USD/CAD

The dollar traded higher against all of its G10 major peers during the European morning Thursday, after having corrected over the past few days.

The euro was lower during the European morning ahead of the preliminary German CPI for November. All of the regional CPIs were 0.1-0.3ppt lower on a yoy basis (except Bavaria), indicating that the national inflation rate is also likely to be lower. In the meantime, even though the unemployment rate remained unchanged at 6.6% in November, the unemployment change declined 14k from -23k previously, showing that the labor market in Germany remains strong. Although the labor market shows signs of improvement, the softer inflation data raise the likelihood that Friday’s Eurozone estimate CPI rate may show a decline as well. With just a week ahead of the ECB’s crucial December meeting, the low inflation confirms President Draghi’s concerns that a stronger recovery is unlikely in the coming months and reinforces my opinion that the euro has plenty of room to the downside.

The Canadian dollar moved lower ahead of the OPEC’s press conference later in the day, due to concerns that the organization may not reach to an agreement to cut its oil production. However, given the recent batch of positive data and the positive sentiment towards CAD since early November, the currency doesn’t seem to react much on the ongoing decline in oil prices. Nevertheless, OPEC’s decision today could have a strong downside impact on CAD, given that the members fail to reduce oil production.

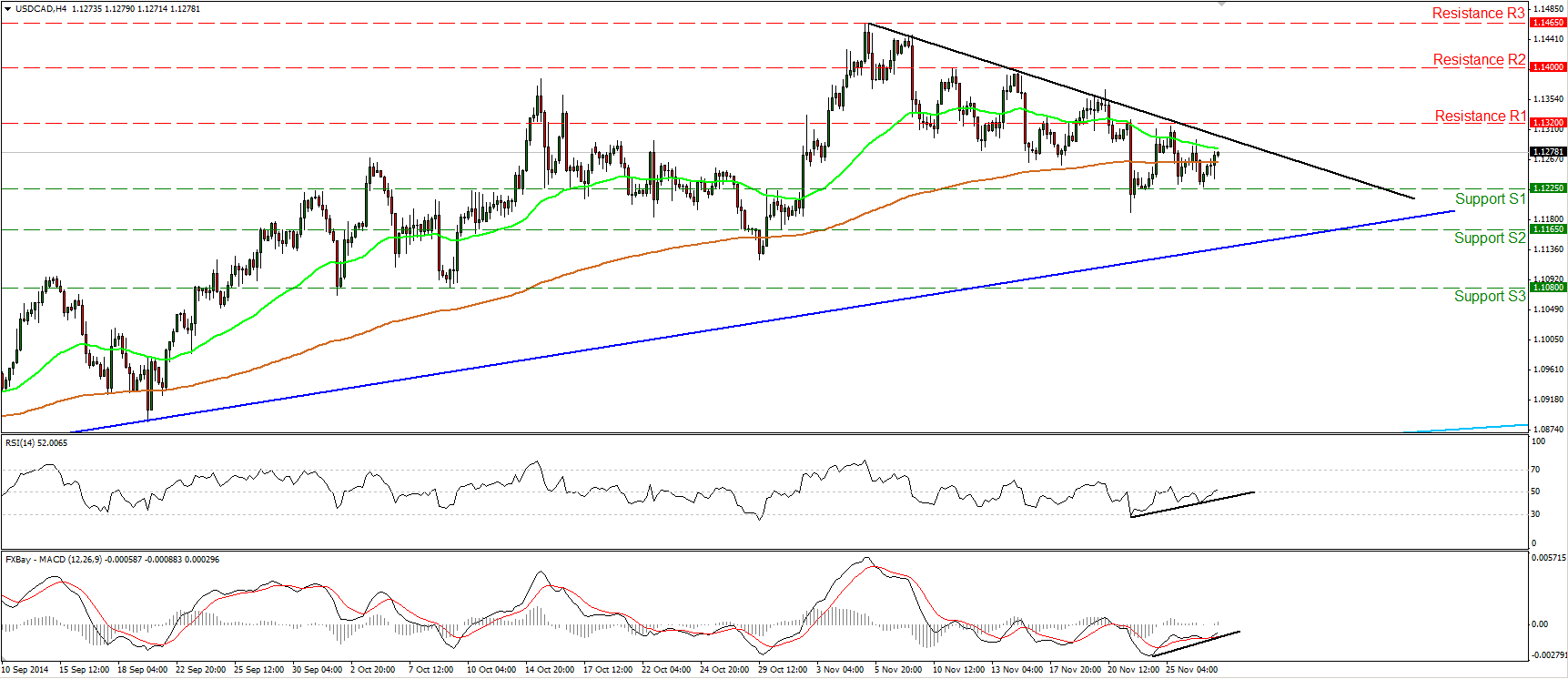

USD/CAD rebounded somewhat after finding support at 1.1225 (S1). Although the pair is still in a retracing mode, as marked by the short-term black downtrend line, I see signs that we may be experiencing the latest stages of the correction. A move above the black downtrend line and above the 1.1320 (R1) area is likely to reaffirm the case and perhaps trigger extensions towards our next resistance hurdle at 1.1400 (R2). The first reason why I believe the retracement could be ending is that, after printing a low below 1.1225 (S1) on the 21st of the month, the following lows where formed above that line. Second, our momentum studies have started printing higher lows as marked by their black upside support lines. Also, the RSI moved above its 50 line, while the MACD stands above its signal line and could enter its positive field in the near-future. As for the broader trend, on the daily chart, the dollar/loonie rate is still trading above both the 50- and the 200-day moving averages, and above the blue uptrend line drawn from back at the low of the 11th of July. Hence, I still see a longer-term uptrend.

Support: 1.1225 (S1), 1.1165 (S2), 1.1080 (S3).

Resistance: 1.1320 (R1), 1.1400 (R2), 1.1465 (R3).

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.