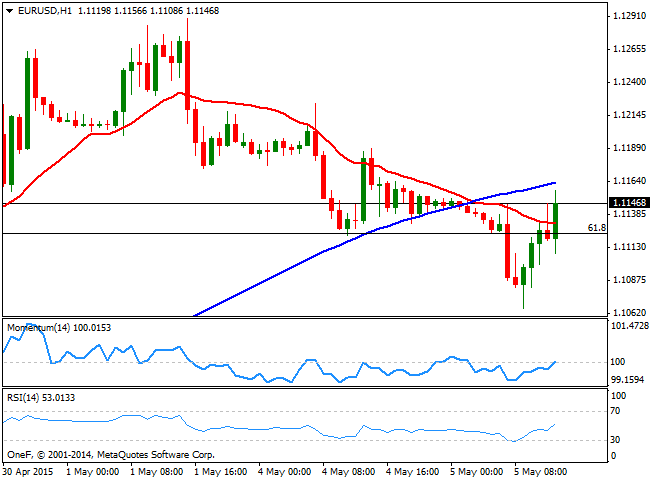

EUR/USD Current price: 1.1147

View Live Chart for the EUR/USD

The EUR/USD pair has fell down to 1.1065 intraday, but recovered some ground amid an optimistic forecast from the EU Commission regarding GDP and inflation figures, both revised to the upside for this 2015. Nevertheless, the pair is accelerating above the critical 1.1120 resistance, following the release of poor US Trade balance figures. Earlier in the day, market rumors pointed for more delays in the Greek drama, with the IMF retreating its support to the country, whilst German FM Schaeuble hit the wires stating he's skeptical on reaching a deal before the next due payment to the international organism. The technical picture shows a limited upward potential as the 1 hour chart shows that the price can't advance its 100 SMA, whilst the technical indicators aim higher, but remain below their mid-lines. In the 4 hours chart the 20 SMA turns lower around 1.1190, whilst the technical indicators maintain their strong bearish slopes in negative territory, supporting a downward continuation towards 1.1050, 38.2% retracement of its latest bullish run and former highs. Should the price hold above 1.1120, the upside is favored towards the 1.1200 price zone.

Support levels: 1.1120 1.1095 1.1050

Resistance levels: 1.1120 1.1150 1.1190

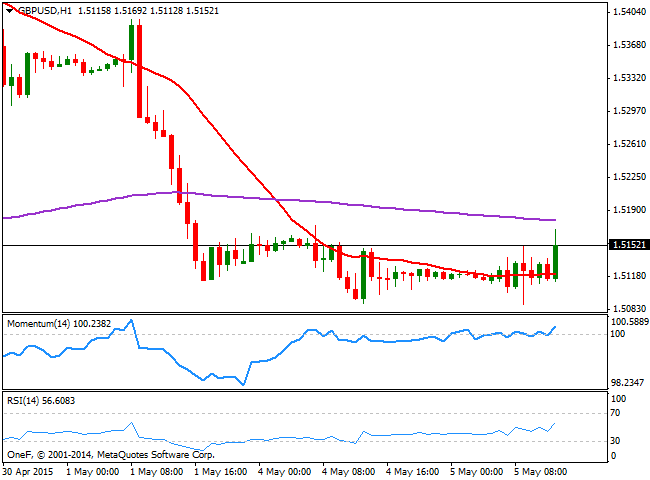

GBP/USD Current price: 1.5150

View Live Chart for the GBP/USD

Investors continue to ignore the British Pound ahead of the general elections to be conducted next Thursday, with the pair stuck in a tight range right above the 1.5100 figure. Additionally, the UK has not released macroeconomic data this week, which only has made the range tighter. Nevertheless, the GBP/USD spiked higher after US data, and the 1 hour chart shows that the price advanced above its 20 SMA, whilst the technical indicators are aiming to move away from their mid-lines. In the 4 hours chart the 20 SMA maintains a strong bearish slope above the current price whilst the technical indicators have recovered from oversold levels, but remain in negative territory, limiting chances of a strong recovery ahead.

