Technical Bias: Bearish

Key Takeaways

- Most majors are sitting in ranges as the Forex market prepares for action.

- Chinese Gross Domestic Product (GDP) measuring the annualized change in the inflation-adjusted value of all goods and services is set to rock market during the next Asian session.

- Aussie dollar might climb and take advantage of the Japanese yen weakness moving ahead.

Earlier, the Governor of the Bank of Japan Haruhiko Kuroda stated that the central bank would keep up with monetary easing until inflation is firmly anchored. His remarks increased bearish pressure on the Japanese yen especially against the Aussie dollar.

Technical Analysis

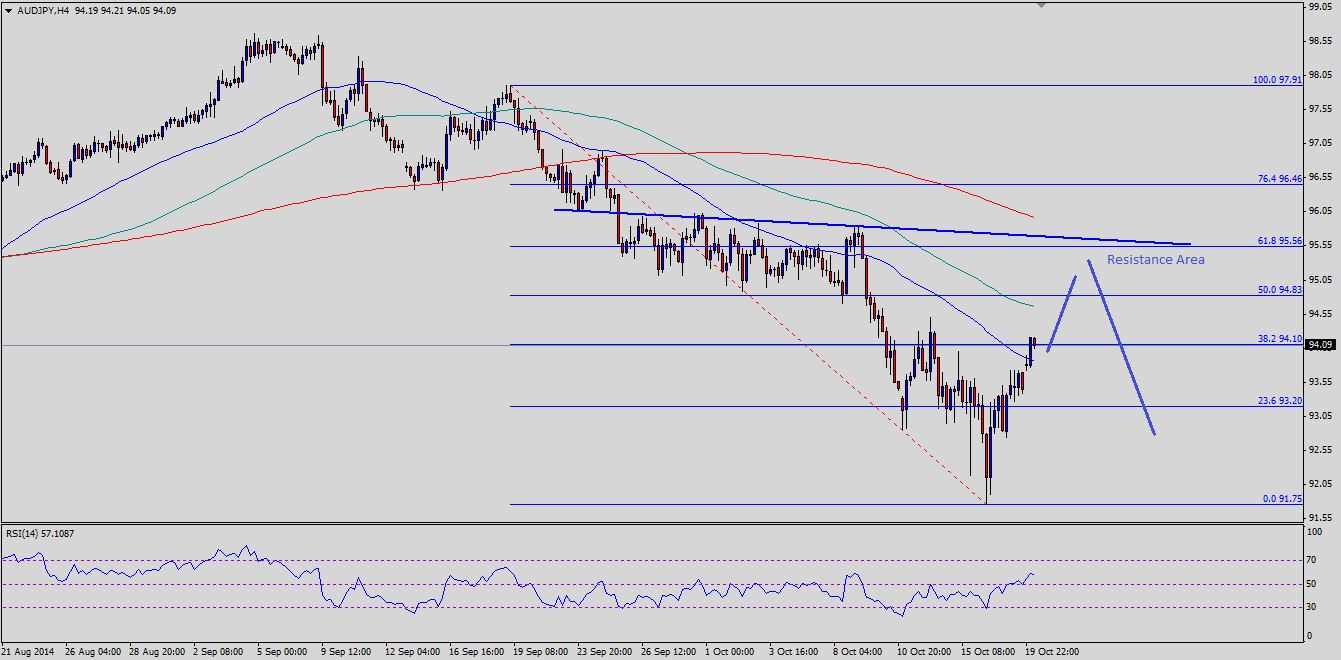

AUDJPY benefited from the Japanese news as it climbed higher above the 94.00 level. There is no denial that the pair is positively biased in the near term, but a lot would depend on the upcoming Chinese GDP release. If the outcome surpasses market’s expectation, then the Aussie dollar might surge against a basket of currencies including the Japanese yen. There are several hurdles on the way up for the pair, starting with the 100 simple moving average which is sitting around the 50% Fibonacci retracement level of the last drop from the 97.91 high to 91.75 low. If AUDJPY buyers manage to surpass the mentioned resistance area, then it might head towards another critical zone at 95.50. There is a monster trend line around the stated area which is also meeting the 61.8% fib level. So, AUDJPY buyers could struggle around 95.10-95.50 if the pair climbs higher.

On the downside, there is only open space. So, if the Chinese GDP fails to impress investors, then we might witness pressure selling in AUDJPY. In that situation, the pair might fall towards the 92.00 support area.

Chinese GDP

There is an important economic release lined up during the next Asian session i.e. the Gross Domestic Product (GDP) will be published by the National Bureau of Statistics of China. The forecast is of a minor decline from the previous rate of 7.5% in Q3 (YoY). Let us see how the outcome shapes out and affects the price action moving ahead.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.