![]()

The FX markets have been fairly quiet thus far today and understandably so because of the lack of any major market moving events. But things could change dramatically from tomorrow onwards due to a number of high-impact economic reports from both the euro zone and the US later in the week. Wednesday will be a particularly busy day as for as economic data is concerned, for not only will we have the preliminary German CPI and the US first quarter GDP estimates but a FOMC meeting, too. The Fed is widely expected to produce a modestly dovish policy statement following the release of generally disappointing economic data since its last meeting. But as mentioned the market will be expecting this, so the Fed will either have to say something uber dovish or something surprisingly hawkish for volatility to spike. One potential factor that could cause the dollar to rally would be if the Fed officials downplay some of the economic slowdown as temporary. If seen, this will undoubtedly increase market conviction about a rate hike later this year. In addition to the FOMC meeting, there will be plenty of other US and non-US macro pointers to look out for this week. Please refer to the “Data Highlights” section of our latest Weekly Outlook for details.

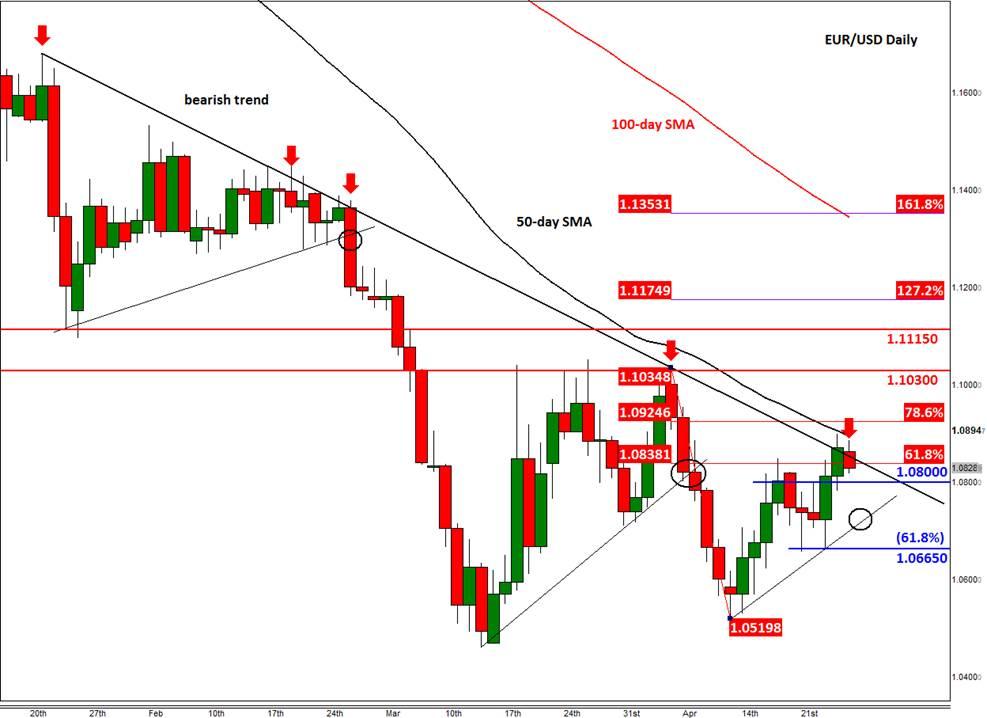

From a technical point of view, the EUR/USD is looking vulnerable for another move lower this week following its recent bounce back. As can be seen on the chart, the world’s heaviest traded currency pair is currently struggling to get passed a bearish trend line around 1.0850/80. This is not the first time that this trend line has offered stiff resistance and may not be the last time either. If more sellers choose to show their presence here then the EUR/USD could fall dramatically, for the fundamentals still point to lower levels as the ECB’s on-going euro zone government bond purchases further weigh on yields. In the past, each time the euro sold off from around this trend line, it went on to take out a corresponding short-term corrective trend, before extending its decline. There is another such trend seen around the 1.07 area, but to get there it will first need to take out the 1.0800 support level. Meanwhile if for whatever reason the EUR/USD manages to extend its gains from last week then it may go for another test of the key 1.1030/50 resistance level. For as long as it holds below this area, the near-term bias would remain bearish. But a decisive break above here would create the first “higher high”, which, if seen, would thus mark an end to the near term bearish trend. The probability of this happening is low, in our view. Indeed, data permitting, we expect the EUR/USD to not only turn lower from around these levels, but also go on to achieve fresh multi-year lows, soon. As well as the corrective trend, the 1.0665 support (which incidentally also corresponds with the 61.8% Fibonacci level of the most recent upswing) is the key pivotal level; a break below here would be decisively bearish. For a detailed explanation of Fibonacci analysis, please read our Ultimate Fibonacci Guide.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.