Analysis for January 28th, 2015

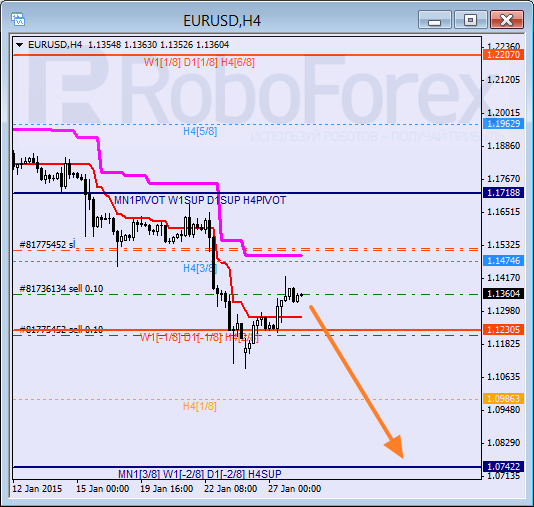

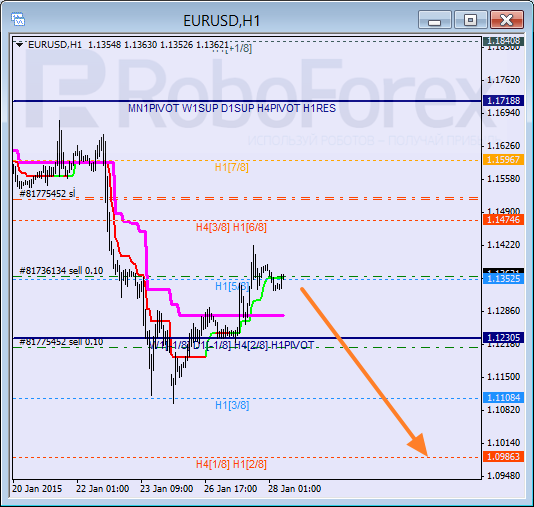

EURUSD, “Euro vs US Dollar”

At the H4 chart, Eurodollar is still being corrected between Super Trends. Possibly, after completing this local correction, the price may try to stay below the 2/8 level. This attempt may indicate that the market is going to resume falling towards the 0/8 one.

The price is moving in the middle of the H1 chart. Probably, in the nearest future the price may rebound from the 5/8 level and resume moving downwards. I’m planning to open one more sell order after the market stays below Super Trends.

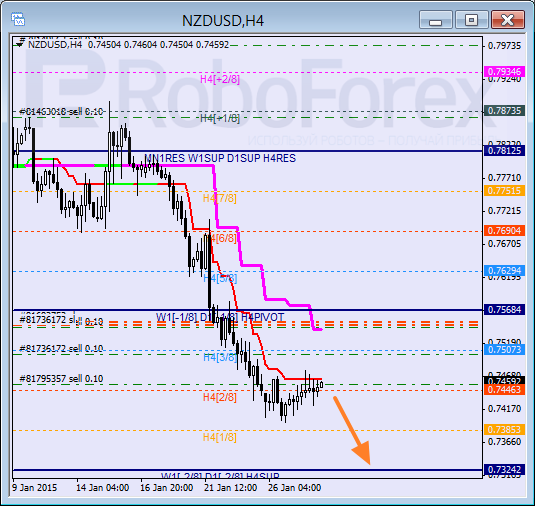

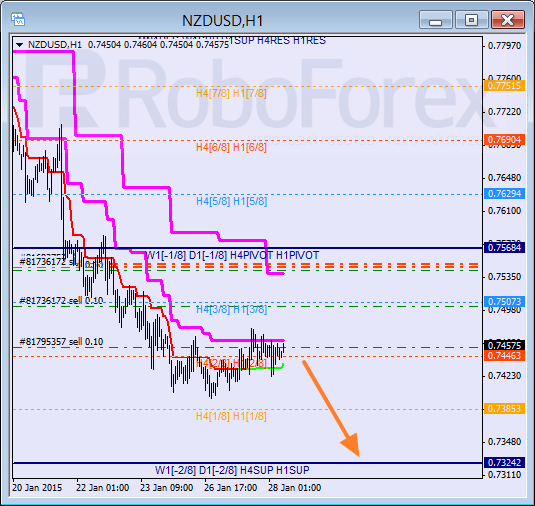

NZDUSD, “New Zealand Dollar vs US Dollar”

New Zealand Dollar has started a new correction. Earlier Super Trends formed “bearish cross”. Considering that the market is already moving below the 3/8 level, later it is expected to reach the 0/8 one.

The lines at the H4 and H1 charts are completely the same. Possibly, the pair may break its local minimum during the day. I’m planning to open another sell order when the pair rebounds from Super Trends.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

USD/JPY trades below two-week top set on Thursday; looks to BoJ for fresh impetus

USD/JPY trades with a positive bias below the 143.00 mark as traders await the BoJ policy update before placing fresh directional bets. In the meantime, data published this Friday showed that Japan's Core CPI rose to a 10-month high in August and reaffirmed bets that the BoJ will hike interest rates again in 2024.

AUD/USD strengthens above 0.6800 on RBA-Fed policy divergence, eyes on PBoC rate decision

The AUD/USD pair trades on a stronger note near 0.6810 during the early Asian session on Friday. The uptick of the pair is bolstered by the softer US Dollar amid the prospects of further rate cuts by the US Federal Reserve this year. Later on Friday, the Fed’s Patrick Harker is set to speak.

Gold price holds steady near record peak amid bets for more Fed rate cuts

Gold price hovers near the all-time peak touched earlier this week amid a bearish USD and rising bets for more upcoming rate cuts by the Fed. Moreover, concerns about an economic downturn in the US and China further underpin the safe-haven XAU/USD.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.