Analysis for July 8th, 2014

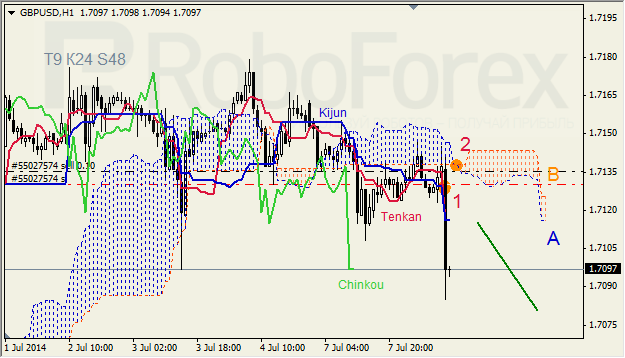

GBP USD, “Great Britain Pound vs US Dollar”

GBP USD, Time Frame H4. Tenkan-Sen and Kijun-Sen are close to each other above Kumo; both lines are directed downwards (1). Ichimoku Cloud is going up (2), Chinkou Lagging Span is on the chart, and the price is below Tenkan-Sen – Kijun-Sen. Short‑term forecast: we can expect attempts of the price to stay inside Kumo.

GBP USD, Time Frame H1. Tenkan-Sen and Kijun-Sen are close to each other below Kumo (1). Ichimoku Cloud is going down (2), Chinkou Lagging Span is below the chart, and the price is below the lines. Short‑term forecast: we can expect resistance from Kijun-Sen, and decline of the price.

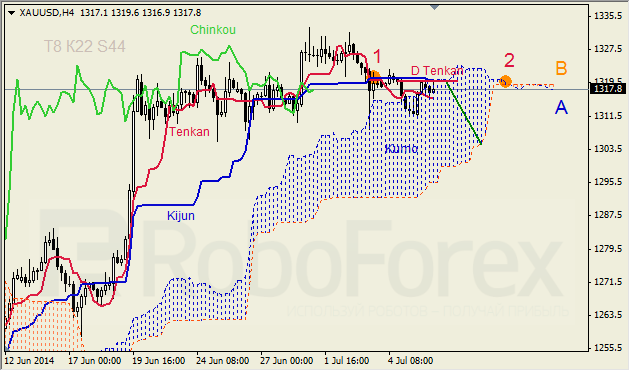

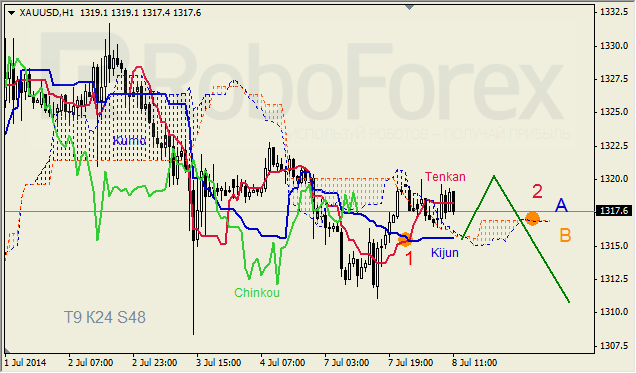

XAU USD, “Gold vs US Dollar”

XAU USD, Time Frame H4. Tenkan-Sen and Kijun-Sen formed “Dead Cross” (1) above Kumo. Ichimoku Cloud is closed (2), Chinkou Lagging Span is below the chart, and the price is near Kumo’s upper border. Short-term forecast: we can expect resistance from D Tenkan-Sen – Kijun-Sen – Senkou Span A, and decline of the price inside Kumo.

XAU USD, Time Frame H1. Tenkan-Sen and Kijun-Sen formed “Golden Cross” (1). Ichimoku Cloud is closed (2), and Chinkou Lagging Span is above the chart. Short‑term forecast: we can expect support from Kijun-Sen – Senkou Spans A and B, and attempts of the price to stay below Kumo.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.