Good morning from Hamburg and welcome to our first Daily FX Report for this week. Emergency workers filled thousands of sandbags on Sunday as the area around Buffalo, New York braced for potential flooding as warming temperatures began to melt up to seven feet (2 meters) of snow. Hundreds of members of the New York National Guard were in Erie County and Buffalo to help with flood prevention after days of work to clear roads and dig homes and cars out of the record snow from a storm that killed 13 people. The National Weather Service said roads could flood quickly from snow melt, since the storm blocked drains, and issued warnings for potential flooding of four rivers and creeks.

Anyway, we wish you a successful trading week!

Market Review – Fundamental Perspective

One week after the European Central Bank president vowed to revive inflation “as fast as possible”, policy makers will receive a glimpse on just how feeble cost pressures are now in the euro region. Economists forecast data on November 28 will show consumer-price growth matching the weakest since 2009. That would add to the drumroll for a stimulus debate at the December 4 meeting as panels of officials study possible new measures to prepare to cut their economic outlook. While Draghi has stoked pressure toward sovereign-bond buying, colleagues from Germany to the Netherlands are unconvinced quantitative easing is warranted, and his vice president suggested at the weekend that the ECB might hold off until next year. Inflation data for November are forecast to show a dip to 0.3 percent from 0.4 percent, while economic confidence is seen declining and October unemployment staying at 11.5 percent, according to economists surveyed by Bloomberg before those reports this week. The inflation rate has held below half the ECB ́s target of just below 2 percent for the past year, spurring interest-rate cuts as well as programs of long-term bank loans and covered-bond buying, with purchases of asset- backed securities starting last week. The euro approached a two-year low versus the dollar before German data forecast to show business confidence declined for a seventh month. The shared currency fell against major peers on November 21 after European Central Bank President Mario Draghi said officials “ will do what we must” to raise inflation. It fell 0.2 percent to $1.2373. It touched $1.2358 on November 7, the lowest since August 2012. The single currency slipped 0.2 percent to 145.68 yen.

Daily Technical Analysis

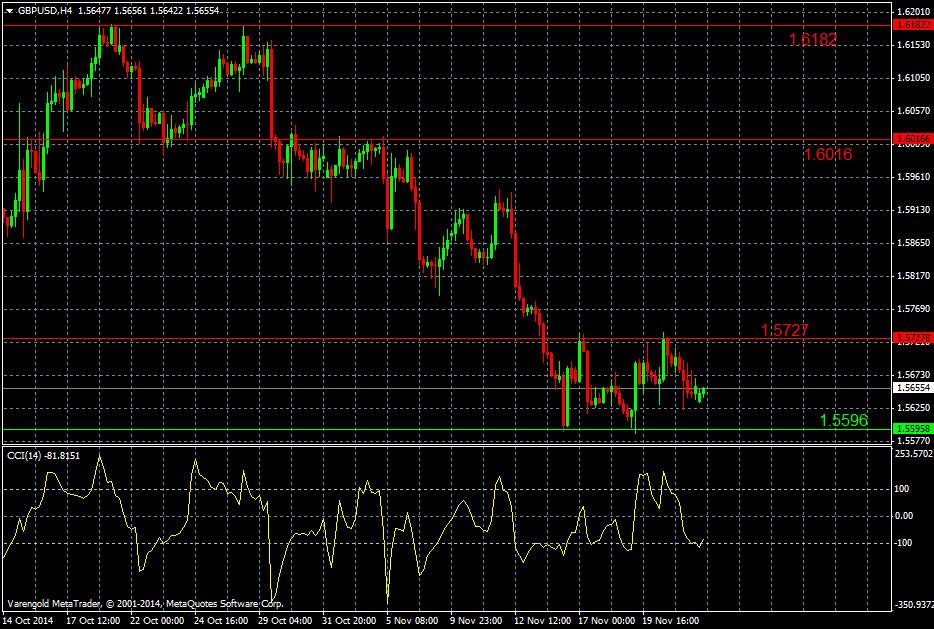

GBP/USD (4 Hours)

As the chart shows, the GBP decreased steadily versus the USD since the mid of October. The support line at 1.5596 was strong enough as the price was unable to break through and rebounded. The price touched twice the 1.5727 and rebounded towards 1.5596. On a short term the CCI is indicating a possible upward movement, but further losses may occur.

Support & Resistance (4 Hours)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.