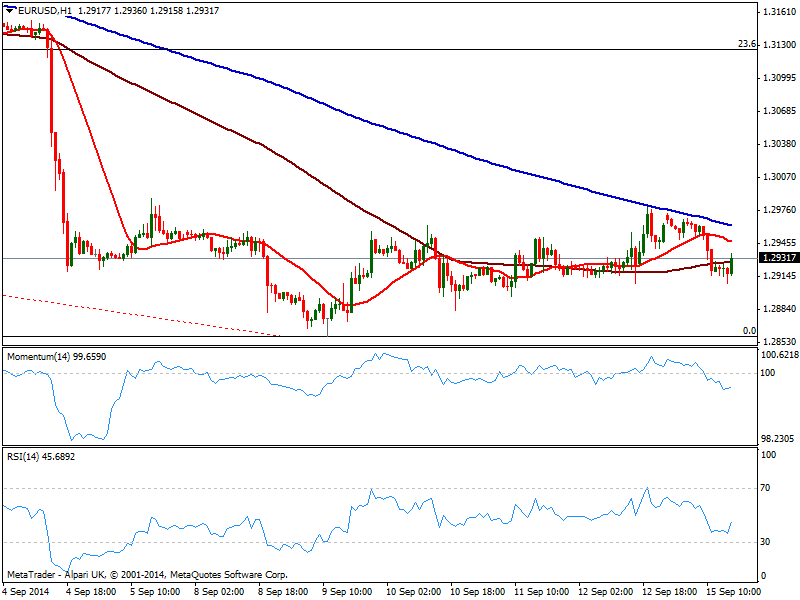

EUR/USD Current price: 1.2931

View Live Chart for the EUR/USD

The EUR/USD bounces from its daily low of 1.2908 early US session, after the release of US NY manufacturing index came out at 27.5 a multiyear high but industrial data missed expectations. Dollar gains however are being limited, ahead of critical data later on the week. In the meantime, the EUR/USD hourly chart presents a mild bearish tone, with price back below its 100 SMA after failing to advance beyond 200 one early Asia, and indicators heading lower into negative territory. In the 4 hours chart technical readings present a more neutral stance, with indicators around their midlines and price around a flat 20 SMA. Lows at 1.2860/80 area should maintain the downside contain if the bearish momentum increase.

Support levels: 1.2910 1.2870 1.2835

Resistance levels: 1.2950 1.2990 1.3045

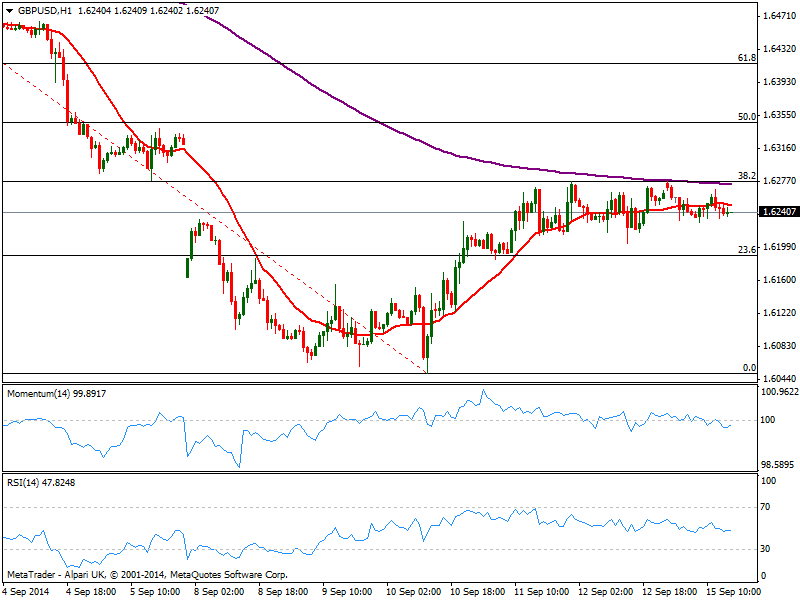

GBP/USD Current price: 1.6240

View Live Chart for the GBP/USD

The GBP/USD entered wait and see mode, with the pair still stuck midrange between Fibonacci levels, ahead of critical UK data starting on Tuesday with local inflation readings. Attempts to rise remained contained by the 38.2% retracement of the latest bearish daily run around 1.6280, with the 1 hour chart showing a quite neutral technical stance as per latest constrained range. In the 4 hours chart indicators turned lower but remain above their midlines, with price approaching a bullish 20 SMA around 1.6220 immediate short term support. Anyway a break below 1.6190, 23.6% retracement of the same rally, is required to confirm a more steady intraday decline towards 1.6140/50 price zone.

