Introduction

Although the NY session yesterday saw some waning of risk-off sentiment, turnover is high across asset classes and the Nikkei 225 index has lost close to 2.5% overnight. EUR/USD broke the 1.1300 barrier during both NY and APAC trading and trades just below there now. Ahead, Yellen takes centre stage in front of the Fed. committee, not before data releases in both Denmark and the UK.

Asian Session

AUD underwent some strength overnight with Westpac bank releasing good consumer confidence data and also positive new home sales info. released. The currency trades close to the .7100 figure versus the greenback and has found resistance there.

Across the Tasman sea, Kiwi trades at .6635 and 1.0678 against USD and AUD respectively. Electronic card retail sales data proved relatively positive overnight, particularly MoM.

Amongst the emerging Asian currencies, IDR was the largest gainer versus US dollar. Largely this came as a result of USD weakness, seen evident in the fact that the ADXY index has traded close to the 106.0 level.

The day ahead in Europe and NY

Holidays continue in Asia and lead the market to lack definition somewhat as Europe opens. USD/JPY trades below 115.0 at the moment and has meandered just above this level and within the 114.0 figure over the last thirsty six hours.

Danish inflation data prints at 08:00 GMT today with USD/DKK trading at 6.6154 right now. The pair has moved down from a high this week on Monday at 6.7316.

At 09:30 GMT the UK will witness manufacturing and industrial production data releases. Although the YoY manufacturing production info. is set to come in at -1.4% compared to -1.2% previously, the industrial manufacturing print is set to rise up to 1.0%.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.128 | -0.11% | 1.1311 | 1.1276 |

| USDJPY | 114.6 | -0.22% | 115.26 | 114.26 |

| GBPUSD | 1.4453 | -0.13% | 1.4486 | 1.4451 |

| AUDUSD | 0.7081 | 0.14% | 0.7093 | 0.7038 |

| NZDUSD | 0.6636 | 0.00% | 0.6646 | 0.6605 |

| EURCHF | 1.0979 | 0.05% | 1.1001 | 1.0973 |

| USDCAD | 1.3889 | -0.15% | 1.3921 | 1.3867 |

| USDCNH | 6.5534 | 0.19% | 6.5678 | 6.5501 |

FXO

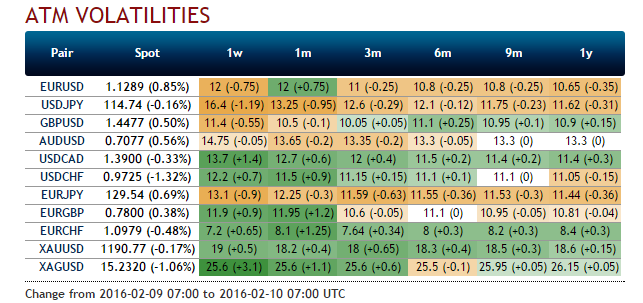

Volatility has come a little softer in general, although Friday options are notably bid after Yellen testifies today and tomorrow. The one month straddles are also notably bid in the EUR space, covering the March ECB meeting.

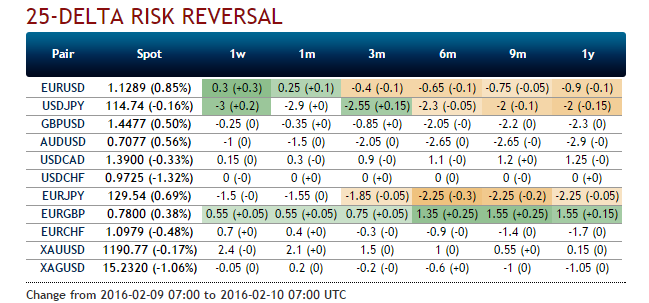

Within the retail currency options space at Saxo Bank A/S, a continued move towards the downside I is evident in the USD/JPY space. 72% of traders now favour long put and/or short call positions regarding options in this currency pair. In another safe-haven currency pair, USD/CHF sees a similar bias.

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.