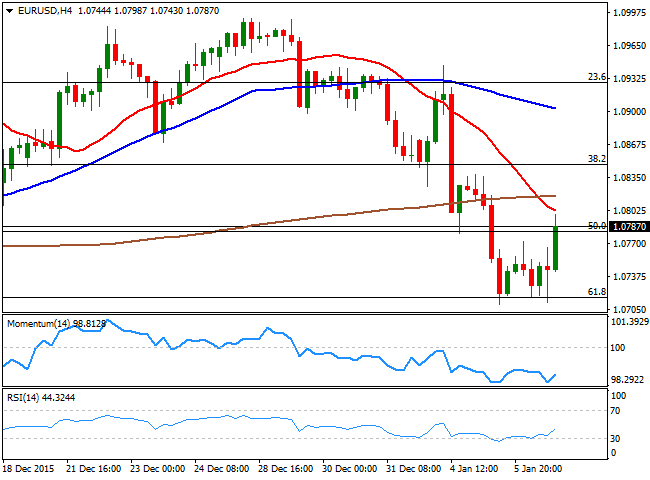

EUR/USD Current price: 1.0785

View Live Chart for the EUR/USD

The EUR/USD pair see-saw between gains and losses for most of this Wednesday, although the dollar traded generally higher across the forex board, during the first half of the day. More bad news coming from China spurred risk sentiment, leading to a strong rally in gold, and more slides in crude, with the commodity reaching fresh multi-year lows as Chinese services sector grew at its weakest pace for 17 months in December, printing 50.2 from a previous 5.2. In the EU however, Markit reported strong gains in the services sector during December, whilst the PPI fell further lower, posting an awful -3.2% yearly basis. In the US however, news were pretty encouraging, with the ADP private survey showing that the economy added 257K new jobs in December, whilst the trade balance's deficit is down to $42.40B in the same month.

Anyway, the dollar came under some selling pressure in the American afternoon, following the release of the latest FOMC Minutes, showing that the lift-off was a "close call," with almost all officials agreeing on economic conditions having been met in December. The EUR/USD surged to its daily high, but remained capped by the 1.0800 figure, unable to confirm a recovery above the 50% retracement of the December rally at 1.0780. Technically however, a short term bullish tone prevails according to the 1 hour chart, as the technical indicators head higher above their mid-lines, whilst the price is bouncing from a horizontal 20 SMA. In the 4 hours chart, however, the price is still below a bearish 20 SMA, while the technical indicators are barely bouncing from oversold levels, suggesting the upside will remain limited as long as the price remains below 1.0810.

Support levels: 1.0750 1.0710 1.0660

Resistance levels: 1.0810 1.0845 1.0890

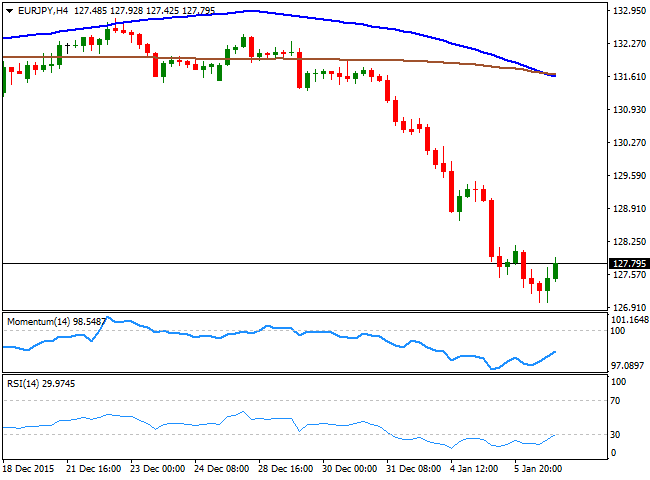

EUR/JPY Current price: 127.78

View Live Chart for the EUR/JPY

The EUR/JPY pair extended its decline down to 127.00 this Wednesday, a fresh 9-month low, although the pair erased most of its daily losses as the common currency recovered ground following the release of FOMC Minutes, exposing FED's officers concerns over low inflation. The EUR/JPY 1 hour chart shows that the technical indicators are recovering, and heading higher above their mid-lines, yet the price is far below its 100 SMA, currently heading south around 129.40, which means that a longer term recovery is still out of the table. In the 4 hours chart, the RSI indicator is aiming higher, but still within oversold territory, while the momentum indicator also bounced from extreme levels and remains far below its mid-line, maintaining the risk towards the downside.

