Forex Weekly Wrap-Up: Mar 21 -25

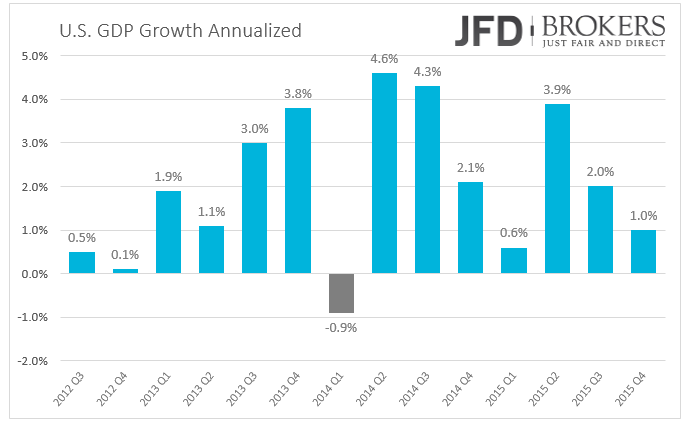

Today most of the European Markets are closed due to Easter holidays. There are no major indicators or speeches scheduled for Eurozone and I expect a quiet day driven largely by technical factors during the morning session. In the second half of the trading session, the U.S. GDP growth for the fourth will be released.

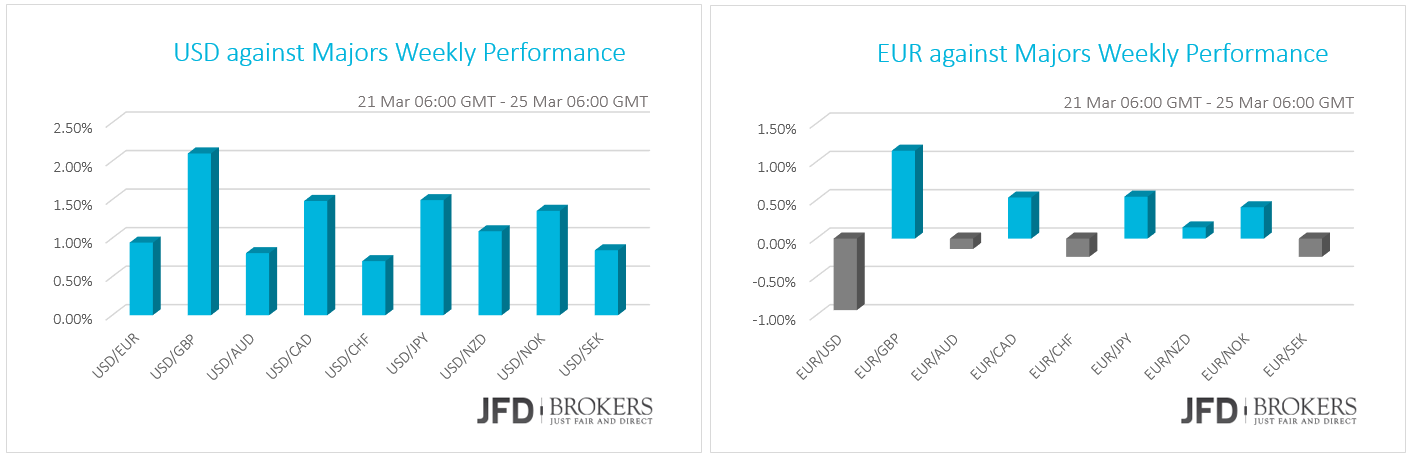

U.S. Dollar underpinned from rate hikes hints

The greenback enjoyed some gains throughout the week after two Fed officials that rates may rise in April underpinned the currency. The strength of the dollar acts heavy pressure at the stocks and the commodities driving the commodity currencies to record severe sell-off on yesterday’s trading session. Other fundamental news from U.S. are the downbeat Durable Goods Orders declined by 2.8% in February from an increase of 4.2% in January. The Existing Home Sales plunged by 7.1% in February from last month’s figure to a seasonally adjusted annual rate of 5.08M.

Euro has been in a choppy session

The euro has been choppy the whole week and has been range-bounded against most of the currencies ahead of Easter holidays and after the bomb attacks in Brussels. Out the politics and terror concerns and no heavyweight economic news affected the market. Eurozone’s flash Consumer Confidence for March slumped more in the negative territory and fell to -9.70, the lowest level since March 2014. Contrary, the flash Markit Manufacturing PMI for March rose at 51.4 from 51.2 before, while the services sector surpassed expectations and increased at 54.0 from 53.3 before. In Germany, the IFO survey surprised positively in all of its three aspects. Expectations surged to 100.0 from 98.9 in February, Current Assessment jumped to 113.8 from 112.9 and the Business Climate beat expectations by rising to 106.7 from 105.7 prior.

The EUR/USD pair has had a quieter session, trading between 1.1150 – 1.1200 leaving the outlook pretty much unchanged. The short-term momentum indicators still appear slightly negative so we could be in for further losses in the days to come. If so, look for a return to the psychological level of 1.1100. Beyond there would see further sellers at 1.1000 – 1.1030, where the short-term rising trend line could provide some support to the price action, temporary at least. Moreover, the 4-hour chart has turned lower, so if we do see a near term decline, then back below the latter level would target 1.1070.

