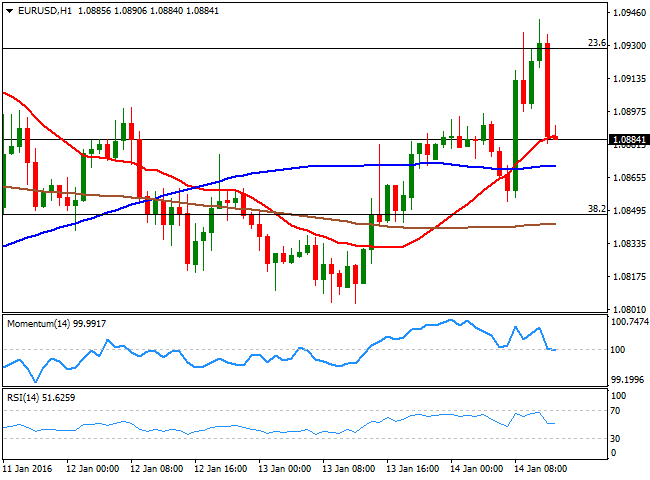

EUR/USD Current Price: 1.0885

View Live Chart for the EUR/USD

The EUR/USD pair reached the top of its latest range mid European session, posting a daily high of 1.0942 as European stocks plummeted after the opening. The pair however, retreated from the strong resistance level, helped by a strongly dovish Minutes from the ECB, showing some members voted for a 20bp rate cut. Anyway, the retracement was mostly technical, given that the price has been rejected from this region multiple times ever since the year started. Technically, the 1 hour chart shows that the price is currently hovering around a bullish 20 SMA, while the technical indicators have stabilized around their mid-lines, limiting slides ahead of the US opening. In the 4 hours chart, the technical indicators have turned south around their mid-lines, whilst the price is above its moving averages, which anyway lack directional strength. Market is being led by sentiment, meaning upcoming moves will depend mostly on stocks and oil.

Support levels: 1.0845 1.0800 1.0750

Resistance levels: 1.0925 1.0950 1.0990

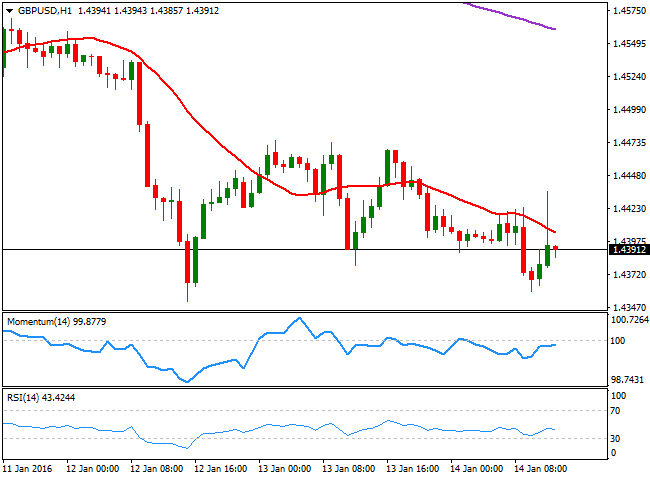

GBP/USD Current price: 1.4391

View Live Chart for the GBP/USD

The British Pound advanced up to 1.4436 against the greenback, following the release of the latest BOE's economic policy decision, showing no changes, as expected, and with 1 out of 9 members voting for a rate hike. The result meeting was less dovish than expected, and that's why the Pound bounced, albeit the dominant bearish trend imposed itself, given that there were no actual surprises. The hour chart shows that the price was unable to extend beyond a bullish 20 SMA, while the technical indicators turned flat within bearish territory after correcting oversold readings. In the 4 hours chart, the price continues meeting selling interest on approaches to a bearish 20 SMA, today around 1.4450, while the technical indicators are hovering near oversold readings, lacking bearish strength but far from suggesting the pair may recover ground.

