Analysis for March 2nd, 2015

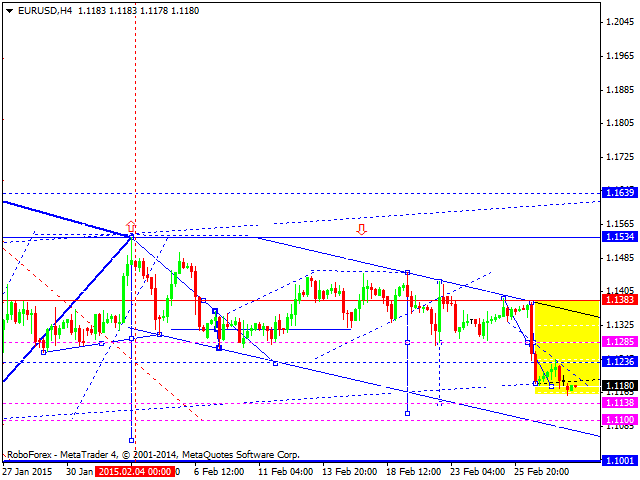

EURUSD, “Euro vs US Dollar”

Eurodollar continues moving downwards; the market hasn’t been able to form a correction. After reaching new lows, the pair is expected to continue falling towards level of 1.1000.

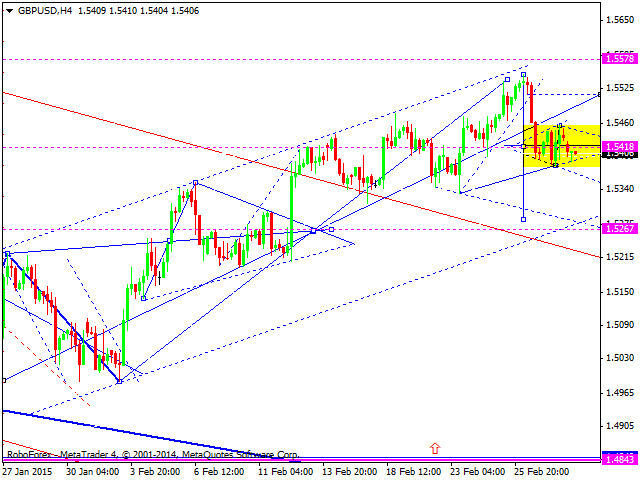

GBPUSD, “Great Britain Pound vs US Dollar”

Pound is consolidating. After leaving the channel downwards, the price may reach level of 1.5285. This descending movement may be considered a correctional one.

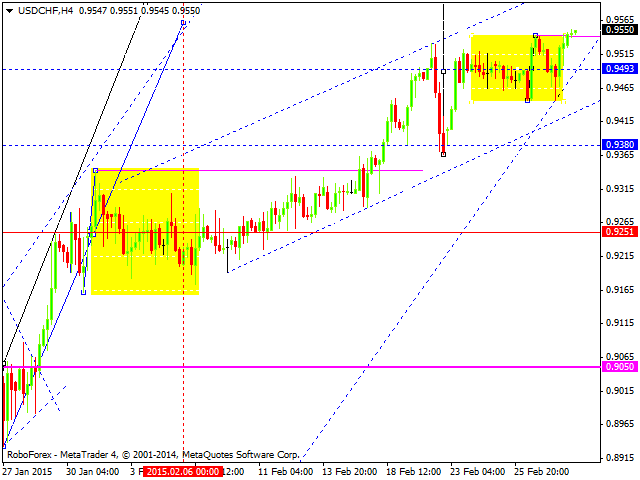

USDCHF, “US Dollar vs Swiss Franc”

Franc continues moving upwards. We think, today the price may reach level of 0.9615. One should note that this ascending movement is the result of regulator’s influence and can stop at any moment. The next downside target is at level of 0.8200; a local one – at 0.8830.