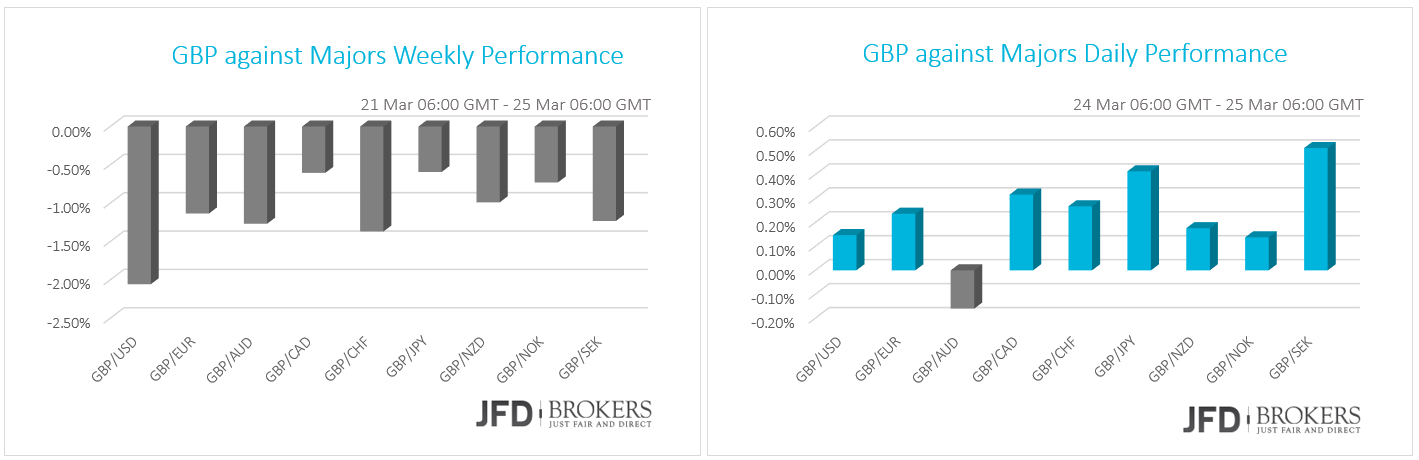

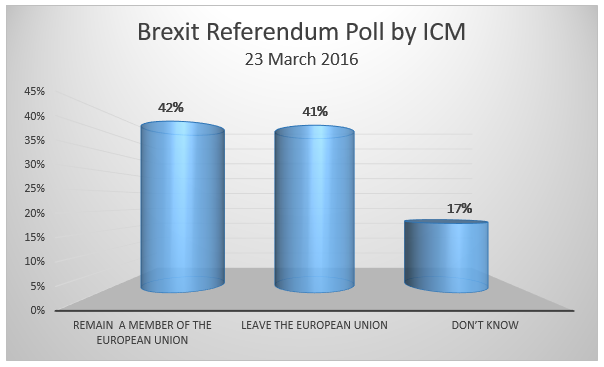

Pound Slumped as Brexit Votes Increased

During the week just past the pound was severely depreciated against the major currencies as the terror attacks in Brussels set the risk in the continental Europe extremely high and the number of British citizens will vote for Brexit in June increased, driving sterling to fall heavily in all fronts. The last ICM poll published on Wednesday morning revealed that 42% of respondents want UK to leave the 19-nation union, while only 41% said that prefer to stay inside the common bloc.

In other news, the final Inflation Rate for March remained unchanged at 0.3% on a yearly basis, far below Bank of England’s 2% target. The month-over-month indicator disappointed the market forecasts of 0.4% and rose to 0.2% from -0.8% before. The UK Retail Sales rose by 3.8% year-over-year in February and 4.1% the Retail Sales ex-fuel. Even the values are worse than last month’s, managed to surpass expectations pushing the pound slightly higher for the daily session. However, the weekly session continues to be negative on all fronts.

Friday will be thin on the ground for data for the UK and any movement is likely to emanate from any Brexit news. Technically the GBP/USD has now broken the around a technical key point at 1.4050. On the topside, resistance will be seen at the session high at 1.4180. On the other hand, if the bulls fail to sustain their recent pullback then we could see a run back to the psychological level of 1.4050 and then to 1.4000. Beyond this latter level, there are a lot of supports to be seen, therefore selling the rallies is the main thing for intraday traders.

