding the lifting of sanctions. Currently, London crude oil is trading around the $29.92 a barrel mark but the additional Iranian supply could very well see prices around the $24.00 range. Subsequently, traders are keenly watching the outcome of the nuclear negotiations for a hint at Brent’s future trend direction.

In addition, poor US consumption and inventory data further complicates the markets view of future demand. As the world’s largest consumer of oil products markets typically look towards the US data for signs of strength. However, gasoline stockpiles continue to grow and are currently at over 240 million barrels, the highest since February of 2015. Subsequently, concerns continue to mount over a US led slowdown in demand that could have a long lasting impact in crude markets.

Given the current lack of demand, coupled with the continuing oversupply of crude, the coming quarter looks bleak for Brent and WTI prices. Crude oil markets are in a perilous position and as the essential rebalancing occurs we could very well see a significant change to the market structure and power of Middle Eastern participants in the coming year.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.