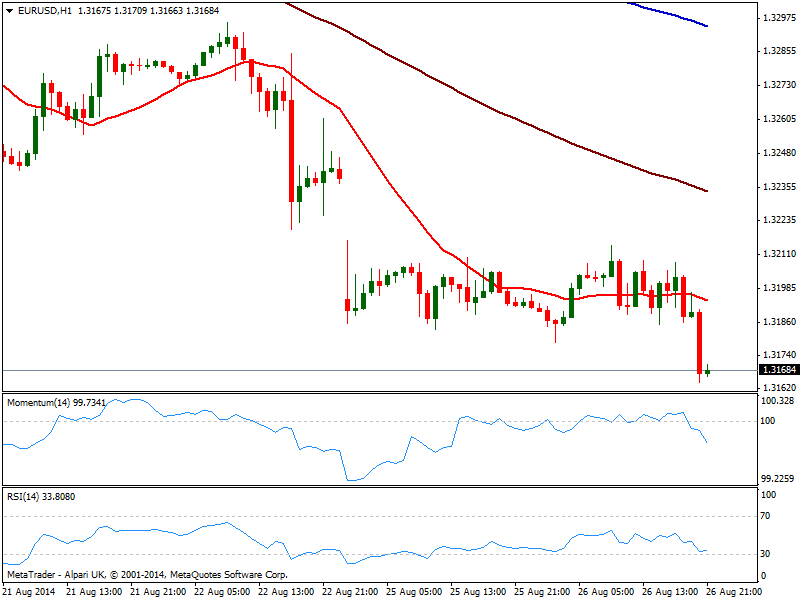

EUR/USD Current price: 1.3170

View Live Chart for the EUR/USD

Action for a change, took place in the American session, with the dollar accelerating higher across the board as stops got triggered on low volumes. For the most, European currencies consolidated within range near their recent multi-month lows against the greenback in the during the first half of the day, with little fundamental news in the old continent, albeit in the US, Durable Goods Orders jumped to 22.6%, with the ex-transportation number resulting down to -0.8%: that resulted from strong gains due to unusually large aircraft orders, albeit the rest of the sectors had remained subdued. Consumer confidence also in the US however, climbed to its highest since 2007, printing an outstanding 92.4, with the dollar regaining the few pips lost after Durable Goods Orders.

The EUR/USD trades at fresh year lows, having so far posted at 1.3164, with the hourly chart showing a stronger downward momentum, albeit due to the sudden break lower, and not because strong selling interest at the time being. In the 4 hours chart indicators head lower near oversold levels, while 20 SMA offers now intraday resistance in the 1.3220 price zone. The dominant bearish trend supports further slides ahead, looking for a test of the 1.3100 figure during the upcoming session.

