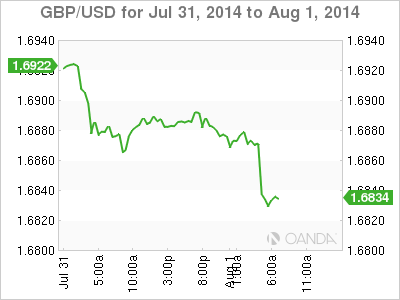

GBP/USD has posted strong losses on Friday, as the pair trades in the low-1.68 range in the North American session. The pound has lost about 150 points this week as it trades at six-week lows against the US dollar. In economic news, British Manufacturing PMI slipped to 55.4 points, marking a four-month low. It's a busy day in the US, highlighted by three key events - Nonfarm Employment Change, Unemployment Rate and ISM Manufacturing PMI. We'll also get a look at consumer confidence levels, with the release of UoM Consumer Sentiment.

British PMIs are closely tracked by analysts, as they are important gauges of the health of key sectors in the British economy. The Manufacturing PMI softened in March, dropping to 55.4 points, short of the estimate of 57.2 points. This was the indicator's lowest level since March. The weak reading follows disappointing housing inflation data. Nationwide HPI posted a gain of just 0.1%, its weakest performance in over a year. The markets had forecast a healthy gain of 0.6%.

On Thursday, Unemployment Claims came in at 302 thousand, higher than the previous release but very close to the estimate of 303 thousand. Earlier in the week, ADP Nonfarm Payrolls posted a sharp drop. If the official NFP release follows suit and misses the estimate of 234 thousand, the US dollar could give up some if its recent gains. Meanwhile, US GDP exceeded expectations in the second quarter, as the economy expanded at an annual rate of 4.0%. This easily beat the estimate of 3.1% and marked the strongest quarter of economic growth since Q4 of 2009. The boost in economic activity was helped by strong consumer confidence and business investment, as well as solid employment data. The US dollar took advantage of the strong numbers, posting gains against the pound and other major currencies.

The Federal Reserve released a policy statement on Wednesday, with the Fed sounding somewhat dovish in tone. Policymakers acknowledged lower unemployment levels, but noted that "there remains significant underutilization of labor resources" in the economy. The Fed statement reinforces the view that the US central bank is in no rush to raise interest rates after the termination of QE, which is expected in October. As well, the Fed said that inflation levels have moved somewhat closer to the Fed's target of 2.0%.

GBP/USD 1.6839 H: 1.6891 L: 1.6822

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY off lows, stays pressured near 142.50 ahead of BoJ policy decision

USD/JPY has bounced off lows but remains pressured near 142.50 in the Asian session on Friday. Markets turn risk-averse and flock to the safety in the Japanese Yen while the Fed-BoJ policy divergence and hot Japan's CPI data also support the Yen ahead of the BoJ policy verdict.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold price treads water below record peak, awaits Fedspeak

Gold price hovers below the all-time peak touched earlier this week amid a bearish US Dollar and rising bets for more upcoming rate cuts by the Fed. Concerns over an economic downturn in China keep the safe-haven Gold price afloat. Fedspeak remains on tap.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.