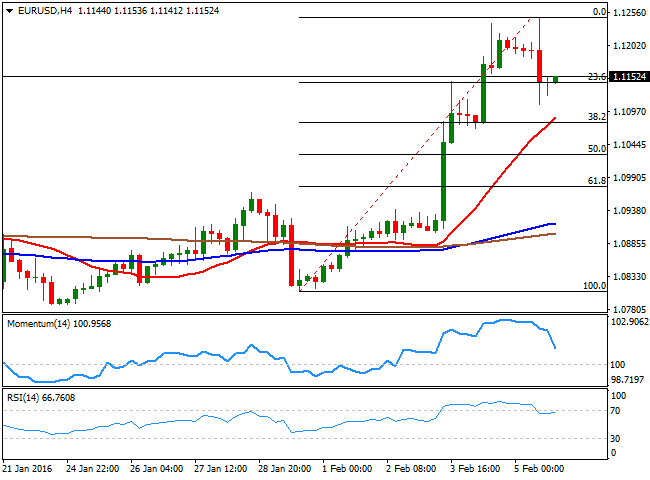

EUR/USD Current Price: 1.1152

View Live Chart for the EUR/USD

The EUR/USD closed the week at 1.1152 after being as high as 1.1245 during this Friday, posting its largest weekly advance ever since ECB's Draghi announced more easing for Europe early December. Dollar's longs got smashed all across the board, as hopes for further tightening in the US turned into speculation of upcoming easing in the number one world's economy. Continued poor growth data ever since the year started, has prevented the dollar from rallying during the first month of the year, but investors rushed to unwind positions after FED's Dudley said last Wednesday that financial conditions ever since the Central Bank rose rates have changed.

For the upcoming days, attention will focus in the semi-annual testimony of Fed Chair Yellen before the Congress, while in China, the Lunar New Year festivities should keep local markets quiet and the country’s data calendar fairly light, diminishing chances of risk-aversion-focused trading.

The greenback took a breath last Friday with the release of the Nonfarm Payroll report, which showed a modest growth in jobs, but impressed with stronger wages and a decline in the unemployment rate to 4.9% the lowest in 8 years. The EUR/USD pair shed some ground, but not enough to support further dollar gains in the week now starting, as the pair closed above the 23.6% retracement of the latest daily bullish run. Daily basis, the technical indicators have lost upward strength near overbought territory, but remain far from suggesting a downward move, whilst the price stands firmly above its moving averages. The closest is the 200 DMA, at 1.1025, and as long as this level holds, bears' chances will be limited. In the 4 hours chart the 20 SMA heads higher around 1.1090, around the 38.2% retracement of the mentioned run, while the technical indicators have retreated from overbought levels, but also lack bearish strength at the time being, in line with the longer term outlook.

Support levels: 1.1120 1.1090 1.1060 1.1025

Resistance levels: 1.1200 1.1245 1.1290

EUR/JPY Current price: 130.45

View Live Chart for the EUR/JPY

The EUR/JPY pair closed the week in the red, weighed by yen's strength. The Japanese currency recovered all of its post-BOJ losses against the greenback and accelerated its advance as safe havens appreciated sharply, resulting in a EUR/JPY slump back to the 130.00 region. Trading within an ascendant symmetrical triangle, the daily chart is currently given an unclear picture, given that the price has retreated multiple times from a slightly bearish 100 DMA, and the RSI indicator heads lower around 55, but at the same time, the price has bounced from the base of the figure and the Momentum indicator heads higher near overbought levels. In the shorter term, the 4 hours chart the price remains well above its moving averages, with the 100 SMA heading higher and approaching the 200 SMA, while the technical indicators head higher within neutral territory, limiting chances of a strong decline. Nevertheless, a break below the 130.00 figure should lead to additional short term declines, down to the 128.80 region, supporting then, a bearish case for the rest of the week.

Support levels: 130.00 129.65 129.20

Resistance levels: 130.85 131.30 131.80

GBP/USD Current price: 1.4499

View Live Chart for the GBP/USD

The British Pound rallied against the greenback, resulting in the largest weekly advance for the GBP/USD since last August. Pound's rally however, was based on dollar's weakness rather than self-strength, and it may well resume its previous decline, particularly as the latest You Gov poll showed last Friday that 45% of respondents favor leaving the EU while only the 36% wanted to stay. The daily chart shows that the pair reached the 50% retracement of the latest daily decline between 1.4239 and 1.4078, at 1.4665, the level to beat this week to support a more constructive outlook. In the same chart, the technical indicators are finally bouncing partially from oversold levels, but remain deep in negative territory, while the 20 SMA heads sharply lower around 1.4950. In the 4 hours chart, the price is currently below a major resistance, as the 20 SMA, the 200 EMA and the 38.2% retracement of the mentioned rally converge around 1.4353, while the momentum indicator heads strongly south after breaking below the 100 level, whilst the RSI indicator stands flat in neutral territory. Friday's low of 1.4451 is the immediate support, with declines below it increasing the risk towards the downside.

