Things look promising for the US economy with consumer confidence returning to levels before the GFC. Yesterday, the U.S. CB Consumer Confidence Index hit highs not seen since October 2007. The data was 90.9 against a forecasted 85.5 and a previous 86.4. The Dollar was inspired and was stronger across the board after the release.

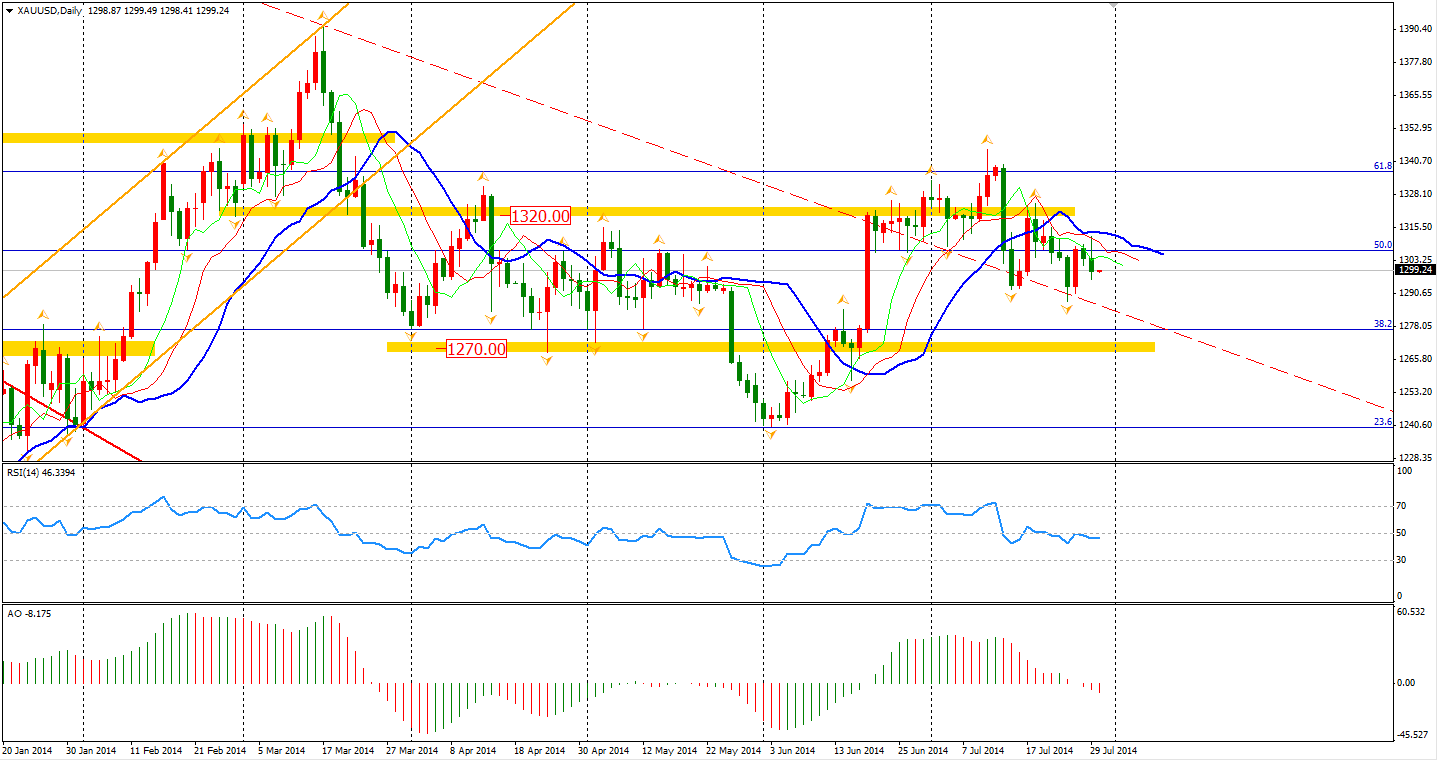

Gold prices crashed through the $1300 integer level, suggesting weakness may continue even though there are no signs of relief from either the Ukraine or Gaza.

