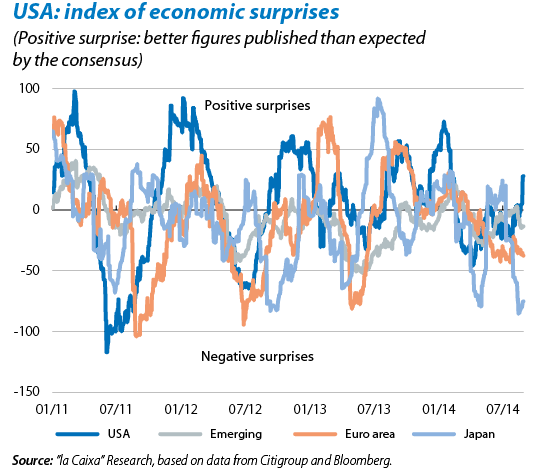

The Federal Reserve maintains its course but internal debate is livening up. At July's meeting of the Federal Open Market Committee, the Fed approved the broad lines of its monetary policy and conveyed a message suggesting a slight shift towards a gradually less accommodative position. In the announcement made after the meeting, it applauded the progress made by the US economy during Q2 and also pointed out the progress being made by the labour market, albeit noting that there was still a large amount of idle resources. This last point has become the crux of the Fed's strategy to justify highly lax conditions after the end of tapering (planned for October). With regard to inflation, and given the improvement in the economic situation, the authority estimates that prices are now less likely to remain below the target of 2% in the medium term. However, the publication of the meeting's minutes in August hinted at growing divergence within the Fed when the first interest rate hike should occur. For the time being, the view of the dovish wing (with Yellen at its head) is prevailing over those advocating an earlier hike although, as admitted by the institution itself, this will all depend on the activity and inflation figures over the next few months.

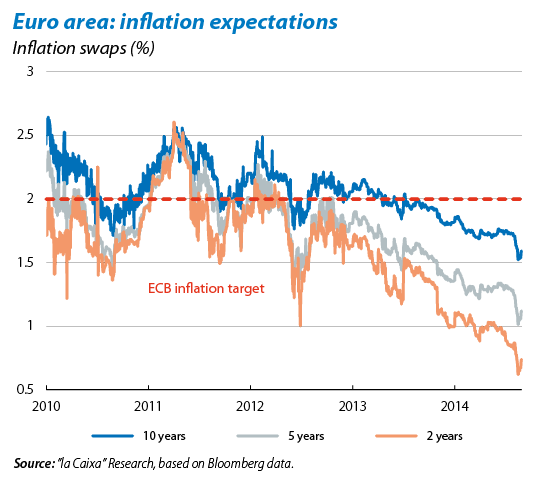

Mario Draghi, the star of the annual central bank symposium at Jackson Hole. Unlike previous years, no important announcements were made regarding US monetary policy and Yellen's speech focused on an empirical analysis of the US labour market. Draghi, however, surprised participants with the tone of his statements. On the one hand the ECB President was very explicit, repeating the commitment to resort to additional expansionary measures to combat the risk of deflation should it be necessary (including a possible asset purchase programme). A direct reference to the reduction in inflation expectations in the short and medium term helped to reinforce his message. On the other hand Draghi moved away from the ECB's usual mantra regarding fiscal policy, declaring that the potential of this tool to boost growth must be reconsidered and duly used.

