Analysis for August 28th, 2014

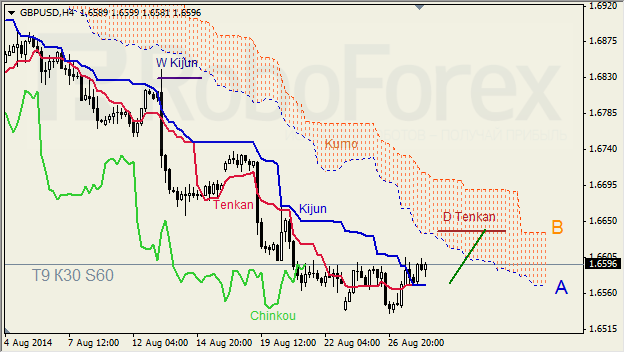

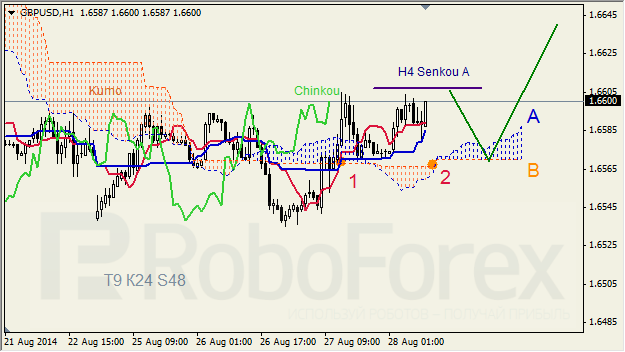

GBP USD, “Great Britain Pound vs US Dollar”

GBP USD, Time Frame H4. Tenkan-Sen and Kijun-Sen are very close to each other below Kumo; they may intersect and form “Golden Cross”. Ichimoku Cloud is going down, Chinkou Lagging Span is on the chart, and the price is above Tenkan-Sen – Kijun-Sen, below Kumo. Short‑term forecast: we can expect support from Tenkan-Sen – Kijun-Sen, and attempts of the price to stay inside the cloud.

GBP USD, Time Frame H1. Tenkan-Sen and Kijun-Sen formed “Golden Cross” below Kumo (1). Ichimoku Cloud is going up (2), and Chinkou Lagging Span is above the chart. Short‑term forecast: we can expect resistance from H4 Senkou Span A, support from Senkou Span B, and growth of the price.

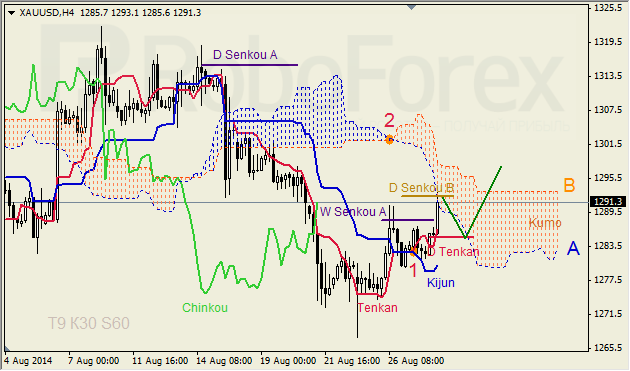

XAU USD, “Gold vs US Dollar”

XAU USD, Time Frame H4. Tenkan-Sen and Kijun-Sen formed “Golden Cross” below Kumo (1); all lines except Senkou Span B are moving upwards. Ichimoku Cloud is going down (2), Chinkou Lagging Span is above the chart, and the price is on D Senkou Span B, near Kumo’s lower border. Short-term forecast: we can expect support from Tenkan-Sen – D Tenkan-Sen – Senkou Span A, and attempts of the price to stay above the cloud.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.