EUR/USD Current price: 1.0947

View Live Chart for the EUR/USD

The American dollar closed the day generally higher across the board, supported amongst other things, by a slump in oil prices, with Brent crude below $ 50 and WTI nearing $ 45 a barrel. Commodities came under pressure during the Asian session following the release of poor Chinese manufacturing figures, signaling further economic slowdown in the country. In Europe, the release of local PMI for July showed that the sector continued expanding in the area, despite the Greek manufacturing PMI plunged to 30.2, which maintained the EUR limited below the 1.1000 level against the greenback. Later on in the day, US data came out mixed, with an uptick in the PCE price index, whilst personal income came up 0.4% and personal spending increased 0.2%. The ISM manufacturing fell to a 3-month low of 52.7 in July, whilst the Markit reading came out flat at 53.8. Finally, construction spending posted its smallest gain in five months, up 0.1% in June.

The EUR/USD closed the day near its daily low of 1.0940, and with the technical picture favoring another leg lower for the upcoming session, as the 1 hour chart shows that the price remained contained below its 100 SMA in its attempts to advance, while the 20 SMA heads lower above the current price and the technical indicators remain below their mid-lines, although lacking directional strength albeit the restricted intraday range. In the 4 hours chart, the price is below a bearish 20 SMA, whilst the technical indicators diverge from each other, but in neutral territory. At this point the price needs to break below the 1.0920 level to be able to extend its losses towards the 1.0840/60 region, while approaches to 1.1000 will likely continue to be seen as selling opportunities.

Support levels: 1.0920 1.0890 1.0850

Resistance levels: 1.1000 1.1050 1.1080

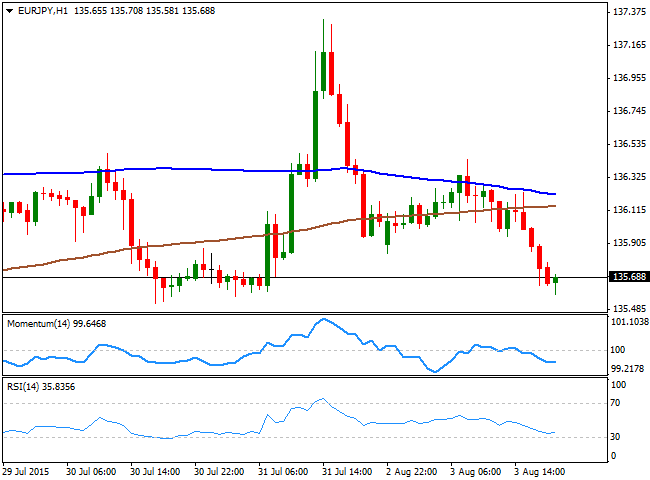

EUR/JPY Current Price: 135.69

View Live Chart for the EUR/JPY

The EUR/JPY fell down to 135.58 by the end of the American session, with the Japanese yen finding strength in falling US stocks and the EUR self weakness. The pair has reached a strong static support level, suggesting a limited bounce may be seen in the current region, albeit the short term bias is bearish, as in the 1 hour chart, the pair is developing well below its 100 and 200 SMAs, whilst the technical indicators hold near oversold territory, losing their bearish strength. In the 4 hours chart, the price is a handful of pips below its 100 SMA, whilst the Momentum indicator holds flat around 100 and the RSI heads lower around 42, maintaining the risk towards the downside, despite the limited directional strength seen at the time being.

