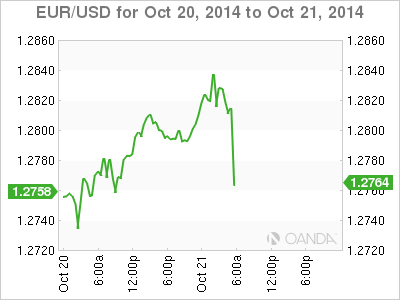

EUR/USD has posted slight losses on Tuesday, as the pair pushed into 1.28 territory but was unable to consolidate. It’s a very quiet day on the release front, with no Eurozone events. In the US, today’s sole release is Existing Home Sales. The markets are expecting the indicator to improve in the September release.

The markets were greeted with lukewarm Eurozone data on Monday morning. Inflation remains anemic, as German PPI came in at a flat 0.0%, shy of the estimate of 0.1%. The indicator has not produced a gain since December, as Germany continues to struggle with a lack of inflation. Eurozone Current Account, which is closely linked to currency demand, posted a surplus of EUR 18.9 billion, little changed from the previous release of EUR 18.7 billion. This reading disappointed the markets, as the estimate stood at EUR 21.3 billion.

The Deutsche Bundesbank issued its monthly report on Monday. The German central bank said that the economy showed little growth in Q3 as manufacturing production fell and business confidence weakened. At the same time, employment numbers and consumer spending were higher, so GDP was likely to remain unchanged. As for Q4, the report stated that the outlook is “moderate”. The report underscores weakness in the German economy, long considered the locomotive of Europe. Weak German data could hurt the shaky euro.

US releases wrapped up the week on a high note, as UoM Consumer Sentiment climbed to 86.4 points, its highest reading since July 2007. The markets had expected a reading of 84.3 points. This indicates that the US consumer remains optimistic about the economy and is not overly concerned about warnings of a global slowdown. On the housing front, Building Permits and Housing Starts met expectations. Strong US employment numbers continue to drive the US recovery, as US job claims dropped to 264 thousand, marking a 14 -year low. The estimate stood at 286 thousand.

EUR/USD 1.2762 H: 1.2840 L: 1.2758

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY drops toward 142.00 ahead of BoJ policy decision

USD/JPY has turned south, approaching 142.00 in the Asian session on Friday. Markets turn risk-averse and flock to the safety in the Japanese Yen while the Fed-BoJ policy divergence and hot Japan's CPI data also support the Yen ahead of the BoJ policy verdict.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold price treads water below record peak, awaits Fedspeak

Gold price hovers below the all-time peak touched earlier this week amid a bearish US Dollar and rising bets for more upcoming rate cuts by the Fed. Concerns over an economic downturn in China keep the safe-haven Gold price afloat. Fedspeak remains on tap.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.