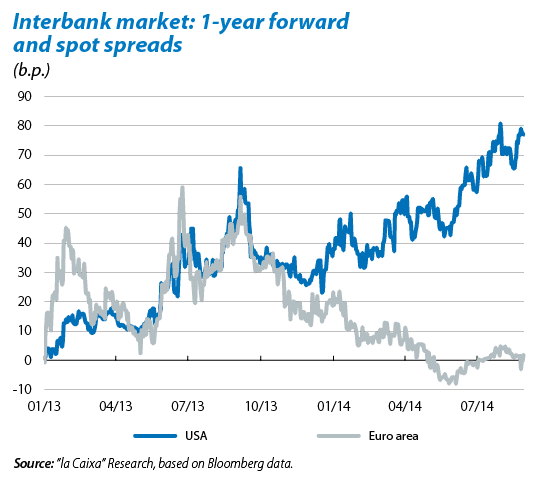

All eyes are once again on the ECB. With the full implementation of June's package of expansionary measures still incomplete, both Draghi's statements and current trends have once again placed the ECB centre stage, although the authority is most likely to reinforce its more accommodative messages before carrying out any new actions. Along these lines, the ECB expects the two targeted longer-term refinancing operations (TLTROs) in September and December to be well received by the banks in the euro area. Meanwhile, preparations have intensified to design a programme to purchase «simple and transparent» asset-backed securities (ABS). The two big sources of risk (inflation and geopolitical tensions) will largely condition the ECB's future steps although a third factor has also come into the fray, related to the normalisation of monetary conditions in the US. As the Fed provides more specific and explicit information on its first interest rate hike, there is the risk that the euro area's sovereign debt curves and monetary rates will be pushed up.

The reappearance of geopolitical risk is pushing up demand for US public debt. Fluctuations in participants' appetite for risk have been accentuated by events in the Middle East and the Ukraine. Treasury yields have started to fall, albeit still within a narrow range. So far the affect of such factors has been modest and offset by the good performance of economic indicators. Paradoxically, the overriding sense of calm in the US bond market calls for even greater caution. Solid indications from US macroeconomic and labour market figures suggest the Fed may toughen up its position. Should this happen, the currently low levels of volatility in the sovereign debt market may give way to a more unstable and erratic environment.

Currently weak macroeconomic indicators in the euro area and conflict in the Ukraine are flattening out the German sovereign curve. The geopolitical disturbances between Russia and the Ukraine and the expected effects of trade sanctions by Moscow on the EU have helped to push down German yields. Specifically, yield on the 2-year Bund has gone into negative terrain while the 10-year yield is below 1%. Confirmation of the German economy's poor performance between April and June (–0.2% quarter-on-quarter) has helped to reinforce this pattern among the country's bonds.

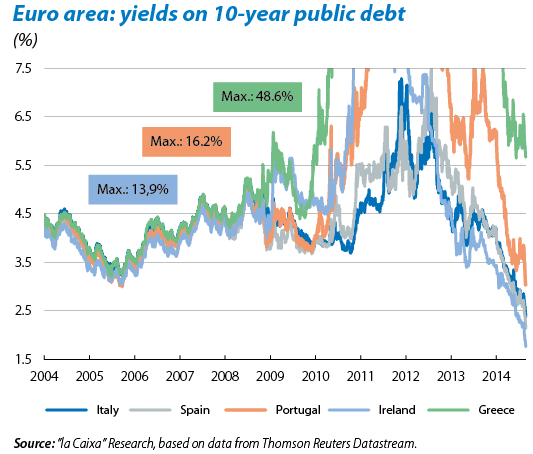

Periphery sovereign debt is showing favourable signs. The outbreak of the crisis for the Portuguese Banco Espírito Santo, later cut short by the government in collaboration with the European authorities, and Italy's relapse into recession resulted in a brief period of nervousness among investors in periphery bonds. In fact, the yield on Spanish 10-year bonds did not take long to start falling again, setting a new all-time low (2.15%) by the end of August. One factor stands out behind this positive trend in periphery sovereign debt: growing market expectation that the ECB will announce further expansionary measures in September. However, we should not forget the risks still facing the EMU economies. On the one hand, the loss of steam observed in Germany, France and Italy could have repercussions on the performance of other EU countries. On the other, the upcoming stress tests on European banks could result in a less benign climate for periphery sovereign debt.

