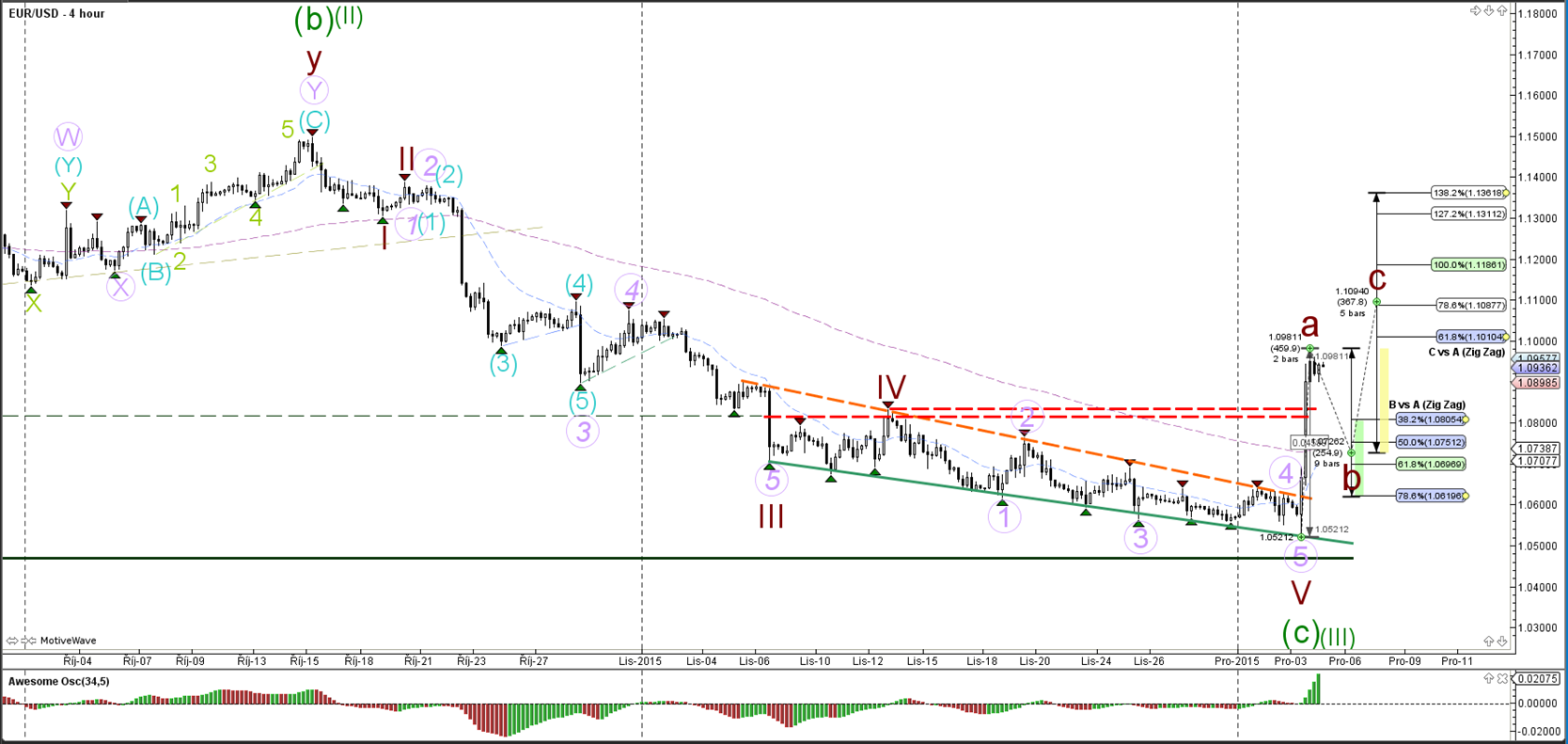

EUR/USD

4 hour

The Euro showed high levels of volatility and strong bullish momentum versus the US Dollar yesterday. The EUR/USD moved from a low around 1.0520 to a high near 1.10. The momentum could broke various resistance levels (dotted lines) and could be marked as wave A.

1 hour

The EUR/USD bullish momentum towers above the downtrend channel. The downside completed a choppy ending diagonal as indicated by the purple 5 waves.

