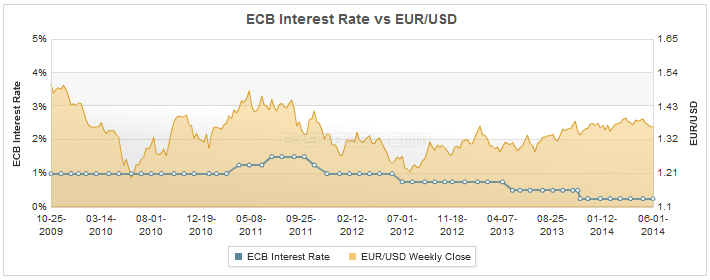

Eurozone inflation numbers released on Tuesday and revealing a further drop from 0.7% to 0.5% in May only boosted investors' expectations that the ECB will adopt a selection of measures to counter the decline. The question is, what tools will the central bank choose this month? The only one on which all of the analysts polled for the forecast report agree is a rate cut.

But even in this case the move might vary, depending on which rates the ECB decides to cut. The general expectation points to a "10-15 bps cut in the main refinancing rate," as Alberto Muñoz predicts, as well as to the deposit rate, which would bring it into negative territory. "The ECB will be the first major central bank to try negative deposit rates, so we are moving into unchartered waters from a market perspective," Alistair Cotton points out, adding that investors' reaction is hard to predict in this case.

Several analysts expect that the ECB will accompany the rate reductions with other actions, because, as Clemente de Lucia explains "when interest rates are already close to zero, further cuts have only marginal impact on the economy." Therefore, we might also see another round of the LTRO announced or, what could really shake the markets, ECB could finally "turn on the printing machine to buy assets," according to Valeria Bednarik.

"If this happens, we will be on a scenario where the US is ending its QE while the EU is barely starting it: the imbalance among both economies will put the common currency under pressure and boost greenback across the board, yet the EUR will likely suffer against all of its rivals," Valeria adds.

Meanwhile, the BoE is expected to stay on hold in June, in the face of the recent string of positive economic data coming from the UK. "However, the odds are still good that as long as the economy continues to do well and house prices rise, the Bank of England may be forced to consider a rate hike earlier than other major central banks (possibly as early as Q1 2015)," in the opinion of Ilian Yotov. But for this kind of information we will have to wait at least until the release of the monetary policy meeting minutes in two weeks time.

The BoE and the ECB will announce their monetary policy decisions on June 5 at 11:00 and 11:45 GMT, respectively. Below you will find the full forecasts of the contributing market experts.

Clemente De Lucia - Economist at BNP Paribas:

"Recently the ECB has become more vocal regarding the exchange rate whose developments are seen as a potential downside risks for the inflation outlook. The ECB would be more than happy if, through its actions, the exchange rate were to ease. Against this backdrop, a cut in the refi rate seems, therefore, very likely. Yet, when interest rates are already close to zero, further cuts have only marginal impact on the economy. To be more effective, an interest rate cut might come together with other actions. The ECB might decide to put into negative territory the interest rate on deposit facility, reducing, thus, the “de facto†lower bound for the Eonia. In this case the impact on market rates and then on the exchange rate would be greater than a mere cut in the refi rate.

"Recently the ECB has become more vocal regarding the exchange rate whose developments are seen as a potential downside risks for the inflation outlook. The ECB would be more than happy if, through its actions, the exchange rate were to ease. Against this backdrop, a cut in the refi rate seems, therefore, very likely. Yet, when interest rates are already close to zero, further cuts have only marginal impact on the economy. To be more effective, an interest rate cut might come together with other actions. The ECB might decide to put into negative territory the interest rate on deposit facility, reducing, thus, the “de facto†lower bound for the Eonia. In this case the impact on market rates and then on the exchange rate would be greater than a mere cut in the refi rate.The ECB might also decide to strengthen its forward guidance on interest rates. Should the ECB be able to convince markets that policy rates will remain at low levels for longer than currently expected, the euro might ease further. The effect would be even greater if the ECB were to manage to reduce money market rates at longer maturities. To achieve this goal, the ECB could conduct another special Longer Term Refinancing Operation (LTRO) with a maturity between 12 to 24 months. The ECB could decide to conduct this operation at fixed rate determined in advance and not equal to the average rate prevailing on the Main Refinancing Operations (MRO) over the life of the operation as it was done in the previous special 3-y LTRO. It is worth stressing that another special LTRO would have the benefit to increase the duration of the liquidity. This would reduce a potential maturity mismatch between assets and liabilities of the commercial banks’ balance sheets, as required by the Net Stable Funding Ratio (Basel III). Last but not least, the ECB could build a mechanism similar to the Bank of England’s Funding for Lending Scheme, linking the provision of cheap central bank liquidity with the provision of new credits to the non-financial sector.

