Analysis for July 31st, 2014

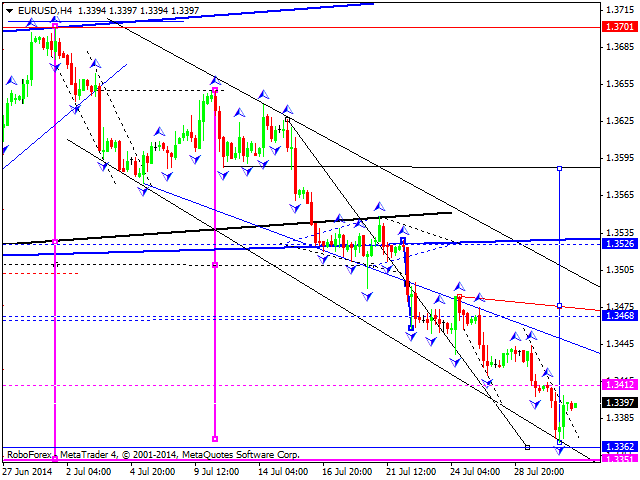

EURUSD, “Euro vs US Dollar”

Euro has started its ascending movement under the influence of recent news. Basic scenario is that price may start moving towards level of 1.3590 with the first target at level of 1.3400. Alternative scenario is that price may reach new minimums and only after reaching new minimums start ascending movement.

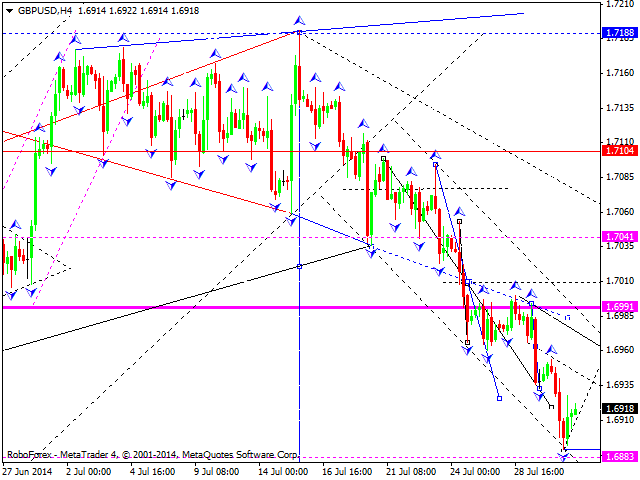

GBPUSD, “Great Britain Pound vs US Dollar”

Pound has started its ascending movement under the influence of recent news. Basic scenario is that price may reach its previous level of 1.7040. Alternative scenario, in our opinion, is that price may reach new minimums and only after reaching new minimums start ascending movement.

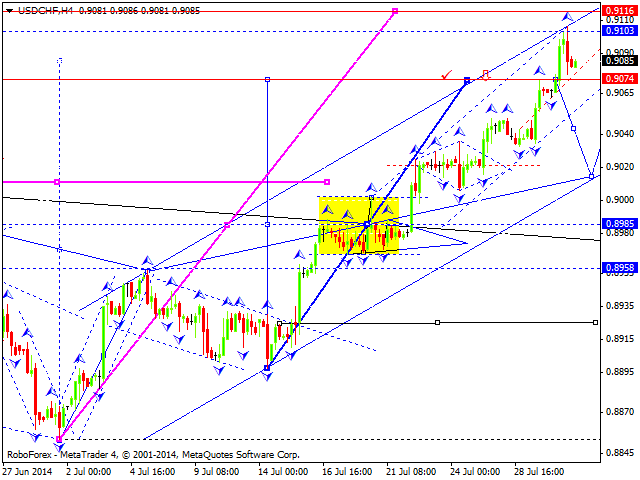

USDCHF, “US Dollar vs Swiss Franc”

Franc has started its descending movement under the influence of recent news. Basic scenario is that price may reach level of 0.8960. Alternative scenario is that price may reach new maximums and only after reaching new maximums start descending movement.

