USD/NOK

The dollar traded mixed against its G10 counterparts during the European morning Thursday. It was higher against GBP and JPY, in that order, while it remained lower against NOK, SEK, AUD, CHF and EUR. The greenback was stable vs NZD and CAD.

EUR/USD moved higher as the bloc’s preliminary PMIs for October managed to remain above the neutral level for the 16th consecutive time. Eurozone’s preliminary composite PMI - covering both the manufacturing and service sectors – beat expectations of a drop below the 50 level and rose from the previous reading. Even more of a surprise was the rise in the German manufacturing PMI into expansionary territory. EUR/USD gained on relief that German manufacturing is expanding despite the recent weak batch of data. However, since EUR/USD failed to reach the 1.2700 level, I would maintain my view that the recovery from 1.2500 has probably ended and a test of 1.2600 as a first step is on the horizon.

The Swedish krona also gained vs the dollar after the country’s unemployment rate declined in September strengthening SEK at the release.

The British pound was the main loser during the European morning following the unexpected drop in retail sales excluding gasoline in September. The poor data only reinforce my opinion that we still have further room to the downside.

Norges Bank left its key policy rate unchanged at 1.5%, as expected. In the statement accompanying the decision, Bank Governor Oystein Olsen noted that the outlook for inflation and output are broadly in line with September projections. NOK gained on the news, most likely due to relief that the Bank left rates on hold despite the fall in oil prices. If oil prices continue to fall, they could weigh on the Norwegian economy and put the NOK under selling pressure.

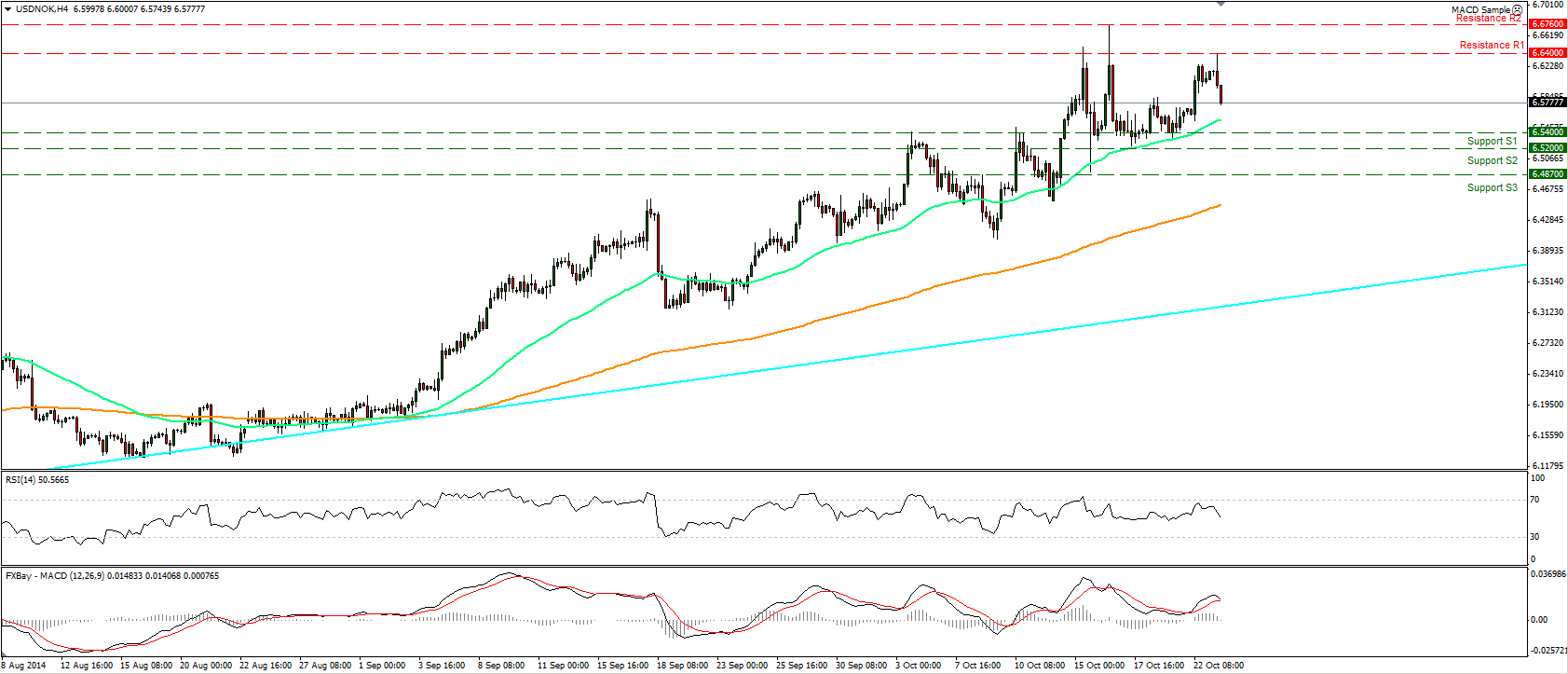

USD/NOK moved lower following Norway’s central bank decision to keep its benchmark interest rate unchanged. The decline of the pair may set the stage for another test near its 50-period moving average, which has provided fairly reliable support for the lows in the recent past. Looking at our short-term momentum studies, the RSI declined after finding resistance near its 70 line while the MACD, shows signs of topping and seems ready to cross its trigger line. Both stochastics are moving down and support the notion that the initial test of the 50-period moving average and then the 6.5400 (S1) support level are possible. A break below could trigger further bearish extensions towards the 6.5200 (S2) zone. As for the bigger picture, as long as the rate is forming higher highs and higher lows above the light blue longer-term uptrend line (taken from back at the low of the 8th of May), I see a positive overall picture.

Support: 6.5400 (S1), 6.5200 (S2), 6.4870 (S3) .

Resistance: 6.6400 (R1), 6.6760 (R2), 6.7300 (R3) .

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.