The Council might surprise us and decide to undertake other non-conventional measures, such as launching a program of asset purchases. Yet, we believe that the ECB would proceed step by step, evaluating the effect on the economy of the actions taken before embarking on more radical options."

Alistair Cotton - Senior Analyst at Currencies Direct:

"The ECB meeting is the key event this week with the European central bank expected to cut interest rates, including taking its deposit rate into negative territory. The ECB will be the first major central bank to try negative deposit rates, so we are moving into unchartered waters from a market perspective. Nobody is quite sure how different markets will react to the move. The Euro is weakening ahead of the announcement with GBP/EUR pair the one to watch given the continuation of good data flow from the UK.

"The ECB meeting is the key event this week with the European central bank expected to cut interest rates, including taking its deposit rate into negative territory. The ECB will be the first major central bank to try negative deposit rates, so we are moving into unchartered waters from a market perspective. Nobody is quite sure how different markets will react to the move. The Euro is weakening ahead of the announcement with GBP/EUR pair the one to watch given the continuation of good data flow from the UK. Although the ECB dropped hints about a change in policy this month it is still unclear if any further easing measures will also be announced alongside a cut in rates. Mario Drahi suggested outright QE was an option at last month’s meeting, but it is unlikely that the ECB would be able to undertake sovereign bond buying at such short notice. The ECB may instead announce a program to support asset back securities markets, to free up an important funding tool for banks and risk transfer tool for investors and borrowers or it may a try similar plan to the Bank of England’s funding for lending scheme, where banks use central bank funding to lend to business."

Yohay Elam - Analyst at Forex Crunch:

ECB:

ECB:"The ECB is likely to act as promised and to keep the pressure on the euro. While the euro dropped throughout May due to Draghi's comment last time, the exchange rate is probably still too high. This keeps inflation low. In addition, money supply is squeezing.

A cut of 10 to 15 basis points is likely in both the main lending rate and the deposit rate. In addition, the ECB could accompany this move with some new kind of LTRO. While the governing council is likely to keep the QE powder dry, Draghi could certainly provide some more details about such a potential program, making it clear that the option is on the table.

A negative rate by such a major central bank is uncharted territory. In addition and despite all the preparations, Draghi's action and words are not fully priced in. I believe that Draghi will drag the euro down once again."

BoE:

"No change is expected from the BOE. The economy continues advancing very nicely, but the rate hike is still far off, especially as the rate of inflation is well within range. Carney and co. would prefer not to make changes in QE or in the interest rate to battle soaring house prices. The BOE could signal the timing of the rate hike in its next inflation report in August."

Ilian Yotov - FX Strategist and Founder at AllThingsForex:

ECB:

ECB:"With the door to more easing opened at the last meeting, the market is anticipating a rate cut by the ECB on June 5. Needless to say, this would be the most likely outcome of the meeting. However, a rate cut is probably already largely priced in and if the ECB does not combine it with other easing measures, the EUR might be able to stage a relief rally."

BoE:

"Concerns about overheating housing market and some potential for economic slack have lead to repricing of expectations for the timing of the first rate hike by the Bank of England. At this point, policy makers would not be likely to change the course of the existing monetary policy and the benchmark rate will stay unchanged. However, the odds are still good that as long as the economy continues to do well and house prices rise, the Bank of England may be forced to consider a rate hike earlier than other major central banks (possibly as early as Q1 2015). The pound sterling should remain well bid on such expectations."

Bill Hubard - Chief Economist at Markets.com:

ECB:

ECB:"Markets.com expects the ECB:

1) 75% chance: To cut the 3 policy rates 10 bps, taking the deposit rate to –10 bps, although on this measure, the risks of a 15 bps cut are finely balanced, with the deciding factor really just more ECB members that have mentioned the number 10 than 15, so this outcome remains a random selection.

2) 65% chance: Draghi clearly communicated in the press conference that the Governing Council does not see –10 bps as a floor and is prepared to cut further if needed, although he would likely avoid suggesting where the floor is for the experiment into the world of negative interest rates.

3) 60% chance: The ECB announces a further extension of the fixed-rate, full allotment tenders from July 2015 to July 2016, and potentially as far as December 2016. This has been their soft “forward guidance†tool to massage markets as to the period they see rate hike risks as very limited.

4) 50% chance: To announce some sort of new 2-3y LTRO or ABS buying scheme, where we think the former would likely offer some form of sweetener if used to support new lending. However, the risk here is that the ECB instead is happy with rate cuts and talking the market into pricing an inverted curve and on these credit support measures, only says that the ECB is ready to act later.