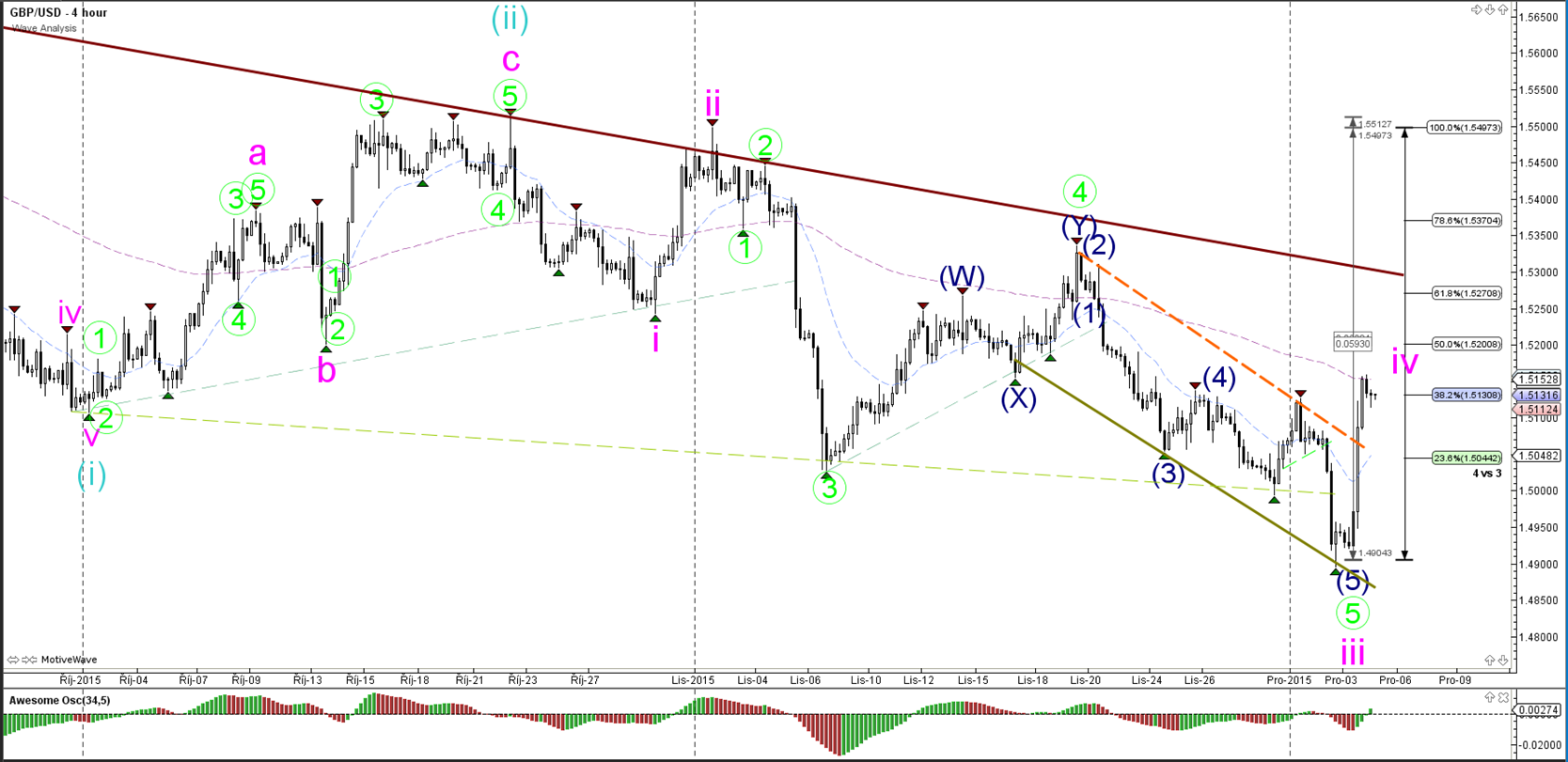

GBP/USD

4 hour

The USD weakened significantly versus the GBP in yesterday’s trading, as also seen in the EURUSD. The GBPUSD still remains in a downtrend as price stays below the resistance trend line but the trend certainly has been choppy. The GU outlook and wave count is uncertain at the moment. The recent upside is showing strong momentum but could now be facing resistance points at the potential 38.2% and 50% Fib levels of wave 4 (pink).