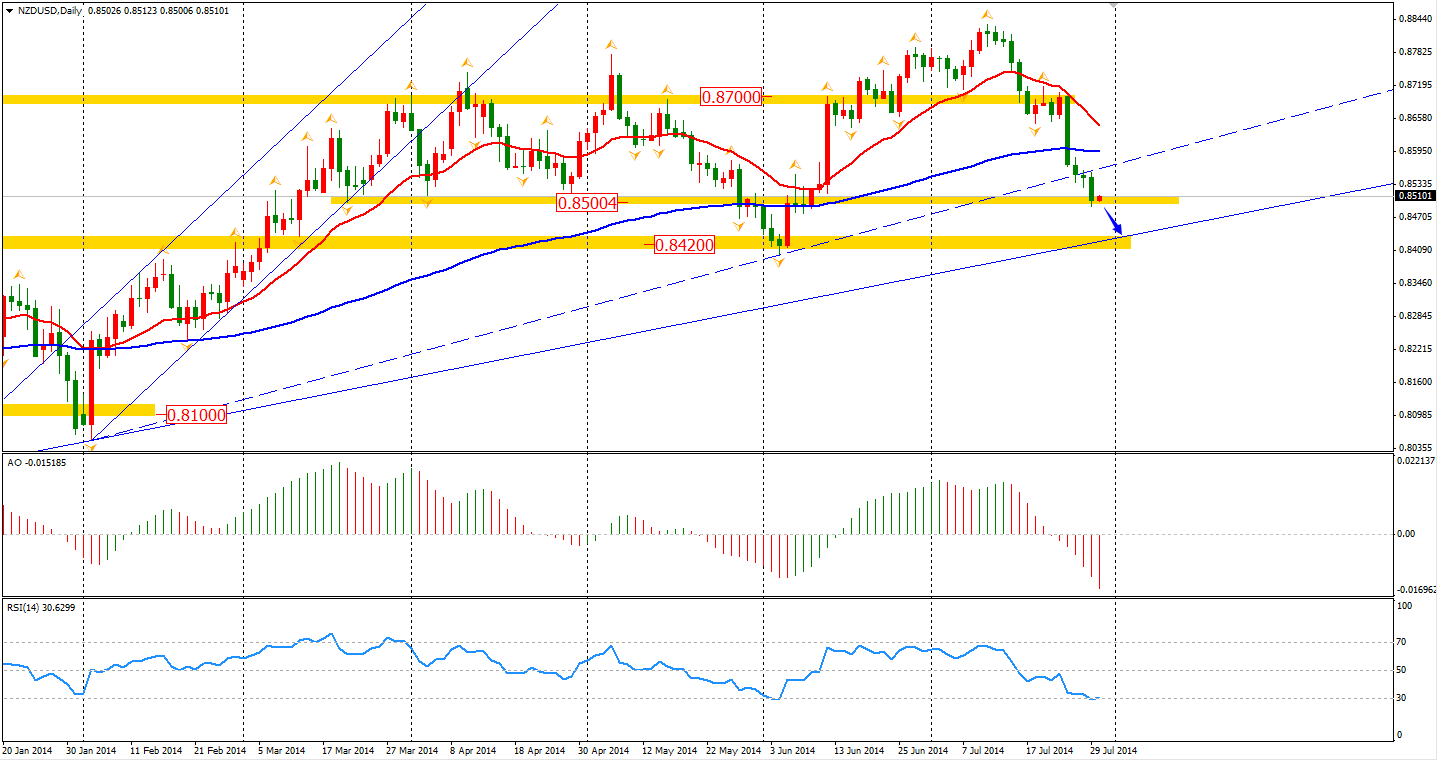

The Kiwi Dollar pared to 0.85 yesterday with news from major New Zealand dairy producer Fonterra with expectations that milk prices will fall in the near future. Looking at it technically, the exchange level has moved to its former support level, and will probably test June’s low at 0.84 and the upward trendline started from August 2013. However, the fundamental condition is in the New Zealand Dollar’s favour. The highest interest rate in the developed world will certainly attract more funds to purchase at its low level.

