Fed – more talk and more data

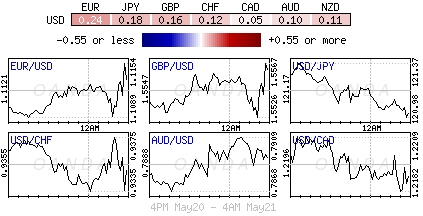

With a Fed June hike off the table has dollar under pressure

Euro PMI’s mixed, fragile recovery expected

UK Retail Sales supports Sterling

There was nothing groundbreaking in yesterday’s April FOMC Minutes. Market price action would suggest that it was rather an uninspired event ticking off most individual’s boxes. With dealers still digesting yesterday’s minutes has temporarily taken some of the wind out of the dollar’s sails.

Fed members were perhaps not quite as pessimistic as suggested by the noticeable downgrade to economic conditions in the April’s statement. Notably, most of them thought the poor data were due largely, to “transitory” factors, and most expected to see moderate growth resume. Still, “many” saw a June hike as unlikely because they do not think the data in June would provide sufficient confirmation that the conditions for hiking were in place.

Since the late April meeting, U.S economic news has been generally mixed, keeping rate hikes odds favoring a September lift off and possibly as late as December. But there was a lengthy discussion about the possibility that the recent weakness in the pace may persist. “A number of participants” suggested that the earlier impact of the dollar strength and weak oil prices could be longer-lasting than anticipated. There was also some concern that the expected boost to consumer spending from lower energy prices may not materialize to the degree anticipated. “A few” participants also noted that, in their view, downside risks to growth since the March meeting had increased. Meanwhile, “most” continued to see the risks to growth and the labor market as balanced.

For the market, it’s back to basics; it all depends on the evolution of economic conditions and the Fed’s outlook for timing of rate normalization – more talk and more data.

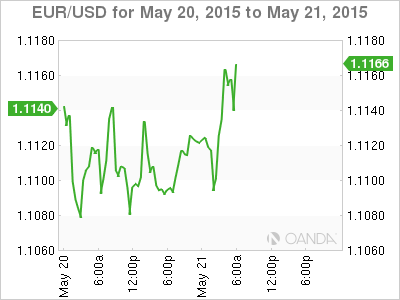

Major European PMI data mixed, fragile recovery

Even this morning’s mixed Euro data releases have not been able to dent the 19-member single currency just yet. The EUR continues to hold above the key support of €1.1065 area, and has even moved temporarily back above €1.1150 after the composite PMI (manufacturing and service) fell to 53.4 in May from 53.9 in April (a three-month low). The data would suggest that the eurozone is struggling to quickly recover from the damage by its long-term debt crisis. Nevertheless, a print above 50 still indicates that the region has surfaced from a long period of near stagnation, aided by lower energy prices, a weaker EUR and the ECB’s QE stimulus program. Nevertheless, it remains a rather precarious and fragile situation for European governments and policy makers.

Low and/or no euro growth has made household and businesses wary of investing and spending, ensuring that officials cannot afford to take their foot off the gas any time soon. This is reason enough for ECB officials to continue to preach the length of time of their QE program (€1.1t to September 2016). Despite the eurozone showing signs of growth before the ECB’s QE launch in March, most fundamental indications since then have been less encouraging. (Note: policies changes usually take months to have an impact before the ‘real’ economy sees any material change).

The slowdown may also reflect growing concerns about Greece’s ability to pay down debts and certainly includes investors’ worries about the euro powerhouses’ (Germany and France) mixed economies. Greece remains at an impasse with international creditors, but that situation is expected to come to a head by June 5 (IMF debt payment due – threatening to default). While activity in Germany, the backbone of Europe slowed over the month, France picked up. Data last week revealed that the Euro economy as a whole grew more rapidly in Q1, but Germany slowed sharply, and that seems to have been carried over into Q2. If Germany sneezes too often, the eurozone will catch a heavy cold.

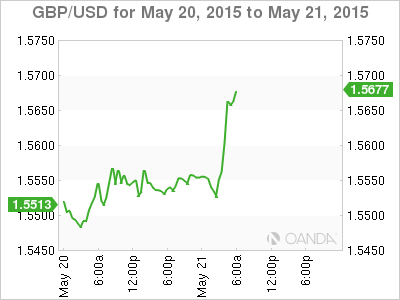

UK Retails sales beat expectations aided by better weather

Sterling has fond some support (£1.5676) from today’s U.K sales report. Retail sales rose in April (+1.2% m/m and +4.7% y/y) after the March slump, which would suggest that the U.K economy might grow at a stronger pace during H2. It seems that retailers were given a helping hand by warmer weather. This helped consumers to bring forward some of their summer purchases. Retail sales were also helped by lower costs, driven down by lower energy prices and cheaper international food. The follow through from energy tax savings seems to be having a material effect on the U.K economy, certainly in contrast to the Fed’s or the ECB’s take on lower crude oil prices not yet filtering into their real economy.

Data earlier this month indicated that the U.K economy grew at a slower rate during Q1 – impeded somewhat by lackluster productivity. This had the BoE cutting its GDP growth expectations last week for 2015 to +2.4% from +2.9% in February. Nevertheless, Governor Carney remains somewhat hopeful and expects GDP will accelerate in Q2.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.