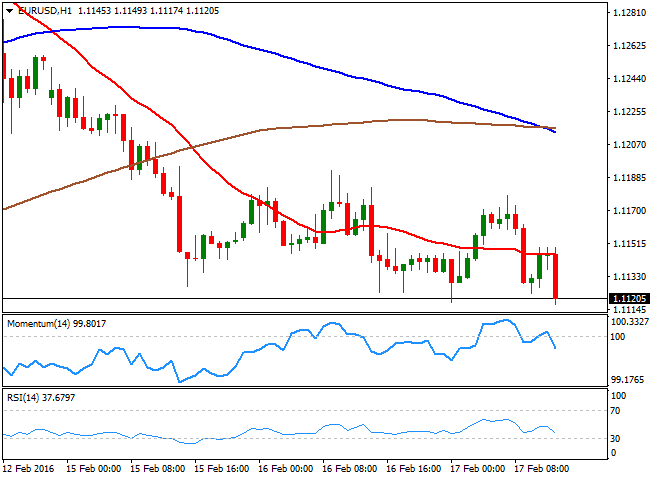

EUR/USD Current Price: 1.1120

View Live Chart for the EUR/USD

The EUR/USD pair trades in the lower half of its latest tight range, down to 1.1118, holding nearby ahead of US data release. Generally speaking, markets are quite active, with Asian stocks down, but European ones higher, and oil recovering ground after yesterday's slump. The common currency however, seems unable to attract investors, and this latest intraday bounce is more related with dollar's weakness than self EUR strength. US data came out mixed, with Housing Starts down in January to 1.1M, although Building Permits surged slightly above the 1.2M expected while Producer Price Index figures surprised to the upside, up by 0.4% monthly basis, and 0.6% compared to a year before, beating market's expectations.

The pair fell back towards its low with the news, and is poised to extend its decline, as in the 1 hour chart, the 20 SMA capped advances whilst the technical indicators turned south around their mid-lines, and are currently accelerating their declines within negative territory. In the 4 hours chart, the technical bias is also towards the downside, with the 20 SMA heading sharply lower in the 1.1160 region, and the technical indicators resuming their declines within negative territory.

Support levels: 1.1080 1.1045 1.1000

Resistance levels: 1.1160 1.1210 1.1250

GBP/USD Current price: 1.4286

View Live Chart for the GBP/USD

The British Pound saw some relief after the release of January UK employment data, showing an improvement in wages and jobs' creation, although the unemployment rate remained at 5.1%, missing expectations of 5.0%. The GBP/USD extended its decline down to 1.4243 during Asian trading hours, but the good news helped it bounce back above the 1.4300 figure. The shallow advance was quickly reverted after the release of good US inflation figures, and the pair is trading back below a daily ascendant trend line, whilst the 1 hour chart shows that the price is aiming to extend below a flat 20 SMA, and that the technical indicators are turning lower around their mid-lines. In the 4 hours chart, the technical indicators have turned back lower after a brief correction from oversold readings, now while the price remains far below a bearish 20 SMA, all of which supports some further declines.

Support levels: 1.4250 1.4210 1.4170

Resistance levels: 1.4325 1.4370 1.4410

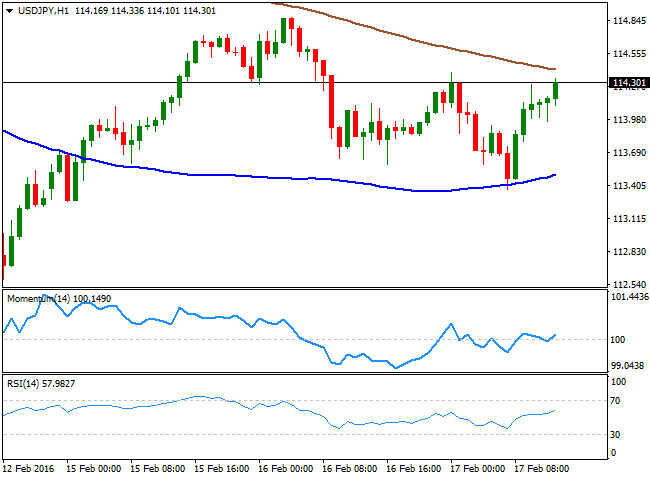

USD/JPY Current price: 114.30

View Live Chart for the USD/JPY

Limited gains on mixed mood. The USD/JPY pair advances above the 114.00 level ahead of the US opening, helped by rising European equities and better-than-expected US data, showing that inflation at factory levels rose in January, leaving negative territory. Housing data showed a slight decline in Housing Starts, but also an improvement in Building Permits during the same month. The USD/JPY pair however, remains within its latest range, with the modest advance still unable to extend beyond the 200 SMA in the 1 hour chart. In the same graphic, the 100 SMA offers a short term support around 113.35, while the technical indicators head slightly higher above their mid-lines, in line with further advances. In the 4 hours chart, the technical indicators are posting nice bounces from their mid-lines after correcting overbought conditions, supporting some further advances towards the 114.85 region, this week high.

Support levels: 114.10 113.70 113.35

Resistance levels: 114.85 115.20 115.50

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.