Support levels: 127.50 127.15 126.60

Resistance levels: 128.20 128.65 129.10

GBP/USD Current price: 1.4623

View Live Chart for the GBP/USD

The GBP/USD pair continued falling, reaching a fresh 9-month low of 1.4599 in the American afternoon, and with the following bounce being quite limited, clearly reflecting selling interest continues to dominate the pair. The Pond came under pressure earlier in the day, following the release of the UK Markit services PMI for December, down to 55.5 from a previous 55.9. Soft data has been the main reason for the continued decline of the British currency during the last few months, and it seems investors will keep on selling it as long as the economy fails to signal clear improvement. Technically, the 1 hour chart shows that the latest recovery remained capped by a bearish 20 SMA, while the technical indicators remain within bearish territory, far from announcing additional gains. In the 4 hours chart, the technical indicators are turning slightly higher in oversold territory, while the 20 SMA has extended its decline further lower, now offering a dynamic resistance around 1.4690.

Support levels: 1.4590 1.4550 1.4510

Resistance levels: 1.4690 1.4725 1.4755

USD/JPY Current price: 118.39

View Live Chart for the USD/JPY

The Japanese yen retains its strong tone, having advanced further against the greenback and with the USD/JPY down to 118.24 this Wednesday, helped by risk aversion triggered by weaker-than-expected Chinese data. Additionally, soft FOMC Minutes are weighing on the pair, which aims to close the day near the mentioned low. The pair has been trading range bound for most for the American session, but the bearish bias is still strong according to technical readings, as in the 1 hour chart, the price is well below its 100 and 200 SMAs, while the technical indicators head south below their mid-lines. In the 4 hours chart, however, the technical indicators are turning back lower within bearish territory and after correcting oversold readings, supporting additional declines for this Thursday, with the pair now poised to extend down to 116.60 on a steady decline below the 118.00 mark.

Support levels: 118.25 117.90 117.55

Resistance levels: 118.75 119.20 119.60

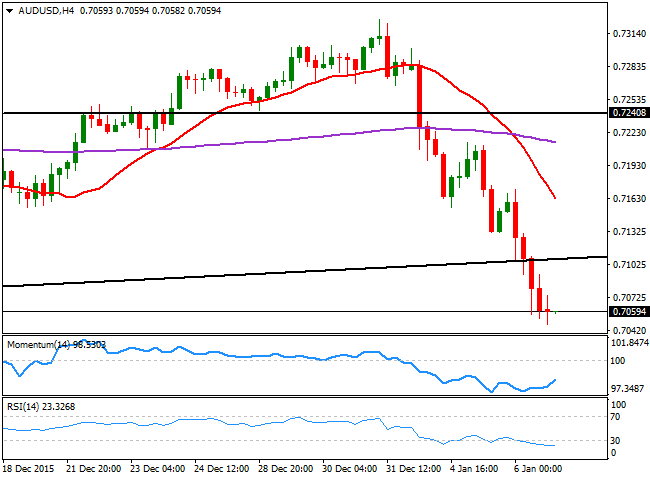

AUD/USD Current price: 0.7059

View Live Chart for the AUD/USD

The Australian dollar broke lower against the greenback, with the pair setting a daily lo at 0.7047 ahead of the release of FOMC Minutes. The AUD/USD pair later bounced, but remained well below the 0.7100 figure, as the poor Chinese data released earlier in the day, affecting by the most the commodity-related currency. Despite a strong recovery in gold prices, the pair has fallen below a daily ascendant trend line coming from September 2015 low at 0.6906, currently at 0.7110, and the 1 hour chart shows that the price is well below a bearish 20 SMA, while the RSI indicator remains near oversold territory, and the Momentum hovers well below its 100 level. In the 4 hours chart, the Momentum indicator aims slightly higher, but far below its mid-line, while the RSI indicator holds in oversold territory, in line with further declines on a break below the mentioned daily low. Large stops are likely to stand below the 0.7000 level, and a break below it should see the price quickly approaching the multi-year low posted last September, the mentioned 0.6906.

Support levels: 0.7045 0.7000 0.6960

Resistance levels: 0.7110 0.7150 0.7195

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.