Support levels: 1.5130 1.5085 1.5040

Resistance levels: 1.5170 1.5210 1.5250

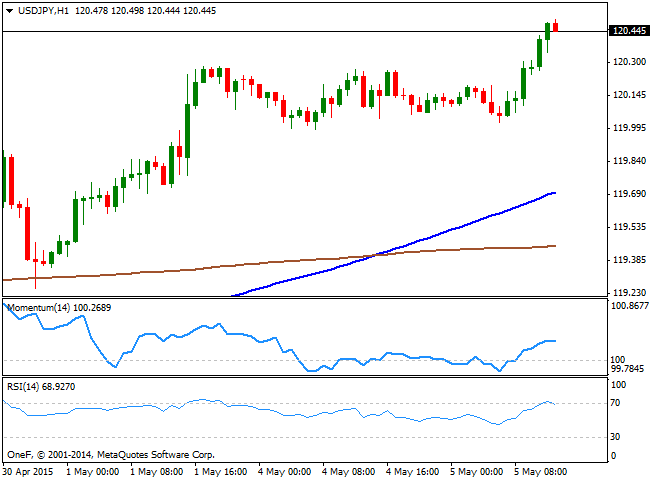

USD/JPY Current price: 120.44

View Live Chart for the USD/JPY

The USD/JPY soared to a daily high of 120.49 as stocks opened with a firm tone, retreating partially from the level after the release of worse than expected US trade balance figures: the deficit surged to 51.37B in March. The 1 hour chart for the pair shows that the technical indicators have turned lower, but are still above their mid-lines, whilst the 100 SMA heads higher above the 200 SMA both well below the current price, something that should keep the downside limited. In the 4 hours chart the technical indicators have retraced from oversold levels, and head lower in positive territory. The pair may retreat down to 120.00 if the dollar keeps fading, albeit the downward risk will remain limited as long as the pair holds above the 120.00 level.

Support levels: 120.00 119.65 119.30

Resistance levels: 120.45 120.85 122.10

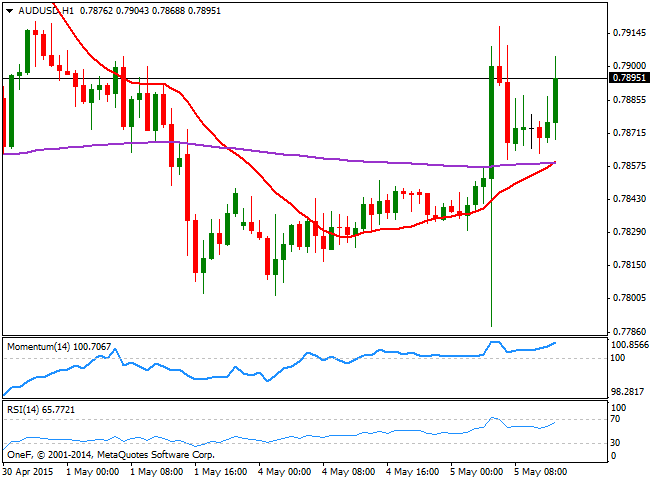

AUD/USD Current price: 0.7892

View Live Chart for the AUD/USD

It was a wild ride for the Aussie after the RBA decided to cut rates down to 2.0% during the past Asian session. The initial reaction of the AUD/USD pair was a freefall down to 0.7788, albeit the pair suddenly changed course and soared up to 0.7917 as investors noticed the RBA was far less dovish than expected. Technically, the 1 hour chart shows that the price extends above a bullish 20 SMA, whilst the technical indicators are aiming higher above their mid-lines, supporting some additional advances. In the 4 hours chart the technical picture is also mild bullish, albeit the price needs to break above 0.7940 to gain upward momentum and approach to last week highs in the 0.8100 price zone.

Support levels: 0.7860 0.7800 0.7770

Resistance levels: 0.7900 0.7940 0.7980

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.