Support levels: 135.50 135.10 134.60

Resistance levels: 135.90 136.60 137.10

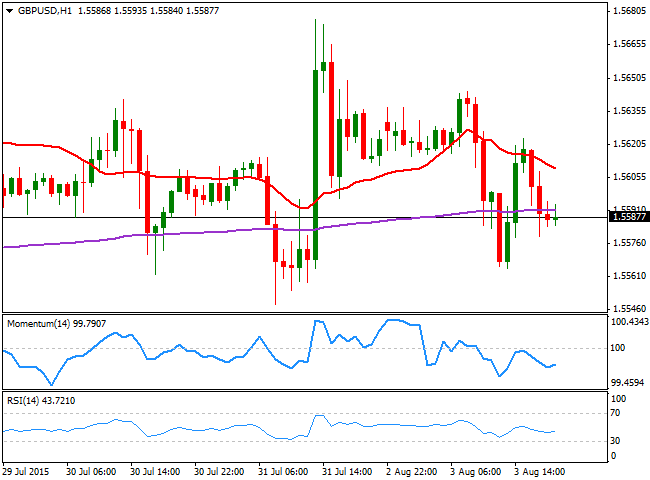

GBP/USD Current price: 1.5587

View Live Chart for the GPB/USD

The GBP/USD pair lost the 1.5600 level during the European morning, triggering some short term stops and falling down to 1.5564, despite the UK Markit manufacturing PMI for July signaled the sector continued growing, up to 51.9 from 51.4 in June, albeit new orders grew at the slowest pace in nearly a year. The pair attempted a recovery after the American opening on the back of US tepid data, but failed to sustain its gains beyond the mentioned 1.5600 level. Technically, the 1 hour chart shows that the technical indicators aim lower below their mid-lines whilst the 20 SMA heads south around 1.5610, favoring additional declines on further declines below the mentioned daily low. In the 4 hours chart, the price has bounced from a horizontal 200 EMA that anyway provides a strong dynamic support since mid last week, and reinforces the idea of a breakthrough of the 1.5560 level to confirm a continued decline. Also, in this last chart, the 20 SMA turned south above the current level whilst the technical indicators head south below their mid-lines, in line with the bearish bias seen in smaller time frames.

Support levels: 1.5560 1.5520 1.5475

Resistance levels: 1.5600 1.5635 1.5670

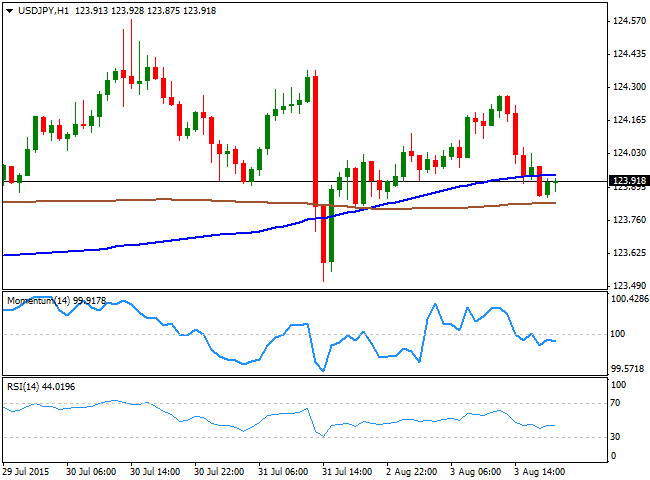

USD/JPY Current price: 123.91

View Live Chart for the USD/JPY

The USD/JPY pair traded as high as 124.26 during the European session, but resumed its decline following the strong sell-off in US indexes, breaking back below the 124.00 figure where it stands. The pair has remained confined to a tight intraday range, and the 1 hour chart shows that the price is now consolidating between its 100 and 200 SMAs, both within a 20 pips range, a clear reflection of the lack of directional strength in the pair, whilst the technical indicators present tepid bearish slopes below their mid-lines, favoring the downside, but not yet confirming a bearish extension. In the 4 hours chart, the technical indicators are also below their mid-lines, but heading nowhere, whilst the 100 SMA stands a few pips below the current level. There are little chances of seeing the pair gaining momentum either side of the board during the upcoming hours, and the more likely scenario is an extension of the 123.30/124.45 range until the release of the US Nonfarm Payroll report next Friday.

Support levels: 123.70 123.30 122.90

Resistance levels: 124.45 124.90 125.30

AUD/USD Current price: 0.7269

View Live Chart for the AUD/USD

The AUD/USD pair edged lower this Monday, trading below the 0.7300 level for most of the day. Australian data resulted for the most positive, as July AIG performance of manufacturing index expanded to 50.4, while HIA new home sales rose 0.5% monthly basis in June against a prior fall of 2.3% in May. Finally, TD securities inflation ticked higher in July, resulting at 0.2%. The Aussie however, was hit by the Chinese China Caixin manufacturing PMI that contracted to a 2-year low at 47.8 in July compared with estimates of 48.2 and down from 49.4 in June. The pair however, held above 0.7250, the immediate support, and the 1 hour chart presents an increasing bearish potential, as the technical indicators stand in negative territory, whilst the 20 SMA turned sharply lower above the current price. In the 4 hours chart, the technical picture is neutral-to-bearish as the technical indicators head slightly lower below their mid-lines whilst the 20 SMA is for the most flat around 0.7300.

Support levels: 0.7250 0.7220 0.7190

Resistance levels: 0.7300 0.7340 0.7375

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.