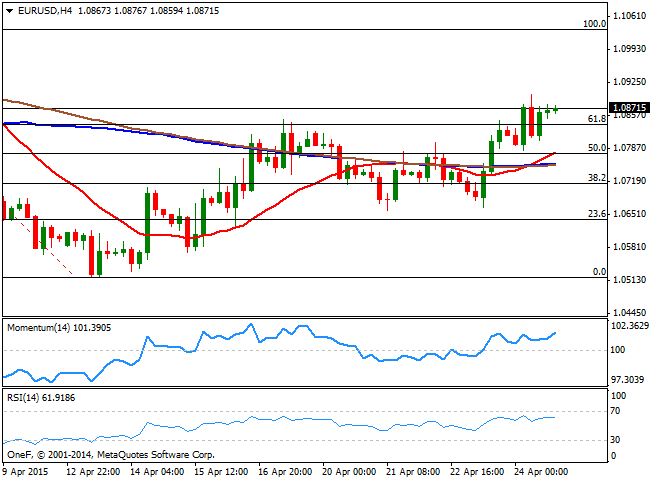

EUR/USD Current price: 1.0871

View Live Chart for the EUR/USD

The last week was all about Greece and tepid US data. Regarding the first, optimism on a deal jumped to speculation of a "Grexit", with the Athena's government and the rest of the Eurogroup throwing the ball to the other side when it comes to determinate who's responsible of the current situation. The Eurogroup meeting that took place during the weekend in Riga, ended with no deal reached, which should increase the risk of an EUR decline. As for the US, March core Durable Goods Orders printed -0.5% against a 0.3% raise expected, although the main reading largely surpassed expectations. Nevertheless, this latest data confirms economic growth has softened during the first quarter of 2015. In the upcoming days, the FOMC will have its 2-day-meeting, which will end with the release of a statement. The general consensus is that there will be no change in the current economic policy, but investors will be looking for clues on when the Central Bank will raise rates.

From a technical point of view, the EUR/USD managed to close a second week in-a-row with gains and above 1.0840, the 61.8% retracement of the daily slide between 1.1034 and 1.0519. The short term picture is bullish, as the 4 hours chart shows that the price holds near last Friday's high set at 1.0899, whilst the 20 SMA heads higher below the current price and converging with the 50% retracement of the same rally in the 1.0780 region. In the same chart, the Momentum indicator heads north above 100, whilst the RSI indicator hovers around 61, all of which supports additional gains, should stops above 1.0900 get triggered.

Support levels: 1.0840 1.0800 1.0760

Resistance levels: 1.0900 1.0950 1.1000

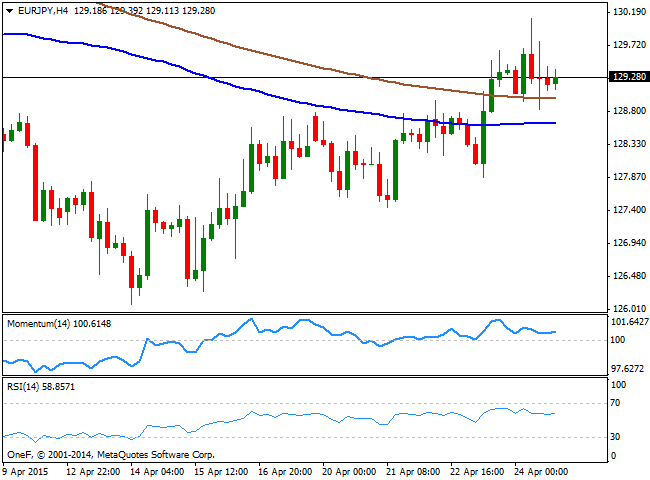

EUR/JPY Current price: 129.28

View Live Chart for the EUR/JPY

The Japanese yen ended the week lower against the EUR, but higher against the greenback, although held within familiar ranges against both. The week will start with a couple of holidays in Japan, but later on in the week, the country will release its inflation figures, and the BOJ will have its monthly economic meeting. Inflation in Japan remains far from the Central Bank target, and is expected to remain subdued, despite the economic stimulus. The Central Bank, however, is expected to keep its policy unchanged. From a technical point of view, the pair presents a mild positive tone according to its 4 hours chart, as the technical indicators head higher in positive territory whilst the price holds above its 200 SMA, for the first time in month. The pair however, needs to establish above the critical 130.00 figure to be able to extend its advance during the upcoming sessions, eyeing an advance up to 131.30, early April high.