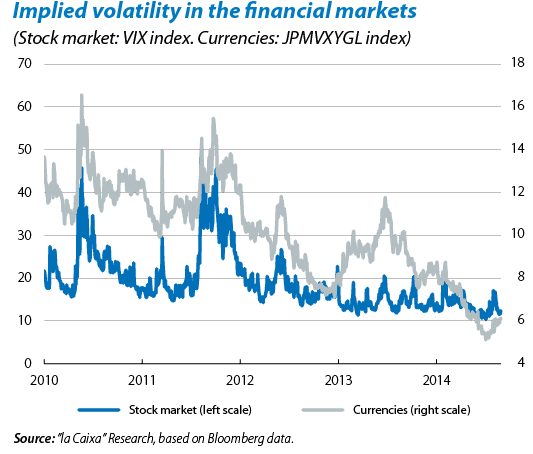

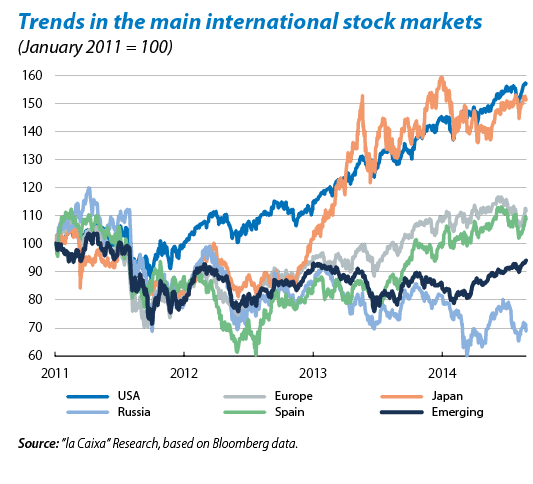

Ups and downs in the stock markets. The fluctuations were quite pronounced in the equity markets in July and August but still far from the tensions seen during the crisis. The disparities between countries have been reflected in their stock markets with the succession of geopolitical tensions and the nature of the economic figures from each one highlighting their differences. US indices, such as the S&P 500, reached new all-time highs thanks to the improvement in the economy and the recovery in corporate earnings. In Europe, equity suffered from the BES crisis, Russia's reprisals and the slump in growth for the region. Interrupting the upward trend started in spring, European indices lost ground between July and mid-August and the modest earnings season for European companies failed to sustain investor optimism. However, the second half of August saw an upswing in European indices, as well as the Ibex, thanks to their US peers and Draghi's messages. The prices of risk assets from the emerging block reported solid gains. The stock markets of some of these countries, such as India, Indonesia and Turkey, with gains close to 20%, are benefitting from increased capital inflows. The other side of the coin is provided by the Russian stock market, a victim of the deterioration in the country's macrofinancial environment.

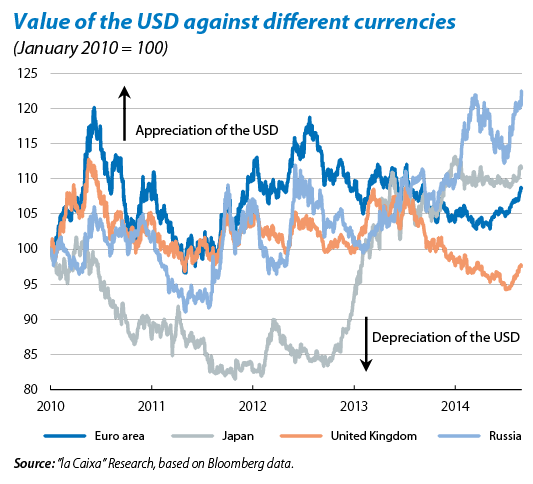

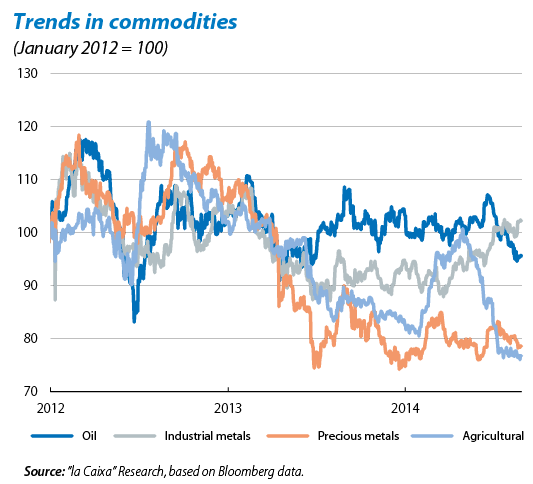

The euro is weakening. Since the ECB announced its package of unconventional measures in June, the euro-dollar exchange rate has shifted in favour of the US currency. With monetary policy moving in different directions on both sides of the Atlantic, the euro has gradually but continually lost value, falling to 1.311 dollars, its lowest value for the last 12 months. The good activity figures for the US, unlike the weak data posted by the main European economies, has helped the dollar to appreciate. The underlying trend will be for the euro to continue depreciating. Regarding commodities, of note is the sizeable fall in Brent oil due to the increase in production capacity and poor performance figures from Europe.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.