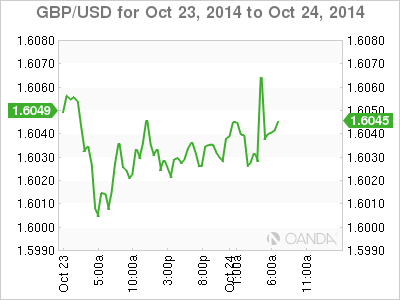

The pound is showing little movement for a second straight day, as GBP/USD trades in the mid-1.60 range in the European session. On the release front, British Preliminary GDP posted a gain of 0.7% in Q3, compared to 0.9% in the Q2 reading. The Index of Services came in at 0.8%, meeting expectations. Over in the US, today’s sole release is New Home Sales. The markets are expecting the indicator to soften this month, with an estimate of 473 thousand.

British Preliminary GDP is one of the most important economic indicators and is closely watched by the markets. The indicator dipped to 0.7% in Q3, down from 0.9% in the previous quarter, revised from 0.8%. This figure matched the forecast, so there was little reaction from the pound. Still, the drop in GDP is a cause for concern, coming on the heels of weak UK data from several sectors on Thursday. Retail Sales, the primary gauge of consumer spending, declined by 0.3%, its worst showing since May. BBA Mortgage Approvals dropped for a third-straight month, slipping to 39.3 thousand. CBI Industrial Order Expectations rounded out the bad news with a reading of -6 points, its worst showing since June 2013.

In the US, jobless claims were softer than expected. Unemployment Claims rose to 284 thousand last week, much higher than the previous reading of 264 thousand, and above the estimate of 269 thousand. However, the markets were not too concerned, as the four-week average, which is less volatile than the weekly release, dipped to 281,000, a 14-year low. Meanwhile, weak inflation levels continue to point to slack in the economy. On Wednesday, this trend continued with soft consumer inflation numbers. CPI rose to +0.1%, an improvement from the previous reading of -0.2%. The estimate stood at 0.0%, so the markets clearly did not have high expectations. It was a similar story from Core CPI, which also posted a 0.1% gain, up from 0.0% a month earlier. This was shy of the forecast of 0.2% but still within expectations.

GBP/USD 1.6040 H: 1.6072 L: 1.6018

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.