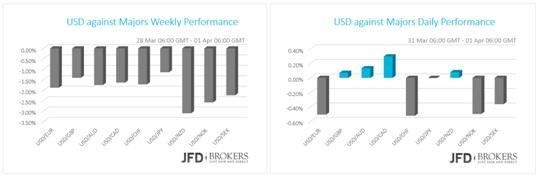

The market continued moving quietly during the Asian session, following yesterday’s volatile day, as traders turned their focus on today’s U.S. Non-Farm Payrolls report. The U.S. dollar plunged versus Euro, Swiss franc, Norwegian Krone and Swedish krone on Thursday, the day before the NFP while since Monday the dollar dropped severely against all of the majors.It fell nearly 2.0% against the euro and Australian dollar, more than 3.0% against the New Zealand dollar, around 1.4% against the British pound and just near 0.8% against the Japanese Yen.

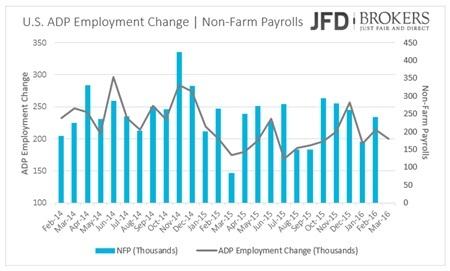

The market expects U.S. payrolls to have increased 205k in March and the jobless rate to have remained to 4.9%. That would be a slowdown in hiring from the previous month of 242k, but not a cause for concern as it would be exactly in line with the average for the last year. Average hourly earnings need to show a monthly gain of +0.2% following a negative 0.1% the previous month. On Wednesday, the ADP Employment Change revealed that economy added 200k jobs in March, more than forecasts of 194k.

A strong NFP outcome above 200k, will indicate that the Fed does not need to worry too much about the U.S’s labor market conditions yet while a print below 150k could trigger an unexpected volatility in the market. Technically, a disappointing number, below 150k, will help the euro recover further against the greenback, while a good number, above 200k, would support the dollar. On the other hand, a number around 180k it could increase the possibility for false breakouts.

EUR/USD – Technical Outlook

Technically, we have said that a close above the key level at 1.1377 (Wednesday’s suggested target) for the EUR/USD pair would be a very bullish development for the euro as we have not seen a daily close below that level since October 2015. With the NFP report coming later in the day, we could expect any kind of reaction as the NFP figure will determine the pair’s move and trend direction if we consider that the pair is moving in a sideways channel since March 2015.

For position traders, the most important levels to watch are the 1.0450 – 1.0525 zone while on the upside the first obstacle for the bulls will be the significant level at 1.1500. A break of any of these levels we should expect a rally of more than 400 pips.

For the short and medium terms traders, we can see that the pair is moving in an uptrend sloping channel, following the strong rebound from 1.0530 and more recently from 1.0820. The price is currently challenging the upper boundary of the sloping channel, near 1.1400. On the downside, the first initial support will come at 1.1300. A rebound at that level would probably extend the movement towards yesterday’s high at 1.1410. At the moment, the pair is increasing the attempts to break above the latter level, as this is the second time that is retesting it within the last day. The momentum indicators do remain mildly neutral to positive so further gains may lie ahead which could potentially see a break above the ascending trend line, near 1.1410 for a return to 1. 1500.

However, ahead of the biggest event of the month traders should be cautious as the pair could release a high volatility in case of a surprise figure.

UK Trade Deficit the Highest since Records began!

The British Pound was traded lower against the euro, Swiss franc, Norwegian krone and Swedish krona while it was virtually unchanged against the other G10 currencies on Thursday and early Friday. The UK Current’s Account Deficit Widened to a record high the last quarter of the year. For 2015 as a whole, the trade deficit ballooned to £96.2 billion or 5.2% of annual GDP, the highest since records began in 1948. The final GDP growth for the fourth quarter showed that economy advance by 0.6% qoq, higher than market estimates of 0.5% and 2.1% yoy from 1.9% expected. The annual growth was 2.3% in 2015 rather than 2.2% as it was initially forecasted.

GBP/USD – Technical Outlook

The GBP/USD was virtually unchanged on Thursday, 0.04% rise while it was traded 1.50% lower since Monday. Technically, there is no major change to the outlook although the pound is looking somewhat heavy going into the New York open, currently sitting just below session lows of 1.4330 and looking as though we could be in for a test of the 50-SMA on the 4-hour chart. A break would see the GBP/USD head towards 1.4185. On the other hand, if the bulls manage to sustain their positions above the 1.4330, which looks unlikely for the moment, could push the price towards the descending trend line, near 1.4460. For now, I will remain slightly bearish on this pair with the first target being the 1.4285 barrier (intraday).