1 hour

The GBP/USD showed strong bullish momentum, which could be a wave A (green) of a larger correction.

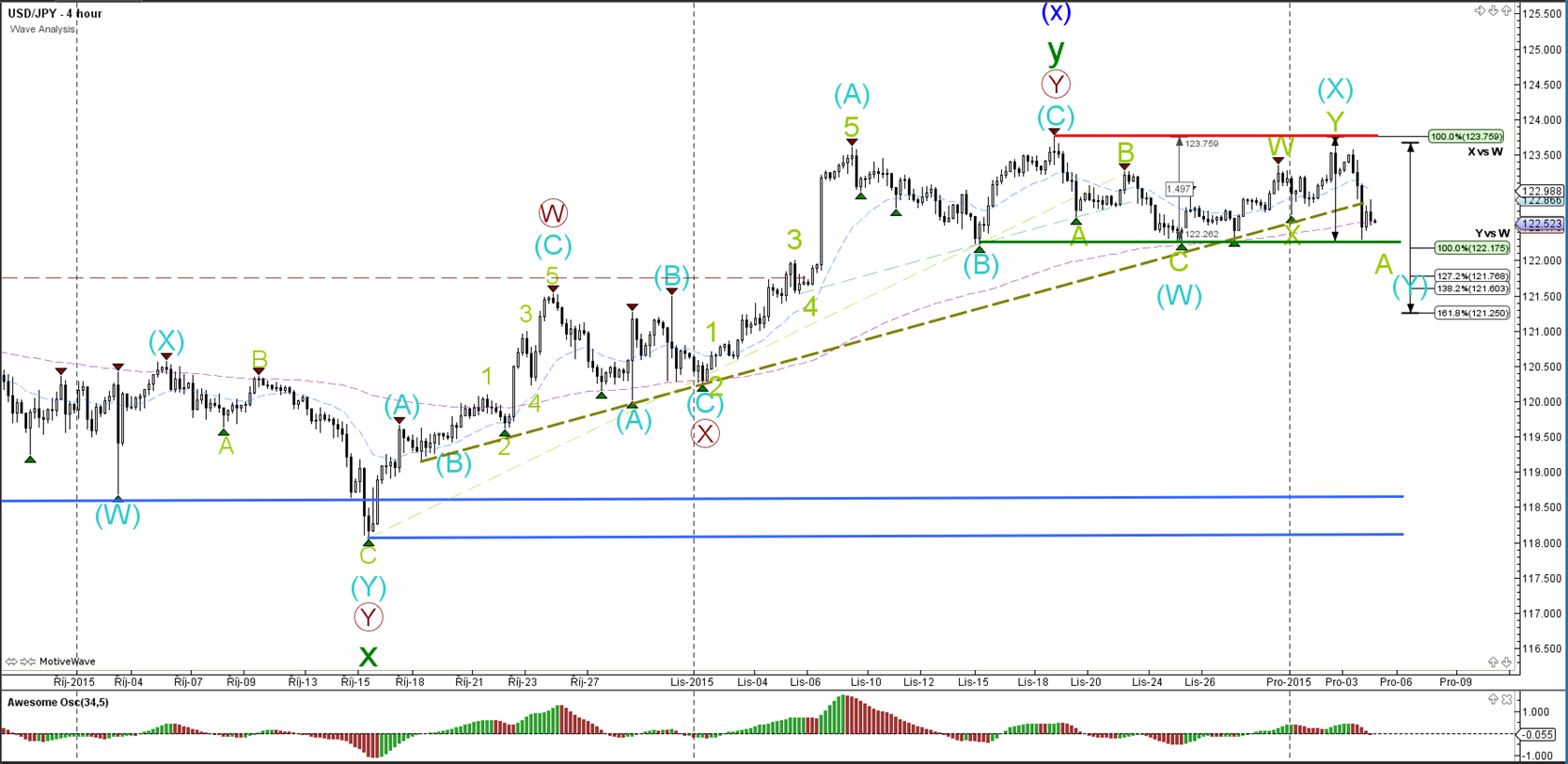

USD/JPY

4 hour

The USD/JPY broke the support trend line (dotted green) but still has unbroken horizontal support below it.

