EUR creditors draft supposed “final” offer to Greece

Dollar bulls are getting an itching trigger finger

Draghi takes center stage tomorrow

RBA wants the Fed to do the heavy lifting

The Institute for Supply Management’s (ISM) U.S. manufacturing purchasing managers’ index for May continues to show expansion with an increase to 52.8 from 51.5 in March and April. Though it’s potentially a positive sign for Friday’s nonfarm payrolls (NFP) report, investors have little to latch onto for the time being.

Meanwhile, an underwhelming Reserve Bank of Australia (RBA) rate announcement has thus far had only had a fleeting effect. And it should come as no surprise that anything related to Greece continues to dominate price moves within the various asset classes.

Berlin’s Euro-Mini Summit

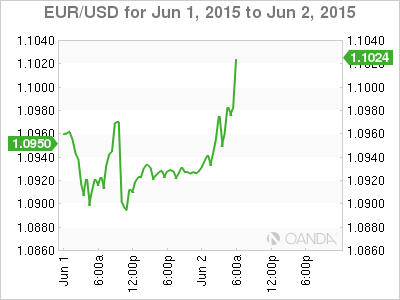

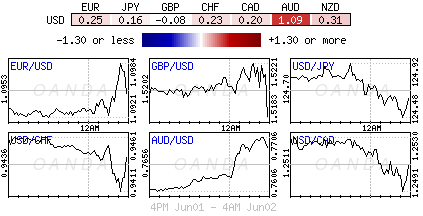

The EUR (€1.0979) has managed to gather some upward traction after a meeting of international leaders in Berlin overnight. Investors are hopeful an agreement between Greece and its creditors may be struck before Friday’s International Monetary Fund (IMF) deadline payment of €300 million.

At the late-night mini-summit, creditors have supposedly drafted a proposal for Greece. In attendance were German Chancellor Angela Merkel, French President François Hollande, IMF Managing Director Christine Lagarde, President of the European Commission Jean-Claude Juncker, and European Central Bank President Mario Draghi. Interestingly, Greek Prime Minister Alexis Tsipras was not at the meeting.

The market should probably be viewing such an event as the last realistic chance to break the Greek-Euro stalemate. The sense of urgency indicates that there will be no other compromises by European creditors, and it’s hoped this last-ditch effort will break the stalemate before Friday’s deadline.

No one knows better than the Greek government that there are many moving parts to the current drama. The “proposal” cannot be sold as an ultimatum, as Europe already knows that this does not work with the relatively inexperienced Athens government — talk about throwing your rattle out of the crib.

It’s understood that the “pitch” would cover the +70% figure that Greece would supposedly accept of the exiting bailout program. If all true, it will be up to Greece to see how far a compromise can be achieved before Friday, and avoid defaulting on its IMF debt repayment. Investors should be expecting Greek headlines and asset price moves to come fast and furious over the next few days. If not, there will be volatility, but not the orderly kind.

U.S Dollar Upped to the Next Level

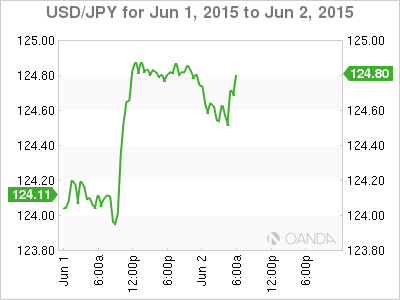

For dollar bulls, this Greek tragedy is but an inconvenience. All greenback-loving investors believe that conditions are shaping up for a long summer dollar rally. Excluding event risk like the Greek saga, the dollar’s superiority hinges on data, as highlighted by the Fed, and especially over the next couple of weeks.

If May’s robust manufacturing ISM print combines with a strong employment component, it could be added to tomorrow’s expected strong non-manufacturing ISM showing (57.1). Assuming that it is followed by a stellar NFP (+226,000, +5.4% unemployment rate) report on Friday, then everyone will be looking forward to June 17’s Federal Open Market Committee meeting for guidance on the first rate hike. Any indication that the Federal Reserve is on target for a September hike will be pushing the dollar onto the next big stage.

RBA Mixes Up Interpretation

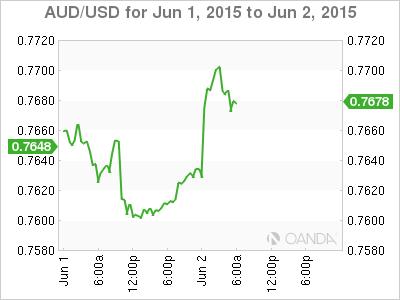

It was not a market surprise that RBA Governor Glenn Stevens opted to keep the bank’s rates on hold (+2%) earlier this morning. The surprise was that the market expected more easing rhetoric. Without it, the Aussie managed to rally hard from its seven-week low.

What transpired is that the new RBA policy outlook favors data dependence over renewed easing bias. In other words, like most central bankers that favor a weaker domestic currency or have issues with an overvalued currency, policymakers will more than ever be relying on a Fed rate hike to do most of their domestic policy lifting. Naturally, the AUD/USD (A$0.7682) saw a fair bit of volatility among the dollar majors, as traders digested the changes in the latest RBA policy stances.

Stevens continued with his usual rhetoric of trying to talk the currency down by insisting, “Further depreciation seems both likely and necessary.” Analysts noted that the policy outlook component of the statement was clouded by data dependency against the expectation of an outright return to an easing bias in light of the latest soft capital expenditure figures out last week. The lack of a rate cut or easing bias convinced the AUD shorts to pare back existing positions (A$0.7707).

The RBA is likely to wait for the May cut to final filter through to the real economy. It’s only natural for policymakers to be somewhat hesitant of cutting rates too soon again, especially with developments in Australia’s “hot” property market. That’s reason enough to wait for the Fed to make the first move.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.