Support levels: 1.4450 1.4410 1.4370

Resistance levels: 1.4535 1.4580 1.4620

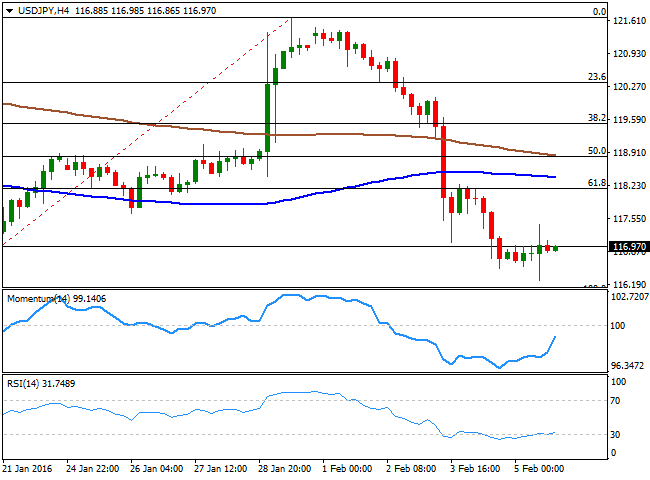

USD/JPY Current price: 116.97

View Live Chart for the USD/JPY

The USD/JPY has sharply reversed all of its post-BOJ gains, and even extended its decline to a fresh 2-week low of 116.27 on Friday, led by dollar's sell-off and the poor performance of equity markets. Despite the Bank of Japan joined the currencies' war by cutting rates into negative territory, diminishing chances of a US rate hike during the upcoming months took its toll on the pair, now poised to extend its decline in accordance to a strong bearish technical bias. The daily chart shows that the price managed to bounce from the mentioned low, but ended the week a handful of pips below the 117.00 figure, having retraced almost 100% of its latest gains and trading well below its 100 and 200 DMAs. The technical indicators in the mentioned time frame have entered negative territory, but lost their bearish strength and turned slightly higher, as the pair closed the day 10 pips above its daily opening. In the shorter term, the 4 hours chart shows that the RSI indicator remains within oversold territory, while the Momentum indicator aims higher below its 100 level and the 100 and 200 SMAs tuned lower far above the current level. A break below 116.00, the base of its recent trading range, should signal a steeper decline for the upcoming days that can extend down to the 112.50 region, should dollar weakness prevail.

Support levels: 117.00 116.60 116.20

Resistance levels: 117.70 118.10 118.50

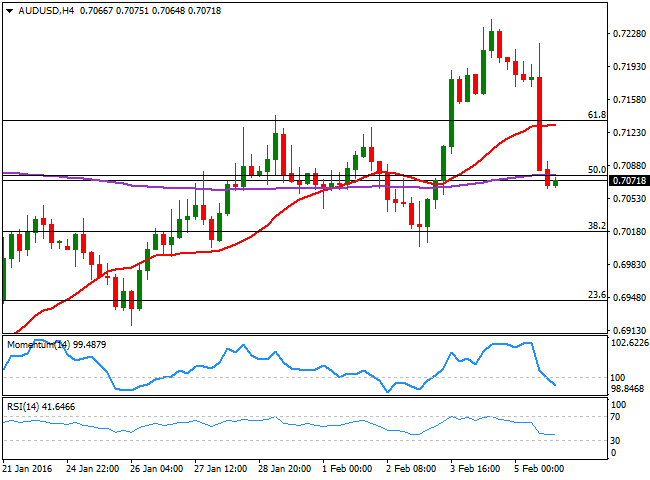

AUD/USD Current price: 0.7071

View Live Chart for the AUD/USD

After trading as high as 0.7242 during the week, the AUD/USD pair plummeted on Friday, to end the week at 0.7071. The Aussie suffered from softer local data, as on Friday, Australia’s retail sales report for December missed expectations, coming in flat against forecasts for an increase of 0.5% the worst result since July 2015. The AUD/USD fell early Asia, extending its decline during the rest of the day as the dollar's decline paused on stronger wages and an impressive decline in the unemployment rate. Additionally, the RBA has released the Minutes of its latest meeting leaving doors opened for additional easing. Technically, the daily chart shows that the price is currently struggling with the 50% retracement of its latest bearish run, while the 20 SMA maintains a bullish slope around 0.7000, and the technical indicators turned south within bullish territory. In the 4 hours chart, the pair broke through its 20 SMA while the Momentum indicator heads south below its 100 level and the RSI indicator consolidates around 41, in line with further declines, particularly on a break below 0.7060, the immediate support.

Support levels: 0.7060 0.7000 0.6970

Resistance levels: 0.7100 0.7140 0.7185

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.