The GBP/USD pair is bouncing from a fresh 2-week low established at 1.5580, barely holding above the 1.5600 level ahead of the US employment data to be released in a couple of hours. The Pound found support in local construction data, showing that the sector rebounded in June, from the almost two year low posted in April, according to the latest Construction PMI reading, up to 58.1. At the same time, the Nationwide Housing Prices report for June, showed that the annual pace of house prices slowed in June, moderating to 3.3% from 4.6% in May. Lower prices are positive for the GBP as the BOE fears a housing bubble due to strong surge in price over the last two years.

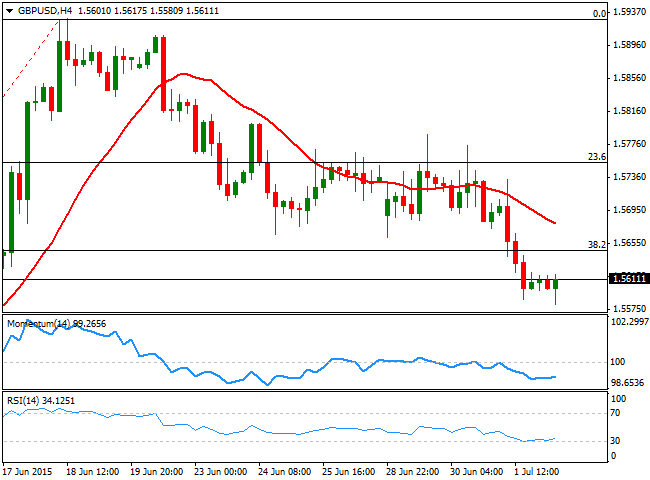

Technically, the pair maintains a negative tone according to its 4 hours chart, as the price is far below its 20 SMA, whilst the technical indicators are barely bouncing from oversold territory. The upcoming direction will be solely dependent on US data, with a negative reading probably triggering a stronger reaction in the pair than a positive one. Should the numbers disappoint, the key resistance level to watch comes at 1.5645, the 38.2% retracement of the latest daily run, as a recovery above it should lead to a continued advance up to the 1.5690/1.5700 region.

To the downside, the main support stands at 1.5550, the 50% retracement of the same rally, with a break below it exposing the pair to a decline down to 1.5480/1.5500.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.