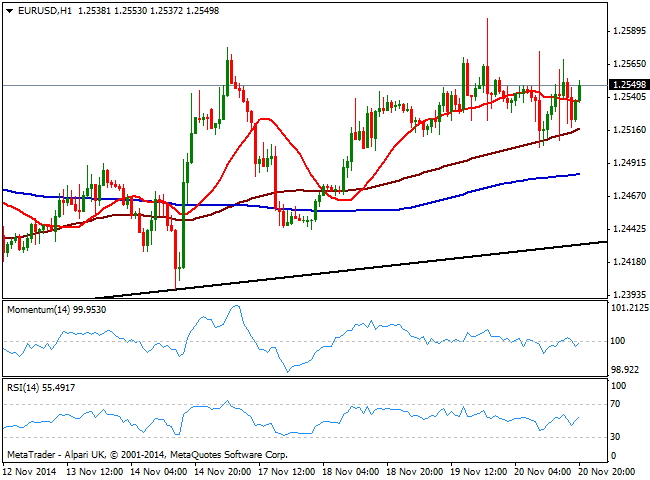

EUR/USD Current price: 1.2549

View Live Chart for the EUR/USD

The EUR/USD pair has once again, failed to define a clear direction this Thursday, despite the notorious imbalance between both economies: earlier on the day, European data shown Manufacturing and Services PMIs in the region fell back particularly in Germany and the EU after last month recovery. In the US on the other hand, inflation rose to 1.7% yearly basis, existing home sales ticked higher, Philadelphia manufacturing survey post it’s highest since 1993, and only weekly unemployment rates missed expectations by printing 291K. However, the dollar was unable to rally on good news, a red flag for buyers.

Technically, the 1 hour chat shows pretty choppy price action within range, with price now above its moving averages, as indicators move back and forth around their midlines, clueless. In the 4 hours chart indicators lack strength but hold above their midlines, while 20 SMA aims higher acting as intraday support now around 1.2525. A higher high of 1.2599 daily basis, suggest some further attempts from buyers are likely albeit sellers won’t give up unless 1.2620 is finally taken, at least in the short term.

Support levels: 1.2525 1.2490 1.2450

Resistance levels: 1.2620 1.2660 1.2700

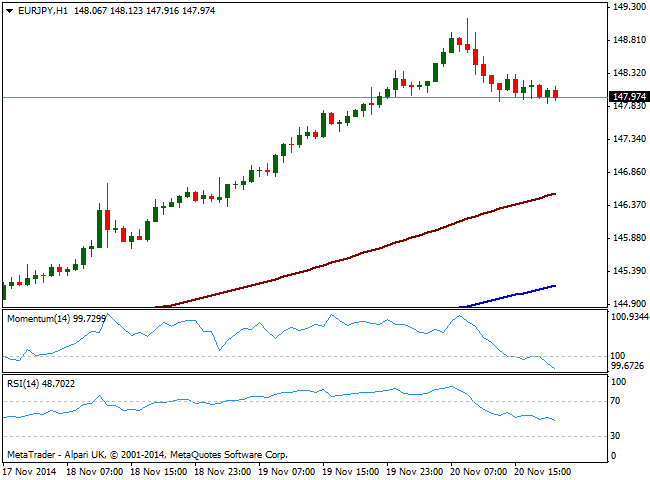

EUR/JPY Current price: 147.97

View Live Chart for the EUR/JPY

Yen continued falling against its rivals in Thursday Asian session, reaching fresh multi-year lows against most of them and sending EUR/JPY up to 149.13. Nevertheless, the pair retraced slowly but steadily from there, finally finding short term buying interest around the 148.00 figure where it stands. Yen’s downward movement may have been too much too fast, and the daily candle, looking like an inverted hammer, may be the first clue of some corrective movement coming ahead. Short term, the 1 hour chart shows price developing well above 100 and 200 SMAs, both with a healthy bullish slope, albeit indicators turned lower, now entering negative territory. In the 4 hours chart momentum turned south still well above its midline, while RSI stands flat at 68, giving room for a deeper corrective movement if initial support at 147.70 gives up.

