Fed’s Yellen on the hot seat mid-morning

Yellen’s remarks available on-line 90 minutes before testimony

50-50 that BoC will Cut

Loonie low under threat

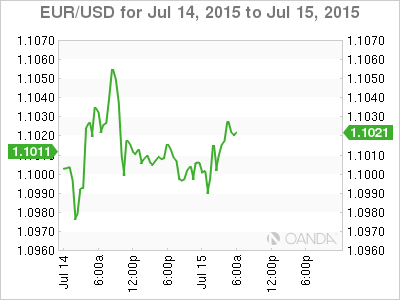

By end of today, investors will have had a lot of rhetoric and data presented to them to decipher. One of the biggest events this week is not an economic release; instead it will be the beginning of this morning’s semi-annual testimony by Ms. Yellen on Capital Hill. The other event is Greece, where the Greek parliament votes on the Eurozone bailout plan. They are required to pass, and vote into law, a number of proposed reforms to secure bridging loans that will enable the country to avoid default and Grexit.

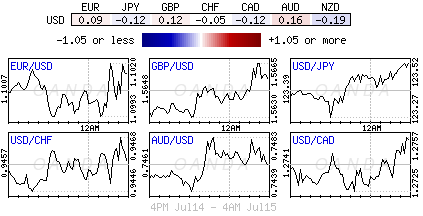

General uncertainty about the U.S economy, combined with global worries over the Greek debt crisis, falling commodity prices and China’s equity markets have backed up market expectations for the first Fed rate increase in nearly a decade. Fixed income traders have nearly priced out a September hike (16%) and are pricing in December to be the front month (53%). The market will be looking to Yellen for any clues on timing, as higher interest rates would draw yield hungry investors to the USD.

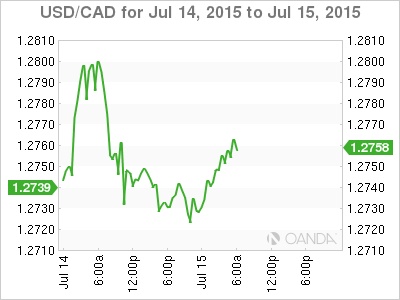

Just north of the U.S border, the Bank of Canada (BoC) will deliver its rate decision mid-morning and also present its monetary policy report. The report will provide valuable insight into the Bank’s view of economic conditions and inflation. It’s a close decision on whether Governor Poloz will cut interest rates by -25bps to +0.5%. There is an argument that the Governor needs to be proactive, driven by the recent underperformance of the Canadian economy, rather than wait for a Fed rate hike, which is unlikely to move in Q3. Currently, the rates market is pricing a 50% chance of ease this morning. A move by the BoC will certainly but the loonie under pressure – the 2015 USD/CAD high of $1.2835 will be vulnerable.

What to expect from the Fed?

Fed Chair Yellen was relatively upbeat when mentioning the U.S consumer last week. While making reference to previous retail sales reports, she was optimistic about purchases in the beginning of Q2, which would suggest that U.S consumer spending was picking up.

Yesterday’s massive miss for June U.S retail sales (-0.3% vs. +0.3%e), on top of downward revisions for the two previous months, will have the market focusing intently on what Ms. Yellen has to say later this morning on the Hill (Her prepared remarks and MPR will be available 90 minutes earlier on the Central Banks Website). Will the Fed chief have to temper her assessment of the U.S consumer after such a dismal display from retail sales? Until now, the consumer has been the Feds “get out of jail” card, and yesterday’s poor display does not reflect well on the U.S economy.

In Q1, a majority of market participants were content side step the weak GDP print (-0.2%), citing the weather as the main culprit, but expected a strong bounce in Q2. However, it seems that a large percentage of the market has gone back to recalibrate their U.S growth projections for Q2, and with that, have now readjusted the timing of the Fed’s first rate hike. The “terrible, but temporary” hopes are not preventing the fixed income market from pushing the beginning of U.S rate normalization further out the curve.

Before this week’s June retail sales print, the market was pricing in a 16% chance of a September rate lift off, now it’s 13%, while December is clearly the markets favorite, their odds have also fallen to 48% from 52%. Any more poor data will surely push a rate lift off into next year.

Investors Seek Clarity

Nevertheless, the majority is expecting Ms. Yellen not to deviate far from her recent comments on rates. The Fed chair is expected to stick to the script, and reiterate that Fed policy is data dependent, and that rate liftoff is likely later this year.

Do not be surprised to see Yellen again emphasize that pace of normalization is more important than exact timing of rate liftoff. Rhetoric like this will not make it any clearer for investors. This will require them to be more focused on external factors, rather than prioritizing all their efforts domestically.

Thus far, currency and bond traders remain cautious. Lack of dollar currency moves would suggest that investors have been cautious about on boarding any large bets. The USD remains in a relative tight range against the majors despite the various geopolitical and economic variables. Last Friday, the U.S bond market in particular took a beating after Yellen said that the Fed is on track to raise rates later this year.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY drops toward 142.00 ahead of BoJ policy decision

USD/JPY has turned south, approaching 142.00 in the Asian session on Friday. Markets turn risk-averse and flock to the safety in the Japanese Yen while the Fed-BoJ policy divergence and hot Japan's CPI data also support the Yen ahead of the BoJ policy verdict.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold price treads water below record peak, awaits Fedspeak

Gold price hovers below the all-time peak touched earlier this week amid a bearish US Dollar and rising bets for more upcoming rate cuts by the Fed. Concerns over an economic downturn in China keep the safe-haven Gold price afloat. Fedspeak remains on tap.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.