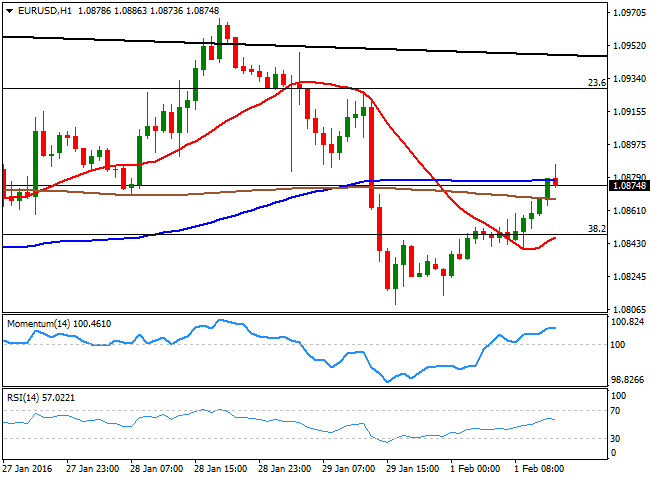

EUR/USD Current Price: 1.0874

View Live Chart for the EUR/USD

The EUR trades slightly higher this Monday, rather finding support in falling oil prices than anything else. The commodity eases as news earlier in the day, spurred risk aversion as the release of the Chinese official PMI survey for manufacturing slipped to 49.4 in January, from 49.7 the month before and short of forecasts of 49.6. In Europe, local PMIs came out mixed, as the German reading resulted at 52.3 against the 52.1 expected and below the 53.2 final December reading. The EU figure matched expectations at 52.3, also below the 53.2 printed in December. US Personal Income rose in December, but spending remained flat, doing little for the greenback across the board.

Technically, the 1 hour chart for the EUR/USD pair shows that the price is unable to advance beyond its 100 SMA, although the 20 SMA heads higher below the current level, while the technical indicators lose upward steam in positive territory. In the 4 hours chart, the price is now below its moving averages, while the Momentum indicator has been rejected from its mid-line, while the RSI indicator hovers around neutral territory. The downside is limited, although the pair lacks strength to advance further. Above 1.0890, the outlook will be more constructive, with 1.0930/60 as the probable bullish target should the greenback come under pressure.

Support levels: 1.0845 1.0810 1.0770

Resistance levels: 1.0890 1.0925 1.0960

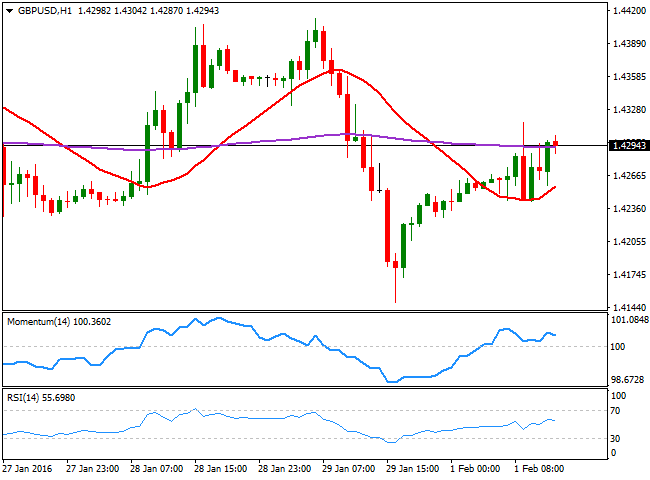

GBP/USD Current price: 1.4294

View Live Chart for the GBP/USD

The GBP/USD pair advanced some at the beginning of the week, but is unable to recover the 1.4300 level, in spite the UK Markit manufacturing PMI for January reached a 3-nth high of 52.9. The short term picture is slightly positive, as the price holds above a bullish 20 SMA, and the technical indicators above their mid-lines, although losing upward strength. In the 4 hours chart, however, the technical picture is mostly neutral as the price is struggling around a flat 20 SMA, while the technical indicators are turning lower around their mid-lines.

Support levels:1.4260 1.4220 1.4180

Resistance levels: 1.4310 1.4350 1.4400

USD/JPY Current price: 121.28

View Live Chart for the USD/JPY

Consolidating at highs. The USD/JPY pair seems unable to attract investors this Monday, confined to a tight 40 pips range ever since the day started. The background trend, however, is bullish ever since the BOJ shocked markets by announcing negative deposit rates, as in the 1 hour chart, the price holds steady near its highs, while the technical indicators have corrected extreme overbought readings and the 100 and 200 SMAs advanced below the current level. In the 4 hours chart, the technical indicators are still in extreme overbought territory, with very limited bearish slopes. The main support comes at 120.60, the 61.8% retracement of its latest daily decline, and approaches to the level may attract buying interest. Above the 121.70 region on the other hand, the pair can extend its rally pass 122.00, particularly if upcoming US data results more encouraging that the income and spending figures.

Support levels: 121.00 120.60 120.15

Resistance levels: 121.70 122.10 122.40

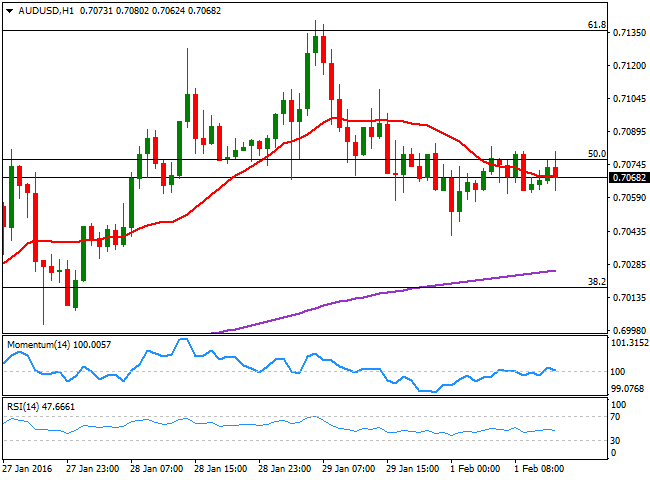

AUD/USD Current price: 0.7068

View Live Chart for the AUD/USD

The Australian dollar is also in a consolidative phase against the greenback, with the pair stuck around the 50% retracement of its latest daily decline. Weakening commodities, however, turn the risk towards the downside. Technically, the 1 hour chart shows that the technical indicators have turned south, but lack strength in neutral territory, while the price is moving back and forth around a flat 20 SMA. In the 4 hours chart, the price is hovering around the 20 SMA and the 200 EMA, both converging in the 0.7060 region, while the technical indicators are going nowhere around their mid-lines. A downward acceleration below the 0.7060, particularly if oil's prices continue to fall, may see the pair approaching the 0.7000 region by the end of the US session.

Support levels: 0.7060 0.7020 0.6980

Resistance levels: 0.7105 0.7150 0.7190

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.