5) 25% chance: Stop sterilizing the SMP, injecting additional liquidity into the system in order to depress Eonia. As we discuss below, we believe if the ECB wanted rates lower now or in the past, they would lower the policy rates, not use liquidity.

6) 1.0% chance: QE—so get it out of your mind for now.

As in recent years, we expect monetary easing to have a relatively larger effect on capital markets (prices and volumes), but consider it unlikely that the marginally negative deposit rate would spur lending through a ‘risk taking channel’ (and may not even be fully passed through to lending rates). But at the same time, as in the case with Denmark, we do not expect major negative consequences to be triggered by the negative deposit rate. Overall, the rate cuts only really make sense to us as a ‘holding action’, as the ECB gathers consensus for additional, more effective, easing measures. We believe these will likely include ‘credit easing’ measures, through an ABS purchase programme and/or a credit-linked ABS purchase programme in future months, even though there is a chance that some measures will already be announced at the 5 June meeting."

BoE:

"Given the strength of the UK data flow, we are starting to hear an acknowledge-ment from some members of the MPC that policy tightening will soon be on its way. However, the message from the Governor remains that the most likely timing for the first hike remains ‘early’ next year.

If the BoE wants to increase rates gradually, then it should start the process “sooner rather than later.†That was the opinion of Martin Weale, one of the 9 members of the MPC, in an FT interview published last Wednesday. We had expected disagreements to emerge at the BoE through this year, but they are coming to the fore even a little sooner than we had anticipated. We expect ‘at least’ one MPC member to vote for a rate hike by late summer, possibly even in August. We look for a majority to support a hike in February 2015, although there is ‘at least’ a 35% chance that they hike rates in November 2014, in our view. The costs of waiting too long before hiking are registering with some rate setters, and the dovish line given by Mark Carney in his Inflation Report press conference early this month is plainly not shared by all of the MPC."

Alberto Muñoz, Ph.D. - Forex Analyst at FXStreet:

ECB:

ECB:"Draghi's show is the event of the week without any doubt. Despite there are many speculations about what the ECB will do, there's a lot of uncertainty about the final outcome of the ECB Governing Council meeting next Thursday. At this moment, the ECB is considering to use the following tools against the deflationary spiral: a 10-15 bps cut in the main refinancing rate, a cut in its deposit rate (turning into negative territory as now it stands at zero percent) and a big longer-term refinancing operation (LTRO). Most likely outcome in my opinion is that Draghi will cut main refinancing rate and announce the LTRO but won't cut deposit rate, probably disappointing the market. In that scenario, EURUSD could spike down momentarily the short term support around 1.3580 but after that it could bounce above 1.3650. Otherwise if Draghi puts the ECB deposit rate in negative territory then expect EURUSD to break support and fall below 1.3500."

BoE:

"Despite Bank of England's Monetary Policy Committee member Martin Weale suggested a few days ago that "interest rates may need to rise sooner than planned, though rises should be gradual", I would not expect any change in UK monetary policy in the short term. Otherwise it would be risky as rate hikes would boost pound demand, pushing Cable above 1.7000 which would definitely damage economic recovery. Probably MPC will raise rates by the end of this year or (most likely) February 2015 as long as business investment, productivity growth and GDP remain strong. Anyway we have to pay attention when MPC minutes are released as we could find an unexpected surprise if any of its members votes in favor of a rate hike, which would produce a strong rally in sterling pairs."

Valeria Bednarik - Chief Analyst with FXStreet:

ECB:

ECB:"The European Central Bank is expected to implement some sort of facilities in order to boost economy and diminish the risk of disinflation, yet they have been talking about it for so long, market players had already priced in most of it.

The ECB has a suite of policy options to deploy, but for the most market has priced in a combination between another round of LTROs, a cut in the main rate currently at 0.25% and/or a cut down to negative on deposits rate, this last as a way of stimulating consumption. It’s important to notice the ECB's founding treaty prohibits it from buying government bonds in the primary market.

Nevertheless, and considering overnight rates are now at 0.0%, a widely expected cut in it would only have a limited impact on money-market rates in the currency bloc, albeit is anyway expected to be launched. So in this scenario, market reaction should remain limited. What may really have a strong impact is if the ECB finally turns on the printing machine to buy assets, something market is not counting on. If this happens, we will be on a scenario where the US is ending its QE while the EU is barely starting it: the imbalance among both economies will put the common currency under pressure and boost greenback across the board, yet the EUR will likely suffer against all of its rivals."

BoE:

"I'm again not expecting much from the BOE this month: the economy is clearly picking up with data supporting a continued growth, inflation is within target, and there are no chances a big announcement about ending facilities will be made during this meeting. If something, Minutes of the BOE 2 weeks later could show if there are some splits among voters, could give tips on what's next for the Central Bank. In the meantime, a non-event."

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.