Support levels: 129.45 129.00 128.55

Resistance levels: 130.00 130.50 131.10

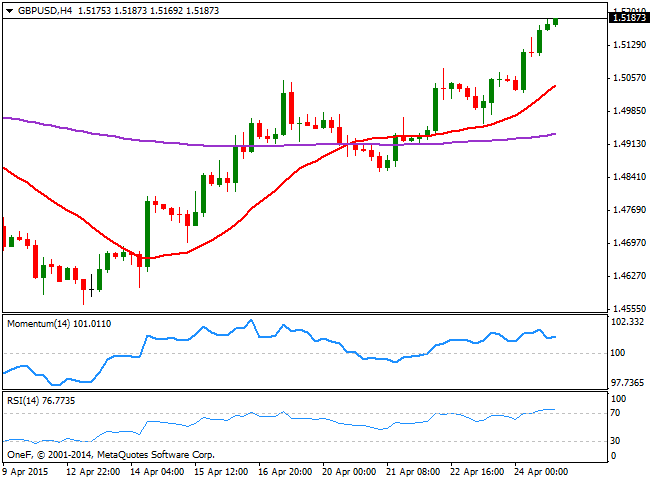

GBP/USD Current price: 1.5187

View Live Chart for the GBP/USD

The GBP/USD pair traded as high 1.5187 on Friday, level not seen since early March, on broad dollar weakness. The British Pound has so far ignored the risk of upcoming elections and the political uncertainty it may follow, if the winning party can't end up with a majority in Parliament, the most likely scenario according to the latest polls. Lowering inflation has also become a risk to the kingdom, particularly after latest BOE Minutes showed that policymakers are expecting it to fall below 0.0% sometime this year. The technical picture however, favors the upside in the short term, as the 4 hours chart shows that the price extended further above its 20 SMA that presents a strong upward slope around 1.504. In the same time frame, the Momentum indicator aims higher after a limited downward correction, whilst the RSI heads higher around 76, both supporting additional advances. Furthermore, the 200 EMA, a key indication of market's dominant sentiment, stands around 1.4930, reflecting buyers maintain the lead.

Support levels: 1.5165 1.5135 1.5100

Resistance levels: 1.5200 1.5240 1.5290

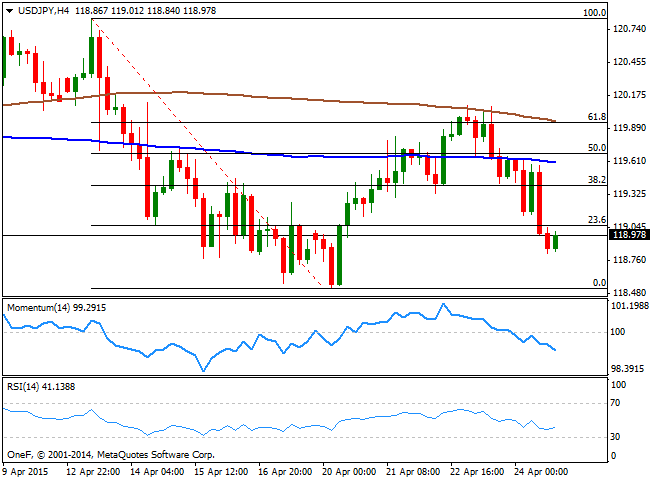

USD/JPY Current price: 118.97

View Live Chart for the USD/JPY

The USD/JPY closed the week a few pips below the 119.00 level, unchanged. The pair surged up to 120.08, but failed to sustain gains above the key level, amid poor US data. Nevertheless, the pair has remained confined to the same 200 pip range for fifth week in a row. Despite both Central Banks are scheduled to have their economic policy meetings this week, none is expected to change its stance, which means the pair may continue to trade in range. Short term, the pair is favored towards the downside, as the 4 hours chart shows that the pair trades well below its moving averages, while the Momentum indicator heads strongly south below 100 and the RSI indicator hovers around 41. The same chart shows that the price stands below the 23.6% retracement of the latest daily decline at 119.10, now the immediate resistance, whilst the mentioned weekly high stands around the 61.8% retracement of the same rally, which increases chances of a retest of the April low at 118.52.

Support levels: 118.55 118.20 117.90

Resistance levels: 119.10 119.50 120.00

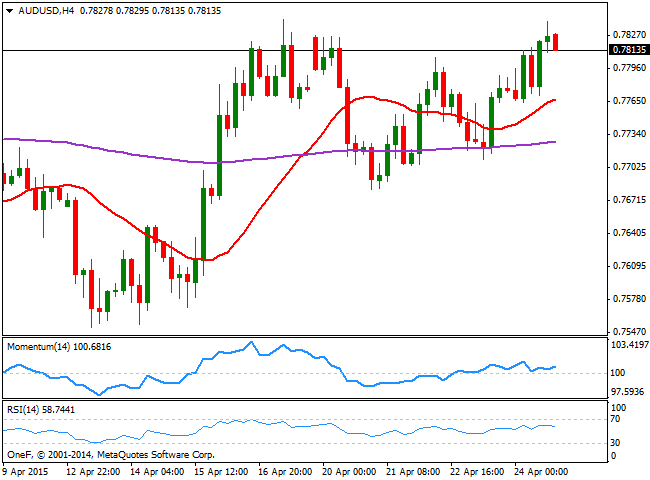

AUD/USD Current price: 0.7813

View Live Chart for the AUD/USD

The Australian dollar surged against the greenback, albeit the pair once again found selling interest around the critical static resistance area around 0.7840. RBA Governor Glenn Stevens is due to speak at the Australian Financial Review Banking & Wealth Summit, in Sydney this Monday, and investors will be looking there for clues of whether the Central Bank will cut rates or not in its May meeting. The overall market sentiment is that the RBA will cut its main benchmark in the short term, something that should keep the upside limited during the upcoming days. Technically, the picture is mild bullish according to the 4 hours chart, as the price advances above a bullish 20 SMA, currently offering support in the 0.7760 region, while the technical indicators stand right above their mid-lines, directionless. Since the pair has set its April high around the mentioned 0.7840 level, stops above the level should be large, which means further dollar declines may trigger a strong upward spike, eyeing then an approach to the 0.7900 region.

Support levels: 0.7800 0.7760 0.7705

Resistance levels: 0.7840 0.7890 0.7940

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.