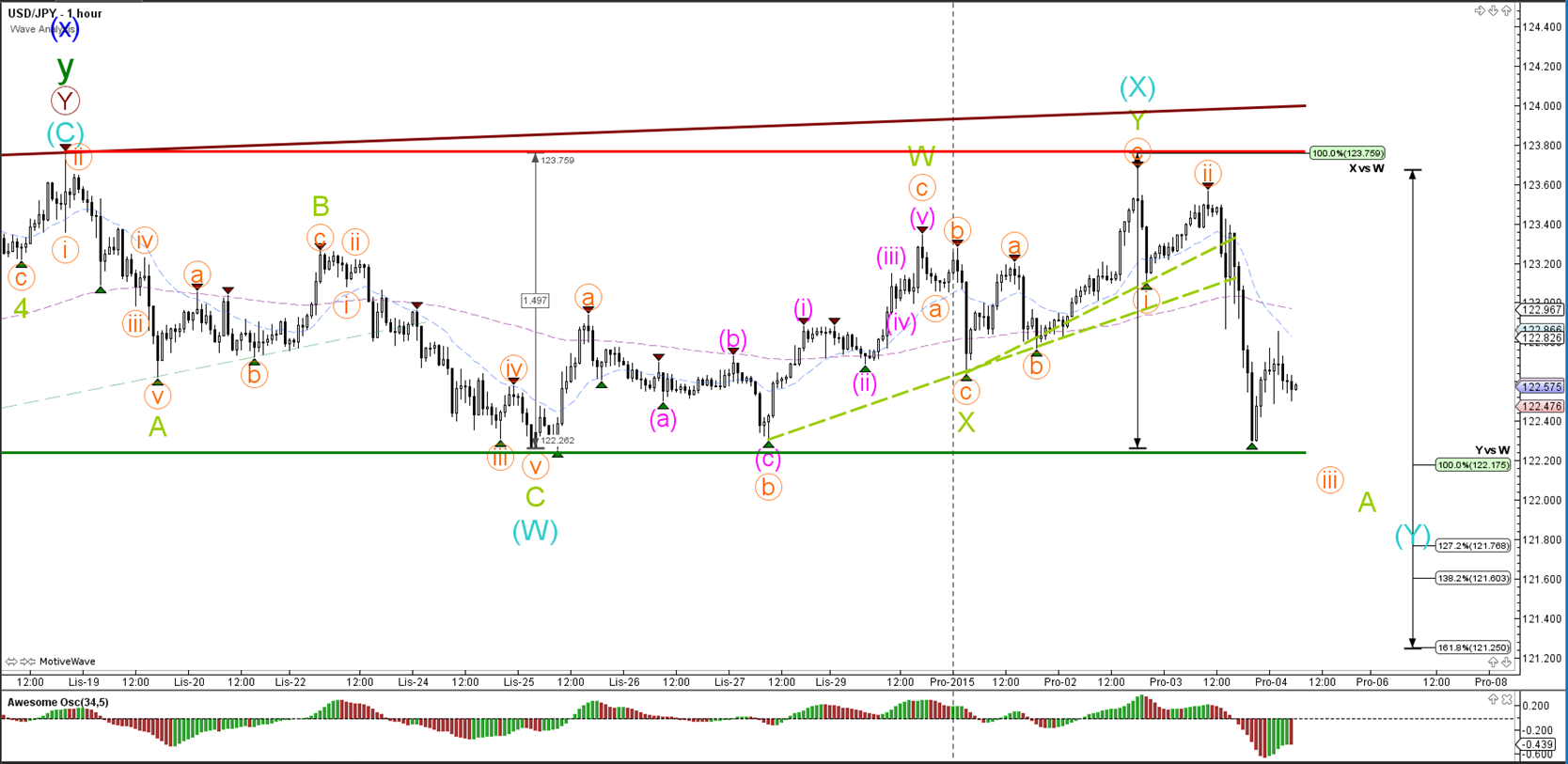

1 hour

The USD/JPY made a bearish bounce at yesterday’s resistance (red) and price is now back at support (green), which also be a bounce or break spot.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.