Support levels: 1.6220 1.6190 1.6150

Resistance levels: 1.6280 1.6320 1.6350

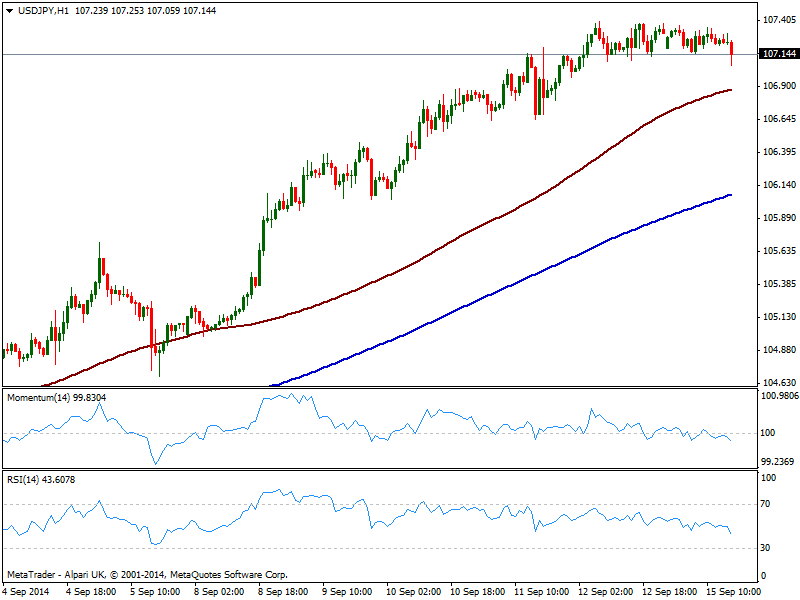

USD/JPY Current price: 107.14

View Live Chart for the USD/JPY

The USD/JPY trades in a limited 30 pips range near its recent multi-month high of 107.38, giving no clues on what’s next in the short term, as per price well above a bullish 100 SMA and indicators with a slightly bearish tone due to latest slide, right below their midlines, yet far from suggesting a strong bearish momentum. In the 4 hours chart indicators had partially corrected extreme overbought leadings but remain well into positive territory, which limits possibilities of a stronger downward move in the short term. 107.40 immediate resistance however, refuses to give up, so a stronger upward acceleration above the level is required to see the pair resuming its bullish trend.

Support levels: 106.80 106.50 106.10

Resistance levels: 107.40 107.90 108.20

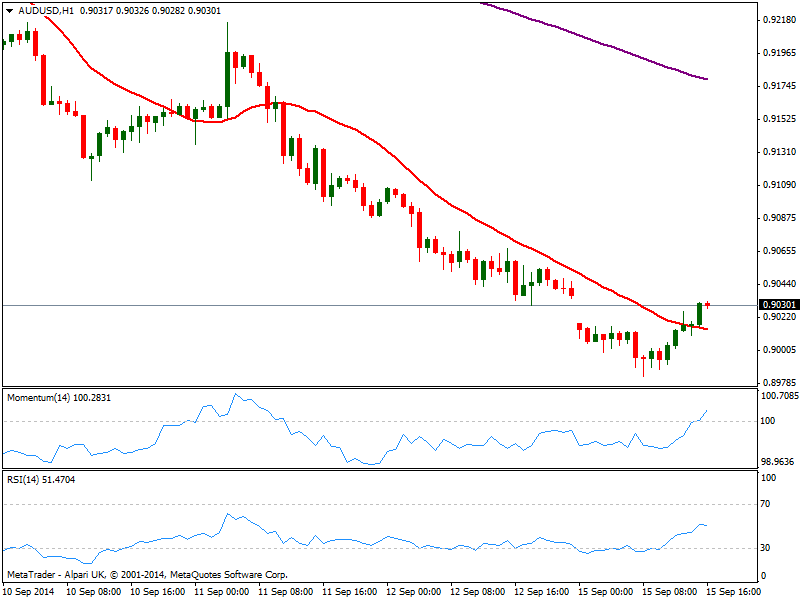

AUD/USD Current price: 0.9032

View Live Chart of the AUD/USD

The AUD/USD tested levels sub 0.9000 early Europe, recovering some ground after weak US data, with the pair filling the weekly opening gap just now. The 1 hour chart shows price above its 20 SMA and indicators heading higher above their midlines, yet price action seems not able to follow through. In the 4 hours chart indicators barely corrected oversold readings before turning back flat well into negative territory, while 20 SMA maintains a strong bearish slope well above current price, limiting chances of a steadier advance.

Support levels: 0.9000 0.8960 0.8920

Resistance levels: 0.9040 0.9070 0.9110

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.