Support levels: 1.3160 1.3125 1.3090

Resistance levels: 1.3185 1.3220 1.3250

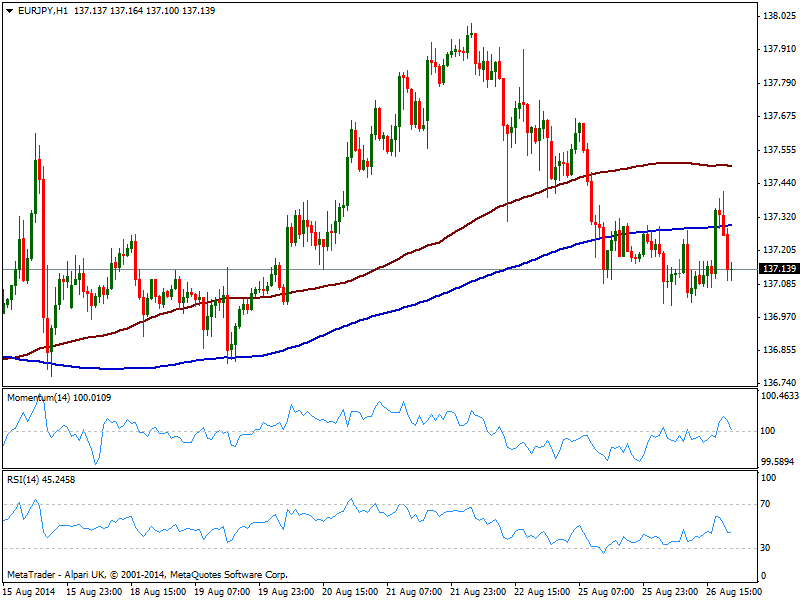

EUR/JPY Current price: 137.13

View Live Chart for the EUR/JPY

The EUR/JPY attempt of recovery faltered around 137.40, with the pair down a few pips its daily opening, holding for now above the 137.00 figure. US indexes traded positive for most of the day thus not far away from yesterday’s closes, with the S&P a few points above 2000 for most of the day. As for the EUR/JPY, the hourly chart shows price extending below its 200 SMA while indicators turned lower but hold so far above their midlines. In the 4 hours chart price hovers around both 100 and 200 SMA, together in a 20 pips range, reflecting latest lack of clear direction, while indicators diverge in negative territory. Price needs to break below the 136.90 to be more bearish constructive towards the 136.00 price zone.

Support levels: 136.90 136.40 136.00

Resistance levels: 137.35 137.60 138.00

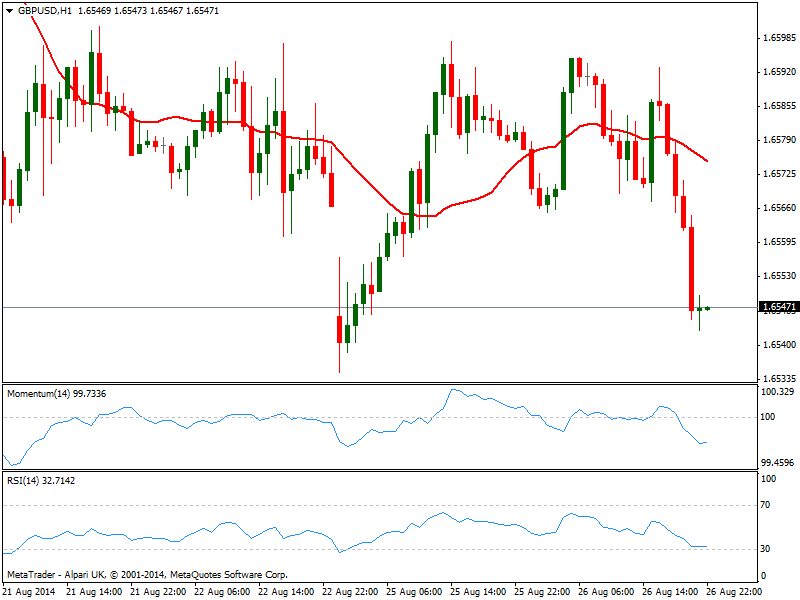

GBP/USD Current price: 1.6547

View Live Chart for the GBP/USD

The GBP/USD pressures 1.6540 support area ahead of Asian opening, with the hourly chart showing price extending away from a mild bearish 20 SMA and momentum turning flat in negative territory, showing not much strength at the time being. In the 4 hours chart indicators gained some bearish slope, but momentum remains around its midline, leaving a neutral to bearish technical stance: some downward acceleration with volume through 1.6540 area is required to see the pair extending its decline, pointing then for a probable test of 1.6465 strong static support.