Support levels: 147.70 147.24 136.90

Resistance levels: 148.20 148.60 149.00

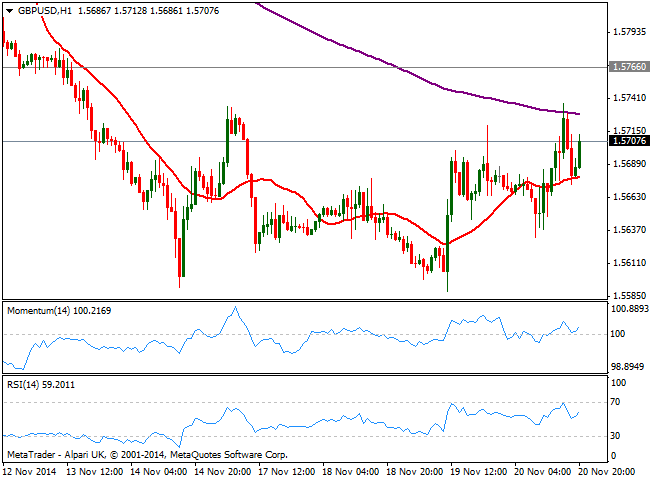

GBP/USD Current price: 1.5707

View Live Chart for the GBP/USDCable posted its second day in a row of gains, stalling however around critical resistance, the 1.5740 price zone: the level stands as the neckline of a double floor established around 1.5585. From the data front, UK Retail Sales resulted well above expected, helping the local currency recover ground against an unattractive greenback. Technically, the 1 hour chart shows price above its 20 SMA and indicators aiming higher after bouncing from their midlines, keeping the short term upward tone alive. In the 4 hours chart however, the picture is much less attractive: 20 SMA stands flat providing intraday short term support around 1.5655, whilst indicators barely aim higher above their midlines, neutral for the most. Some follow through above afore mentioned resistance of 1.5740 should see a quick advance towards 1.5770 a strong long term resistance area. If above this last, sellers will likely retreat, at least temporally, letting the pair run above the 1.5800 figure.

Support levels: 1.5655 1.5610 1.5585

Resistance levels: 1.5740 1.5770 1.5815

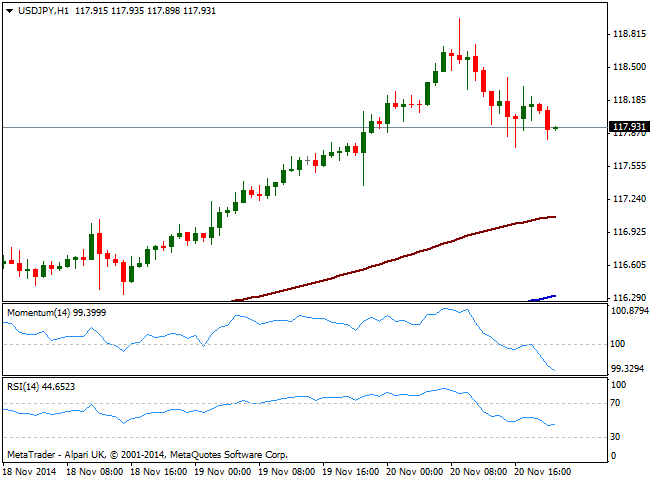

USD/JPY Current price: 117.82

View Live Chart for the USD/JPYAnother day, another figure: the USD/JPY flirted with the 119.00 level early Asia, despite local share markets failed to post higher highs, with Nikkei posting a shy 0.07% advance before the close. Some profit taking and dollar dumping favored latest decline in the pair that posted an intraday low of 117.74. Now struggling to regain the 118.00 mark, the 1 hour chart shows indicators with a strong bearish momentum deep into negative territory, whist 100 and 200 SMAs head strongly up well below current price, the shortest in fact around 117.10. In the 4 hours chart momentum regains the upside after a limited correction in positive territory, while RSI signals a possible downward correction, reentering from overbought territory now at 63. Considering the pair added over 1000 pips ever since the BOJ announced a surprise round of stimulus past October 31st, risk of a stronger downward corrective movement has increased exponentially, moreover on a break below afore mentioned 117.10 level, now the line in the sand for a bearish breakout.

Support levels: 117.80 117.45 117.10

Resistance levels: 118.20 118.60 119.00

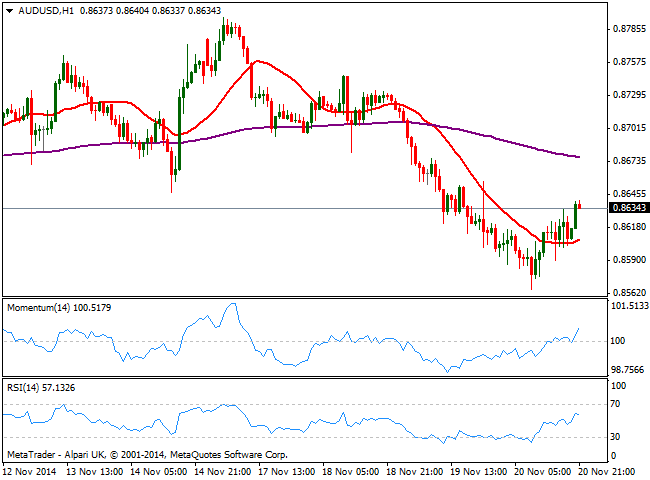

AUD/USD Current price: 0.8634

View Live Chart of the AUD/USDThe AUD/USD decline extended to 0.8565 daily basis, with the pair finally recovering the ground lost over Asian hours and closing in the green. News that Chinese manufacturing output contracted for first time in six months last November down to 49.5, weighted on Aussie, but once again, it was the lack of dollar demand during the last two sessions what helped the pair recover some ground. Daily basis, the picture is still strongly bearish, albeit shorter time frames suggest the pair may extend current recovery during the upcoming hours: the 1 hour chart shows price above its 20 SMA and indicators heading strongly up above their midlines. In the 4 hours chart 20 SMA caps the upside around 0.8670 becoming the level to overcome to see a firmer recovery, whist indicators bounce from oversold level still deep in the red. A drop back below the 0.0.8590 will deny chances of such upward continuation, favoring a quick slide towards 0.8550 in route to 0.8505 price zone.

Support levels: 0.8590 0.8550 0.8505

Resistance levels: 0.8660 0.8700 0.8740

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.