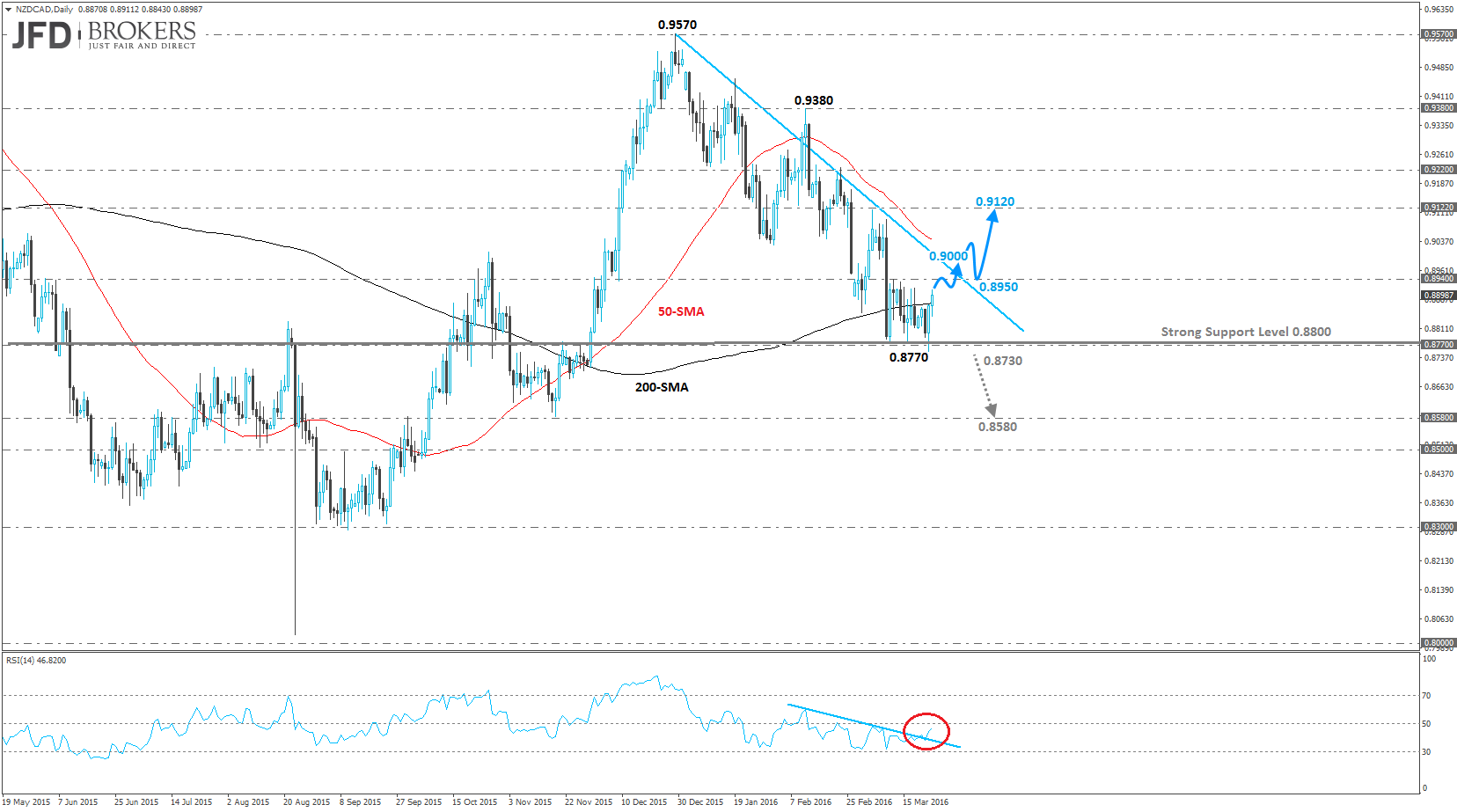

NZD/CAD – Technical Outlook

After seeing a lot of volatility towards the beginning of the month, the NZD/CAD pair has once again stabilised near 0.8800. It may be too early to say this pair is looking bullish again following such a long period of a downtrend, but there is certainly a slight bullish bias being seen in the price action right now. The 0.8770 level has been providing clear support for the pair over the last 2 weeks. A key resistance level in recent months has been the 0.8940 barrier and the pair is once again struggling at this level. This also now coincides with the descending trend line, which started back in early 2016. A break of either of these two levels could give a strong hint about the next move in the pair, with any move to the upside also needing to break through the descending trend line in order to confirm the medium term bearish bias.

EUR/TRY – Technical Outlook

On the daily chart, the EUR/TRY pair continues to be confined within a symmetrical triangle, which is a continuation pattern of the uptrend from September 2010. The pair is nearing the apex of the triangle and a breakout is expected anytime soon. There are strong expectations for an upside move, given the fundamentals surrounding the single currency. Technically, the Turkish lira has now broken the 50-SMA and the 200-SMA but remains above the lower boundary of the triangle. A break of this could then open the way to 3.1430 – 3.1710, below which could see a deeper decline towards the psychological level of 3.000, although a break below this at this stage looks unlikely. Furthermore, if we switch to the weekly timeframe, we could spot a failure swing formation, which is still in progress. Therefore, the position traders should watch that very closely.

What to watch today

Friday is a bank holiday in most European countries and the commodity countries so liquidity will be thin although, the U.S. final GDP for Q4 may well cause some ripples in the market if the forecasts do not be met. The forecasts suggest the figure to remain unchanged at 1.0% quarter-over-quarter.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.