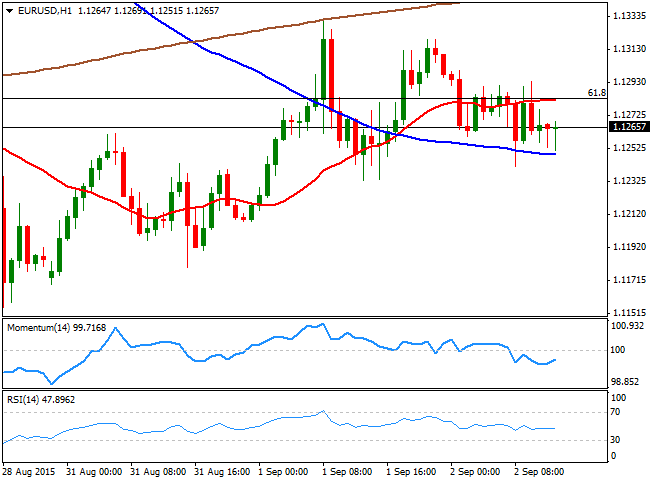

EUR/USD Current price: 1.1260

View Live Chart for the EUR/USD

Markets are quieter this Wednesday, as investors took a step aside ahead of the ECB economic policy meeting on Thursday, and the US Nonfarm Payroll release on Friday. The dollar posted some limited gains against its European rivals, as worldwide stocks halted the bleeding, and trade slightly higher. In Europe, the EU the Producer Price Index for July that matched expectations of -0.1%, whilst year-to-year resulted at -2.1%, triggering no action amongst investors. The US ADP private survey showed that the private sector added 190K last month, missing expectations of 200K, which put some pressure over the American currency, although currencies continue trading in limited ranges. As for the EUR/USD, the pair is back below 1.1280, 61.8% retracement of the latest bullish run, and the 1 hour chart shows that the 20 SMA stands along the Fibonacci level, providing a short term resistance, whilst the technical indicators head lower below their mid-lines. In the 4 hours chart, the technical stance is neutral, with the price hovering around a horizontal 20 SMA and the technical indicators hovering around their mid-lines.

Support levels: 1.1235 1.1180 1.1145

Resistance levels: 1.1280 1.1330 1.1370

GBP/USD Current price: 1.5280

View Live Chart for the GPB/USD

The GBP/USD pair consolidates near a fresh 3-month low of 1.5265, reached during the European morning. Britain's Markit Construction PMI for August resulted at 57.3 against expectations of 57.5 and previous 57.1. Despite the figures showed that the sector is still strong in the UK, the Pound maintains a negative tone, and the 1 hour chart shows that the price is now finding short term selling interest around a bearish 20 SMA, whilst the technical indicators remain directionless below their mid-lines. In the 4 hours chart the 20 SMA is now around 1.5320, while the technical indicators consolidate near oversold readings, losing their bearish strength. The pair needs now to break below 1.5250 to confirm additional declines, whilst upward corrective movements will likely meet selling interest around the mentioned 1.5320 level.

Support levels: 1.5250 1.5220 1.5180

Resistance levels: 1.5290 1.5320 1.5360

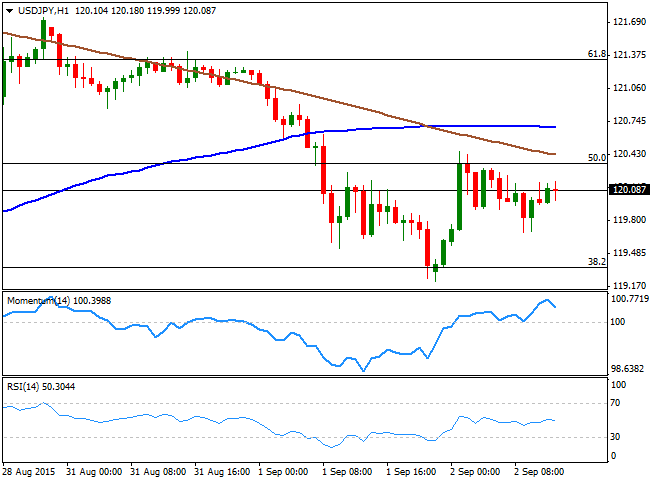

USD/JPY Current price: 120.07

View Live Chart for the USD/JPY

Stuck around 120.00. The USD/JPY pair consolidated around the 120.00 level for most of the first half of the day, bullish in the day, but contained by the 50% retracement of the last two-weeks decline at 120.35. The pair has hardly reacted to the news, and seems limited to the upside in the short term, as the 1 hour chart shows that the price stands below its moving averages, whilst the technical indicators are losing upward strength, and turning slightly lower right above their mid-lines. In the 4 hours chart, the technical indicators have recovered from oversold levels, but have turned lower below their mid-lines, supporting the shorter term outlook, as long as the price remains below the mentioned 120.35 level.

Support levels: 119.80 119.35 118.90

Resistance levels: 120.35 120.60 121.00

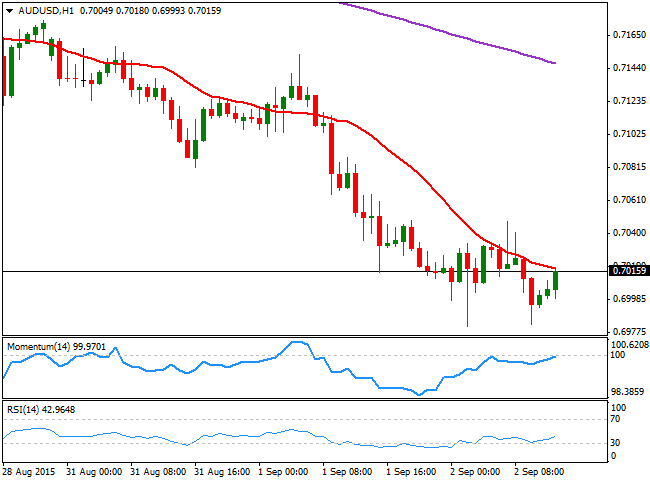

AUD/USD Current price: 0.7016

View Live Chart for the AUD/USD

The AUD/USD pair started the day posting a fresh 6-year low of 0.6981, with a former recovery stalling around 0.7050. The pair maintains a clear bearish trend, although in the short term, is aiming to advance above the 0.7000 region. The 1 hour chart shows that the price is right below its 20 SMA, whilst the technical indicators aim higher, but are still below their mid-lines. In the 4 hours chart, the current recovery seems barely corrective, as the price is well below a bearish 20 SMA, whilst the technical indicators remain directionless near oversold levels.

Support levels: 0.6985 0.6950 0.6915

Resistance levels: 0.7035 0.7070 0.7100

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.