Support levels: 1.6540 1.6490 1.6465

Resistance levels: 1.6600 1.6630 1.6660

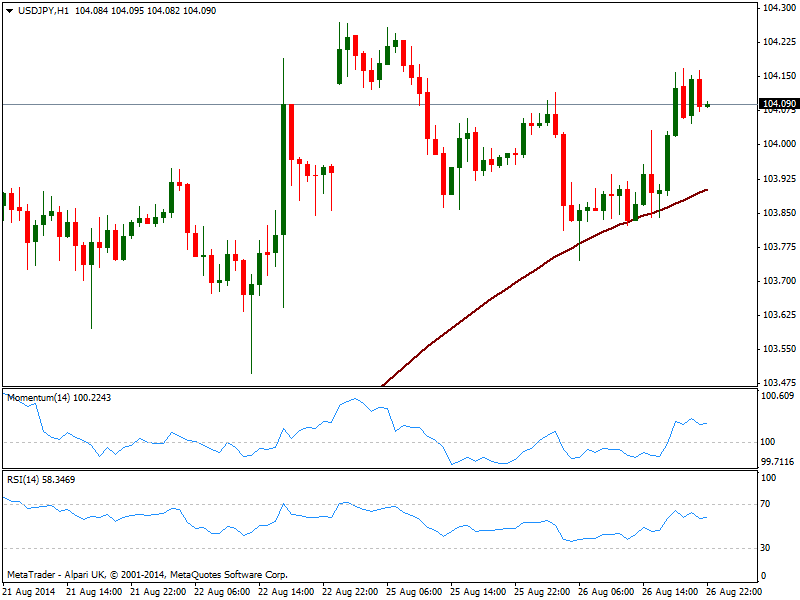

USD/JPY Current price: 104.09

View Live Chart for the USD/JPY

The USD/JPY consolidated around 104.00, having held above 103.70 support yet unable to extend gains beyond recent highs. The hourly chart shows price bounced several times from its 100 SMA, with indicators above their midlines yet showing no directional strength. In the 4 hours chart the technical outlook is also positive but with no directional strength. Some follow through beyond 104.45 is required to confirm a new leg higher, pointing then for a test of 105.00/10 price zone.

Support levels: 103.70 103.20 102.85

Resistance levels: 104.45 104.80 105.10

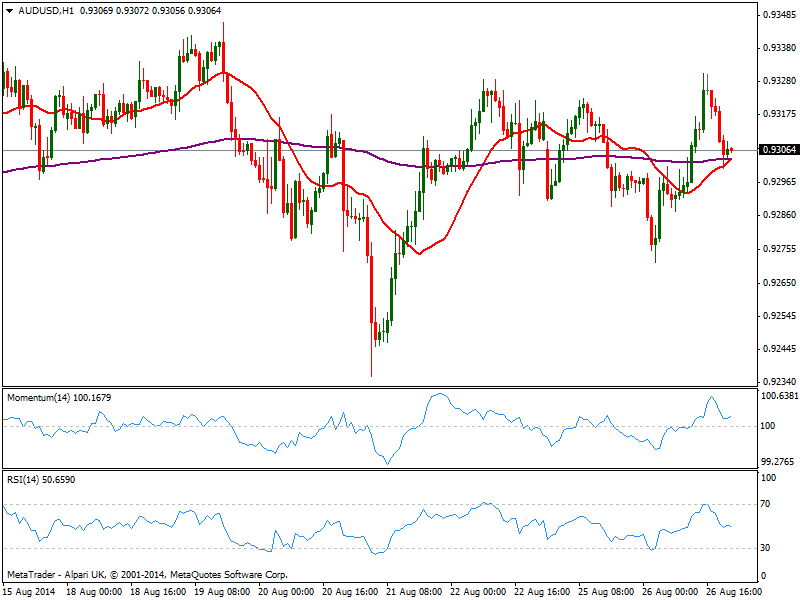

AUD/USD Current price: 0.9306

View Live Chart for the AUD/USD

The AUD/USD found some demand on gold strength and rising stocks, but sellers were stronger at critical 0.9330 resistance, and price retreated from the level. Consolidating around the 0.9300 and with the hourly chart showing price nearing a bullish 20 SMA, a few pips below current price, as indicators corrected overbought readings but stand far from suggesting further falls ahead. In the 4 hours chart the technical picture is neutral, as indicators hover around their midlines with little directional potential.

Support levels: 0.9260 0.9220 0.9180

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.