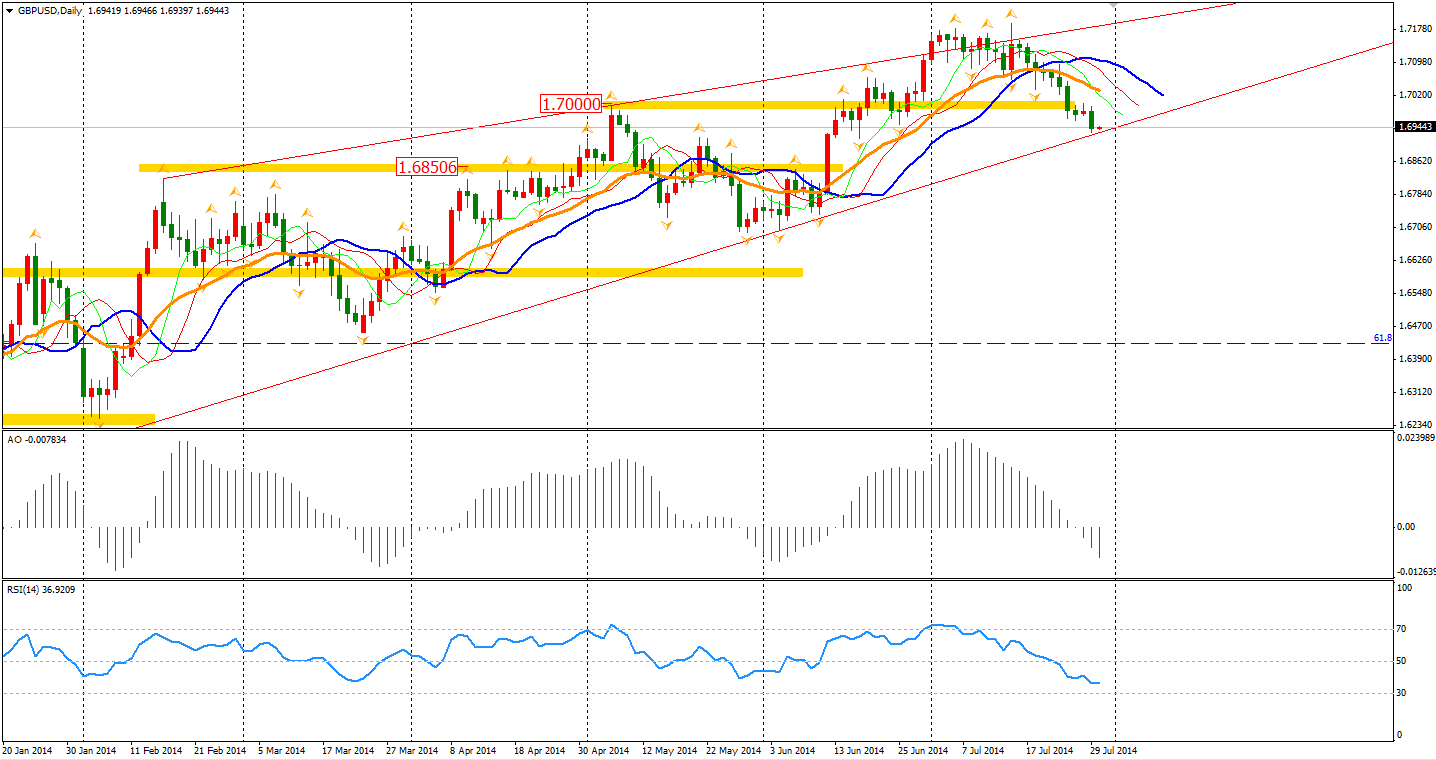

UK’s Mortgage Approvals surprisingly increased to a four-month high. Yet the data still did not improve the weakness of the sterling. The Pound/Dollar broke support of a 50-day MA right after it hit the day’s high at 1.6994. Since this July, upbeat data like CPI, unemployment rate and GDP all failed to push sterling to a newer high against the Dollar. It is reasonable to speculate the bullish trend of Pound will ease in the short term.

Asian stocks moved higher, as earnings reports in Japan and Australia were better than expected. The Shanghai Composite rose 0.24% to 2183 whilst the Nikkei Stock Average gained 0.57% and the ASX 200 advanced 0.20% to 5588. In the European stock markets, the FTSE closed 0.29% higher, the DAX rose 0.58%, and the French CAC advanced 0.48%. The U.S. closed slightly lower whilst the U.S. and EU makes decisions to adopt a new round of sanctions on Russia. The Dows lost 0.42% to 16912. The S&P 500 edged 0.45% lower to 1970, while the Nasdaq Composite Index was down 0.05% to 4443.

The all-important U.S. data is coming tonight. ADP Non-Farm Employment Change will be released at 22:15 AEST. GDP will follow 15 minutes after and the FOMC Statement will be out at 04:00 tomorrow morning.

MXT Global Pty Ltd ACN 157 768 566 AFSL 428901. Trading derivatives and forex carries a high level of risk to your capital and should only be traded with money you can afford to lose. Ensure you read our FSG, PDS and Terms & Conditions, and seek independent advice, to fully understand the risks, before deciding to enter into any transactions with MXT Global. The general information on this website is not directed at residents in any country or jurisdiction where such distribution or use would contravene local law or regulation.

Company disclaimer for reports:

#The views and content above are Anthony Wu's own and do not reflect the views of MXT Global.

The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analyses, prices or other information is provided as general market commentary and not as investment advice.

MXT Global does not warrant the completeness, accuracy or timeliness of the information supplied, and shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content.

No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.#

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.