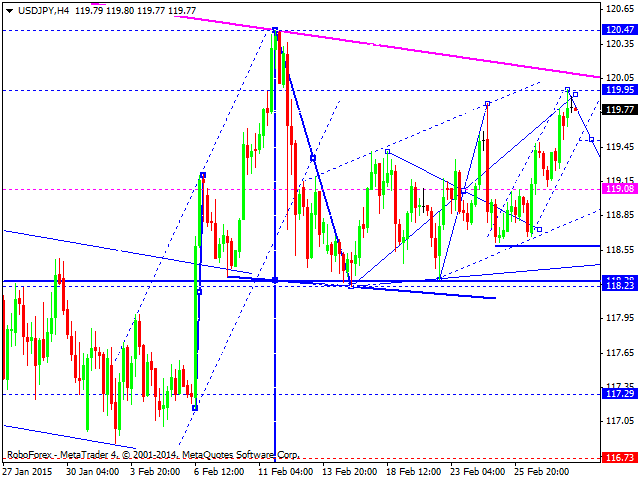

USDJPY, “US Dollar vs Japanese Yen”

Yen has reach the target of another ascending structure. We think, today the price may fall towards level of 119.08. This descending movement may be considered as a part of wave with the target at level of 116.40.

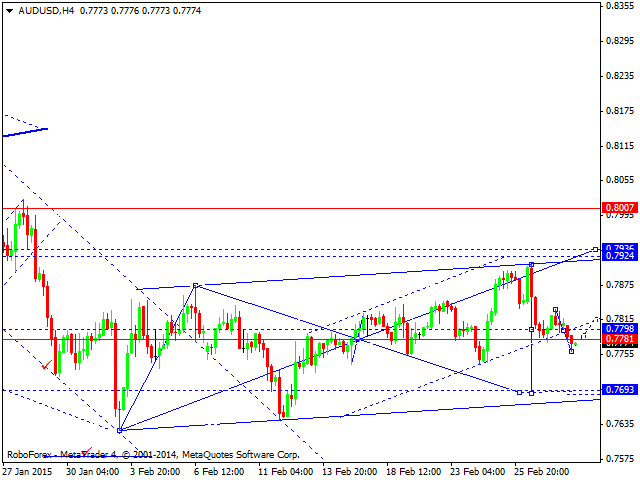

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar continue falling. We think, today the price may form a consolidation range. Later, in our opinion, the market may break it downwards and reach level of 0.7700. After that, the pair may return to level of 0.7800.

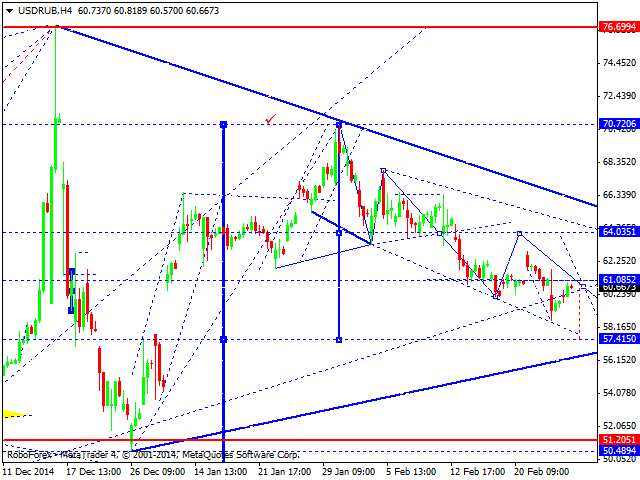

USDRUB, “US Dollar vs Russian Ruble”

Ruble is still moving inside a descending structure towards level of 57.40. This movement may be considered as the first wave of another descending structure. After that, the pair may start a correction to return to level of 64.00 and then continue falling inside the downtrend.

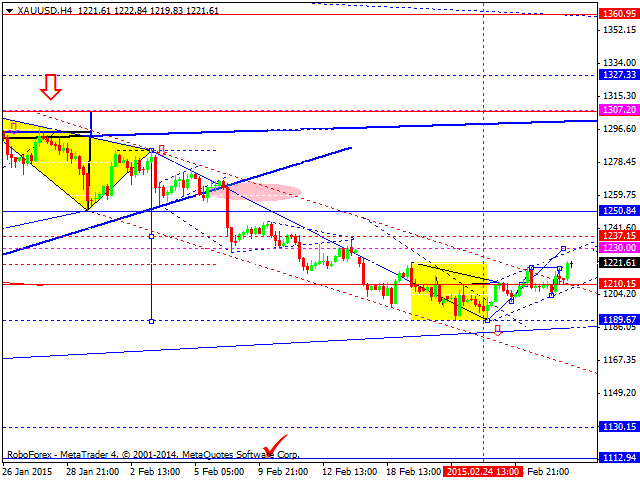

XAUUSD, “Gold vs US Dollar”

Gold is still moving upwards. Possibly, the price may expand its consolidation channel towards level of 1230. Later, in our opinion, the market may continue falling. The main target is at level of 1113.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.