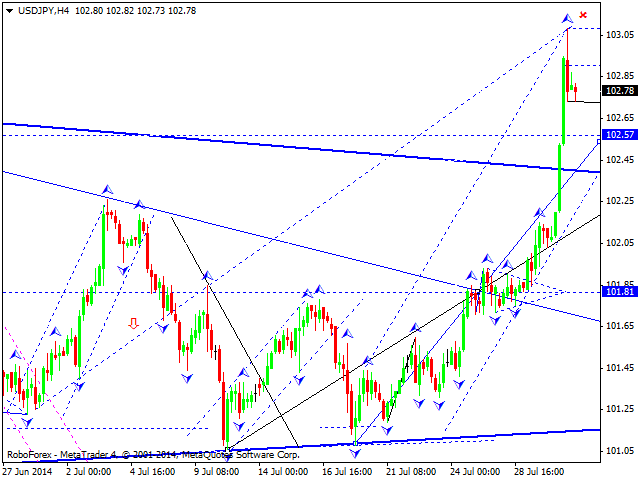

USDJPY, “US Dollar vs Japanese Yen”

Yen has reached local and strategic targets due to the ascending wave extension. Wave has three element structure and is considered by us as correction. Basic scenario, in our opinion, is that price may form new descending wave towards level of 101.70, break this level, and continue its descending movement towards level of 100.50.

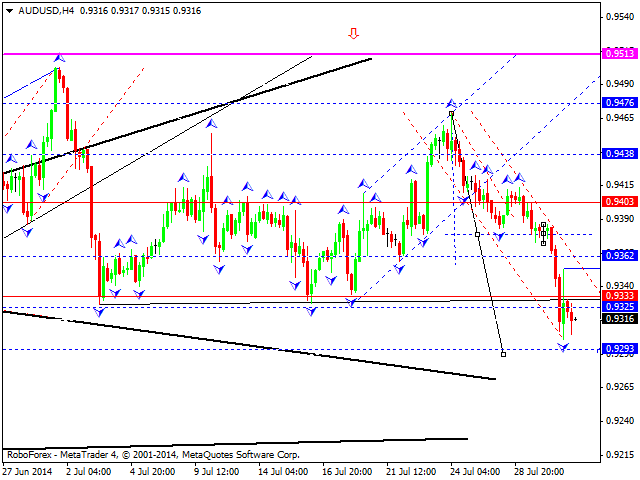

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar has extended descending channel and reached the target of correction descending movement. Today, price may form ascending wave towards level of 0.9510. As an alternative scenario, price may reach new minimums and only after reaching new minimums start ascending movement.

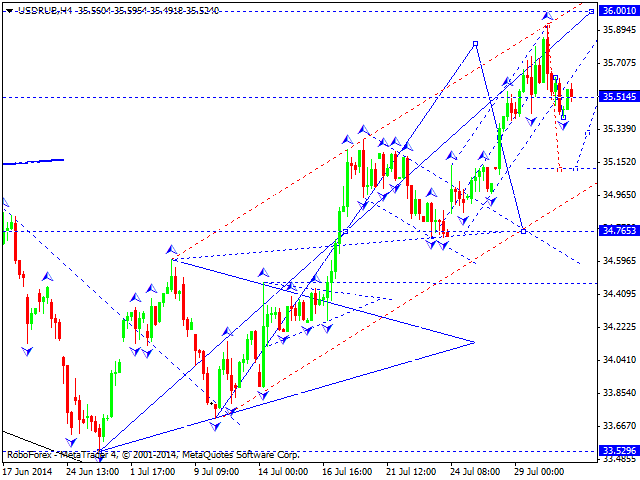

USDRUB, “US Dollar vs Russian Ruble”

Ruble is forming descending wave towards level of 34.80. Descending movement may signal new correction. Then, we expect one more ascending structure towards level of 36.00 that may complete ascending wave. In our opinion, the next structure is the descending structure with price moving towards level of 33.20.

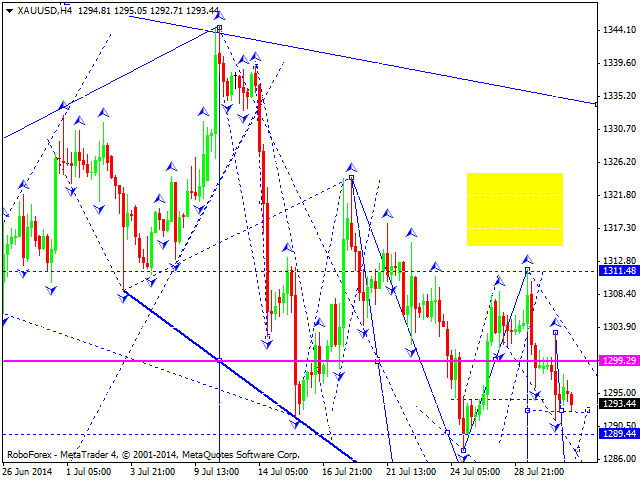

XAUUSD, “Gold vs US Dollar”

Gold continues its descending movement. We expect consolidation with breakout to the downside. The target is level of 1275.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.