![]()

As we reported earlier today, crude oil is currently driving almost everything at the moment. In particular, it has been correlating positively with the equity markets due to oil’s obvious impact on the energy stocks. So, when oil prices bounced back from the key $30 handle today, the severely oversold energy stocks jumped and global indices and index futures have correspondingly rallied. US markets have been supported further by forecast-beating earnings from JPMorgan, which has lifted hopes that the rest of Wall Street banking giants will also provide positive or at least better-than-expected numbers over the next several days.

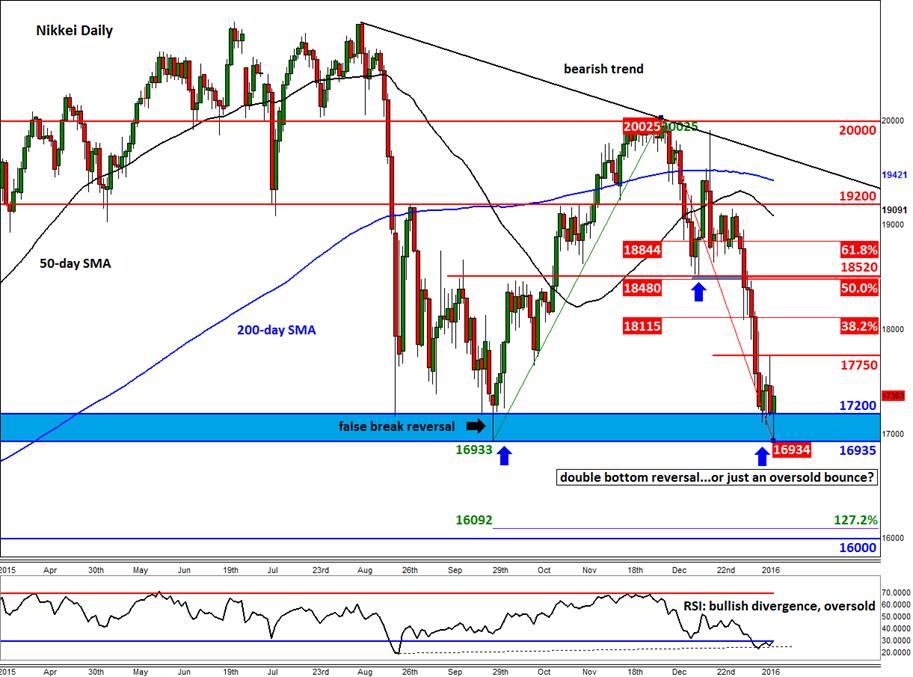

But the key question remains: is this just an oversold bounce, or the start of a new upward trend? To answer that question, we will need to turn our attention to technical analysis. And since it has been a while we last covered the Japanese stock market, we are looking at the daily chart of the Nikkei today, below.

As can be seen from the chart, the index has bounced back sharply during the European and US sessions after closing down more than 2.5 per cent in normal trading hours overnight. As things stand therefore, Tokyo shares could gap sharply higher at the open.

Now, this is not the first time the Index has bounced from the technically-important area between 1935 and 17200. The last time it bounced there was at the end of the last bear trend in September, when it momentarily traded below 17200 to fall to a low of 1935 but only to close the trading day back above 17200. Consequently, it formed a clear reversal pattern: a false break down. From false breaks come fast moves in the opposite direction and so the Nikkei went on to climb all the way to 20000 before the rally stalled at the end of November/early December. December was a bad month and we all know what happened in the first week of 2016.

Today’s bounce however suggests it may have formed a double bottom around the September low of 16935. Either that or the sellers simply took profit here en masse which caused the index to bounce. After all, taking profit at this key level makes perfect sense, especially since the momentum indictor RSI is currently in a state of bullish divergence with the index and that it is also at the oversold territory of below 30. Speaking of 30, that is exactly where the two oil contracts have also bounced; again, that could just be an oversold rebound in the oil market.

So, at this stage, traders should proceed with caution, as the bear trend is still in play. The bulls will need to see some confirmation such as a break of a key resistance in order to grow in confidence that this is in fact a double bottom pattern being formed. So, for that reason, price action around the previous intra-day high of 17750 would be important to watch. A decisive break above here could see the index rally towards the next levels of resistance shown on the chart, including the Fibonacci retracements. Conversely, if the sellers re-emerge and the index falls below the 16935 area decisively then the next stop could be some distance away, possibly around the 127.2% Fibonacci extension level at 16090 or the psychologically-important level of 16000.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY recovers to 143.00 area during BoJ Governor Ueda's presser

USD/JPY stages a recovery toward 143.00 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Gold price advances further beyond $2,600 mark, fresh record high

Gold price (XAU/USD) gains positive traction for the second successive day on Friday and advances to a fresh record high, beyond the $2,600 mark during the early European session.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.