USD/JPY – Technical Outlook

The USD/JPY pair is continuing to trade in a fairly tight range, with 114.50 capping any moves to the upside and 111.00 propping it up. Over the last couple of weeks, the USD/JPY pair hasn’t even reached these boundaries with the range appearing to have tightened further. It should be noted, that the price continued to increase the rate of attempts to reach the 114.50 level the last month.

However, it will need a huge effort from the bulls to break the significant level at 114.50, which includes also the 50-SMA on the daily chart. Therefore, the key to watch over the next couple of days will be the 114.50 level, which I consider a turning point for the pair. On the downside, support will be seen at 112.00, ahead of 111.65 and 111.00. Below here looks unlikely at the moment, but further losses would head back towards the significant level of 110.65.

Gold – Technical Outlook

The precious metal has traded in a tight range the last few weeks and with the short-term charts looking mixed, more range-bound trade looks likely, with direction likely to be led largely by today’s NFP report. Not much change to the outlook as the medium-term charts remain mildly positive, so another test of $1,275 looks possible. On the downside, back below $1,207 would possibly look to retest the psychological level of $1,200 and we need to make a sustained effort to get back below that level to provide confidence of a medium term base. Buying rallies seem to be the plan for today, although I would not be looking for too much ahead of tomorrow’s NFP report which could create some major swings for the yellow metal. It should be noted that the metal has gained more than 15% in the first three months of the year, with February closing up 10.98%, its strongest performance since August 2011 (+13.13%).

WTI and Brent Crude Oil – Technical Outlook

Oil prices continue to plunge early Friday with WTI crude hitting the lowest level in more than two weeks ahead of the NFP report.

The U.S. Crude oil which has risen about 50% since mid-February, have started to track lower in the past week following the failed attempt above the significant level of $42.50 (suggested target in the past). If the WTI continues to the downside, then back below the session low, the first support is seen at $36.40 and then at $35.80. Below here we would at $35.00. It is very significant that the commodity is trading below the 50-SMA on the 4-hour chart, as well as below $40.00. Therefore, I will remain slightly bearish on this commodity.

A similar picture prevails in Brent Crude oil. The UK Crude is failed to break above the significant level at $42.50, following several attempts and is now making is way back towards the key level at $39.00. The short-term momentum indicators still point lower and more particular with the 4-hour indicators – MACD and RSI – still pointing lower we could be in for a move back towards the significant zone at $35.80 - $36.40, which coincides with the 50-SMA on the daily chart.

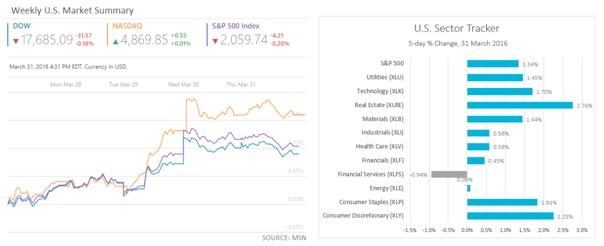

U.S. Indices posted the biggest gains since October

The U.S. indices ended the best-performed month since March! The Dow Jones Industrial Average advanced sharply by 7.08%, Nasdaq Composite Index soared 6.84% and S&P 500 gained 6.60%.

The Dow Jones Industrial Average ended Thursday’s session marginally lower, 31.57 points or 0.18% down, close to 17,680.00. An above expected non-farm payrolls figure could send the Dow Jones to test the significant 17,900.00.For two months, November and December, the index was trying to break above that level without result. Therefore, the next upcoming attempts will be a very interesting battle to watch! On the other, hand, if the jobs report disappoints the market, I would expect the 100-SMA on the 4-hour chart to provide support to the index around 17,500.00.

The S&P 500 slumped by 0.20%, 4.21 points, and closed at 2,059.74. The next level target of the index is the zone between 2,080.00 and 2,100.00 on the upside. However, if the index suffers a sell-off I would expect the 100-SMA on the 4-hour chart to support it slightly below 2,040.00.

The Nasdaq Composite Index was the only one of the three most popular U.S. indices that managed to eke out slight gains on Thursday, even though slightly. It added 0.55 points, +0.01% and ended the day close to 4,870.00. The next level to watch is 4,580.00 and a strong push may send the index higher at 4,740.00.

What to watch today

The final Markit Manufacturing PMIs for Eurozone as a whole, Germany and UK will be out. The highlight of the day is the Non-Farm Payrolls report. The U.S. economy is estimated to add 205k jobs in the non-farm private and public sector, from a robust 242k in February. The Unemployment Rate is expected to remain at the record low level of 4.9% and the hourly wages to have risen by 0.2% from a slight decline of 0.1% before. The final Markit Manufacturing PMI for March is also coming out as well as the Michigan Consumer Sentiment which is expected to have improved slightly to 90.5 from 90.0 before.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.