![]()

The S&P has edged into the negative territory for the year. In contrast, European markets are sharply higher with the DAX up 21%, Euro Stoxx 50 and CAC both 17% higher, and the FTSE lagging behind with a gain of 4.5% year-to-date. In Japan, the Nikkei is up a good 11% so far this year. Clearly funds are flowing into regions where the central bank is still uber-dovish. Whereas the US Federal Reserve is preparing for its first rate hike in several years, the European Central Bank has only just started its bond purchases programme. The Bank of Japan’s policy is still very accommodative while the Bank of England’s Governor has said the next interest rate move will most likely be higher, though the FTSE may nonetheless benefit from an improving Eurozone economy. In the US, the economic conditions have deteriorated slightly, although the jobs market is still growing strongly. And though the Fed is widely expected to raise interest rates this year, the pace of the future hikes will probably be gradual. So, it is not all doom and gloom for the stock market of the world’s largest economy. Also weighing on US markets this year has been the disappointing fourth quarter earnings season. So ahead of the first quarter reporting season, which kicks off in a couple of weeks’ time, investors are understandably exercising a bit of caution, for after all the dollar has risen further since Q4, which is obviously not good news for exports. However that’s not to say that the US markets are necessarily on the verge of a collapse. The first quarter reporting season, for example, may turn out to be better than expected. What’s more, the Federal Reserve is turning less hawkish. Last week, for example, the dot plot of the FOMC showed the pace at which interest rate may rise this year will likely be slower than previously thought. Recent comments from several Fed officials have echoed this view. In this regard, the speech by Fed chairwoman Janet Yellen, at 7:45pm BST this evening will be extremely important.

Technical outlook

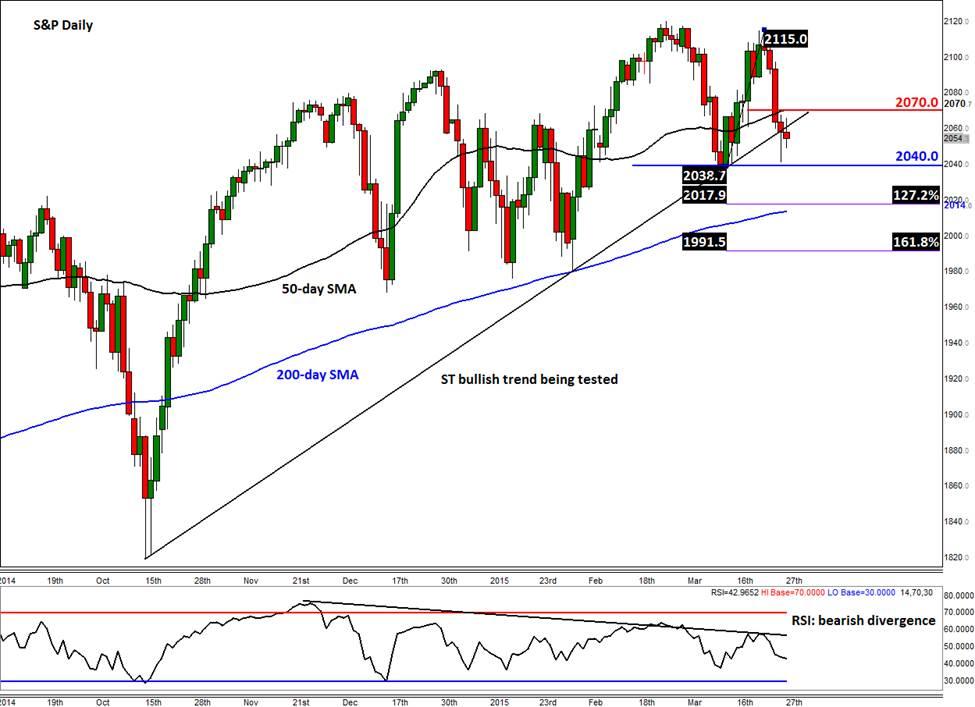

The near-term technical outlook on the S&P 500 looks somewhat bearish. At the time of this writing, the index was holding below a short-term bearish trend line and threatening to head lower. For the bears, the key support that needs to break down is around 2040. If seen, this could give rise to further technical selling towards the 200-day moving average, currently at 2014. The daily and weekly RSIs are both showing bearish divergences i.e. the recent higher highs on the S&P were not confirmed by rising momentum. The weekly chart is also currently displaying an uncompleted bearish engulfing candle. Thus, if the S&P were to close today’s session around these levels then things would not look great for the week ahead. Nevertheless, the index still remains inside a long-term bullish channel and therefore the best the bears can hope for at the moment is a move down towards the support trend of this channel around 1950, which would, however, still mark a significant correction. But as the long-term trend is still technically bullish, it is important not to get too carried away, if you are a bear. Therefore it is vital to watch the support levels, such as the Fibonacci retracements and extensions on the two charts, below, closely. Meanwhile a potentially bullish development would be if the index takes out Thursday’s high (circa 2067) and also the 50-day moving average at 2070. If seen, the index could then easily retrace much or all of its near-term losses and over time potentially rally to a fresh all-time high.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly just above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.