As crude oil and other commodity prices have rallied over the past few weeks, some analysts have pointed to a new, resurgent age, in commodity demand out of China. However, the recent rally hides the current supply side rebalancing that is occurring within the Asian power house.

October has been a watershed month for commodity markets as the weaker US economic data, along with supply cuts to metals, have provided some buoyancy to depressed prices. In particular, crude oil (WTI) has fought its way out, from a tight range, to rally to nearly $50.00 a barrel. The metals markets were also relatively upbeat with both Gold and Silver experiencing rallies. However, the negative fundamentals, that led us to where we are today, are still present within the global markets.

Despite the short term bullish trends, an oversupply is still the key fundamental aspect in the long term. Production capacity across a range of commodity markets has been increasing for well over a decade due to growing demand from emerging markets (EM). Rising commodity prices meant a growing incentive for increased production capacity and innovation within many of the operations. This phase of capacity build-up has effectively led us to where we are today, a fundamental over-supply, and significantly depressed prices.

There is a view that the decline in commodity prices that has occurred since 2014, was primarily caused by macroeconomic factors, including deflation in input costs and the US Dollar. However, this argument seems to avoid any mention of China and the ongoing rebalancing that is occurring between CAPEX and OPEX.

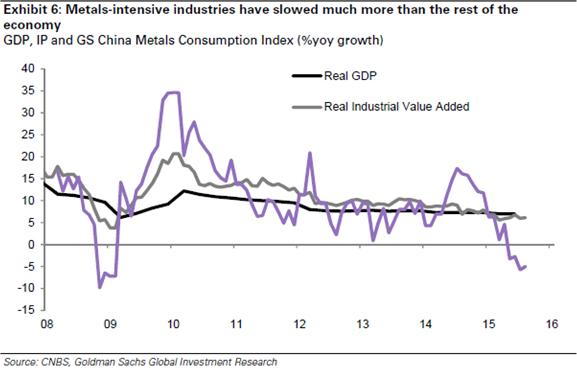

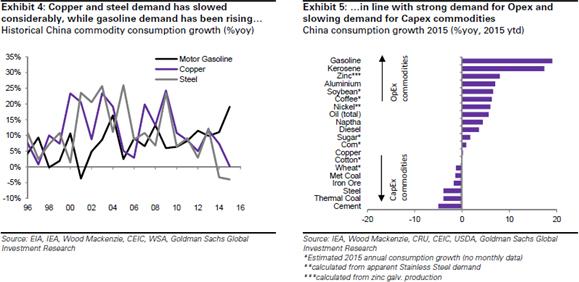

As China’s markets mature, there are some key indicators that investment is moving away from CAPEX industries (Steel, Cement, Iron et.al) towards OPEX based industries (Energy, Aluminium, and consumption based commodities). Historically, China has reached a point where their level of income and growth supports a structural move away from industries requiring significant capital expenditure. This structural change is not at all unexpected, and has been bandied about by analysts for some years, but the reality of the change is yet to become fully apparent to market participants.

The rebalancing of commodity demand within China is likely to pose some challenges for those within the metals industry as it becomes clear that “peak metals demand” might actually now be behind us. China has also recently come some way in developing a level of independence within their domestic metals industry, especially towards nickel pig iron. This level of independence is starting to subsequently impact demand for commodity imports.

The question remains as to which country will fill the Asian powerhouse’s void and step up to become the next “China” within the EM. India certainly has the underlying growth and population to support the strong demand for capex and the requisite building of productive capacity. As likely a candidate as India is, it will have to remain to be seen which country is to fill the exceedingly large shoes that China will leave behind.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.