Support levels: 1.4350 1.4310 1.4260

Resistance levels: 1.4425 1.4470 1.4520

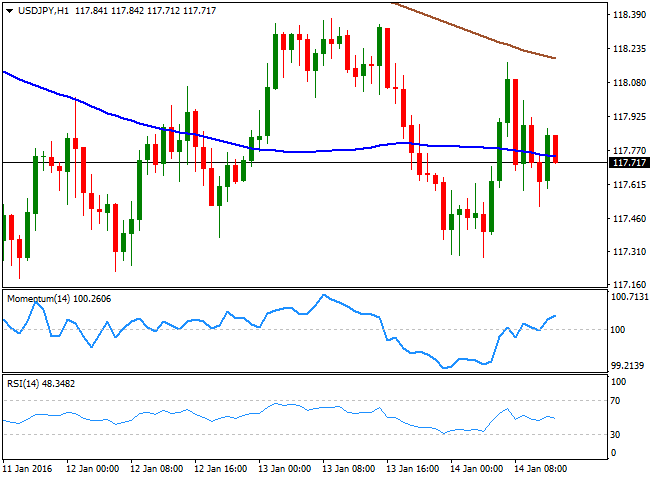

USD/JPY Current price: 117.71

View Live Chart for the USD/JPY

The USD/JPY pair is choppy around the 118.00 level this Thursday, unable to set a clear tone, as uncertainty rules. Stocks are still seeking for direction in Europe, so we may need to wait until Wall Street opening, to see if investors get some clues from there. In the meantime, the 1 hour chart shows that the price remained below a bearish 200 SMA, with the price moving back and forth around a horizontal 100 SMA, as the Momentum indicator heads higher above the 100 level. In the same chart, the RSI indicator has turned south and stands now around 49, anticipating some additional declines on a break below 117.30, the daily low. In the 4 hours chart, the price remains well below its moving averages, while the technical indicators are aiming slightly higher within neutral territory.

Support levels: 117.30 116.90 116.50

Resistance levels: 118.05 118.40 118.95

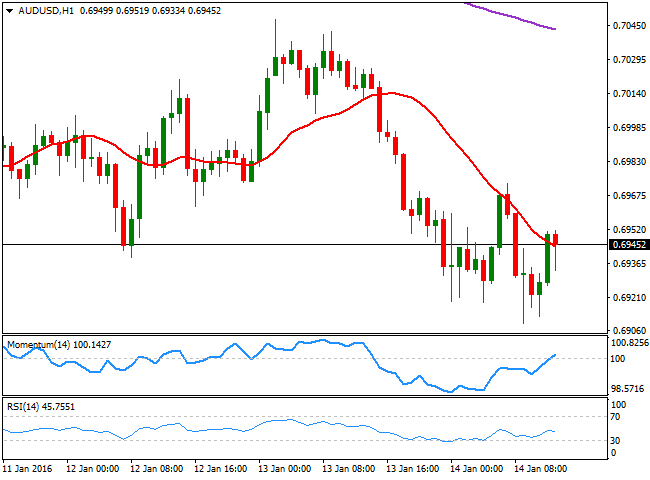

AUD/USD Current price: 0.6943

View Live Chart for the AUD/USD

The AUD/USD pair plummeted to 0.6909, a couple of pips above the multi-year low posted last September at 0.6906, despite Australian employment data released during the Asian session was slightly better-than-expected. Technically, the downside is favored, with the 1 hour chart showing that the price is around a strongly bearish 20 SMA, while the Momentum indicator aims higher around 1000 and the RSI indicator heads lower at 46. In the 4 hours chart, the price is well below its moving average, while the technical indicators head higher below their mid-lines, all of which limits chances of a stronger recovery, but without confirming a new leg south at the time being.

Support levels: 0.6905 0.6870 0.6830

Resistance levels: 0.7000 0.7040 0.7075

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.