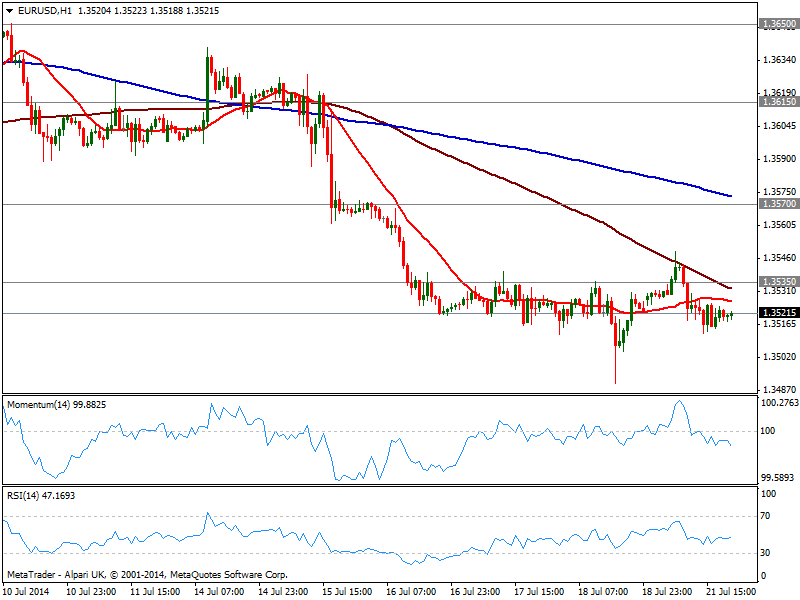

EUR/USD Current price: 1.3521

View Live Chart for the EUR/USD

Monday has ended up pretty much as it started across the forex board, with volume reduced to a minimum on summer vacations and no data to drive majors. As for the EUR/USD the pair continued trading at the lower end of its recent range, having posted a short lived intraday spike of 1.3548 and a daily low of 1.3512. Technically the hourly chart shows price developing below moving averages, with 100 one now around 1.3535 static resistance, and reinforcing the strength of the level, as price stands below a flat 20 SMA a few pips below. Indicators in the mentioned time frame head south below their midlines, although lacking strength due to the tight range. In the 4 hours chart a mild bearish tone is also present, yet some follow through below 1.3510 is required to see an extension towards 1.3476 this year low. Recoveries will find strong selling interest on approaches to 1.3570 former support.

Support levels: 1.3510 1.3476 1.3440

Resistance levels: 1.3535 1.3570 1.3620

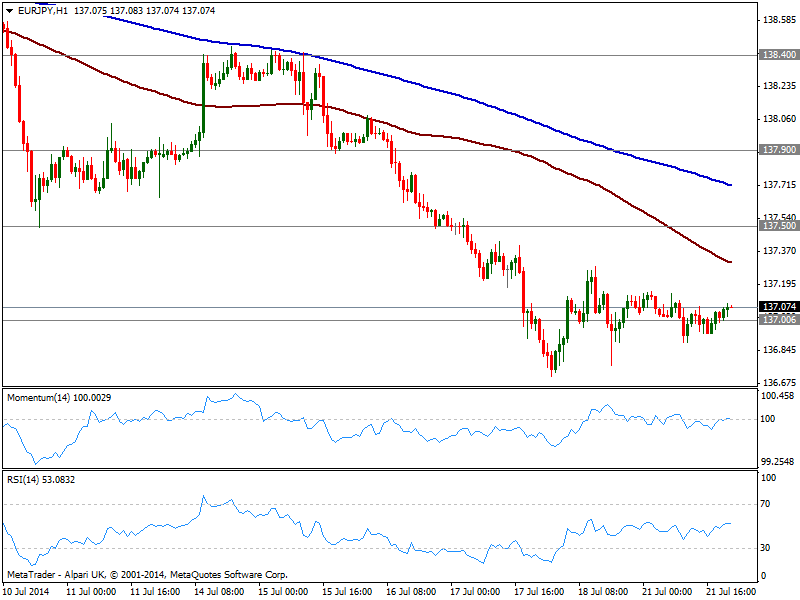

EUR/JPY Current price: 137.07

View Live Chart for the EUR/JPY

Stocks markets were a bit more entertained over the last session, with European indexes strongly down, and leading to a negative opening in Wall Street that saw DJIA down over 125 points. But American indexes managed to bounce and by the session close trade a few points down, still reflecting the strength of the buying on dips. US Yields also edged lower, with yen finally barely up against its rivals and EUR/JPY struggling around the 137.00 mark. Flat in the short term, the dominant trend is still bearish with price near the 5-month low posted last week at 136.70; the hourly chart shows both 100 and 200 SMA with nice bearish slopes above current price and containing the upside, while the 4 hours chart shows RSI flat right above 30 and momentum retracing from below its midline, all of which keeps the pressure to the downside. Critical support continues to be at 136.60 and if broken, the slide may extend closer to 135.00 before finally halting.

Support levels: 137.00 136.60 136.20

Resistance levels: 137.50 137.90 138.40

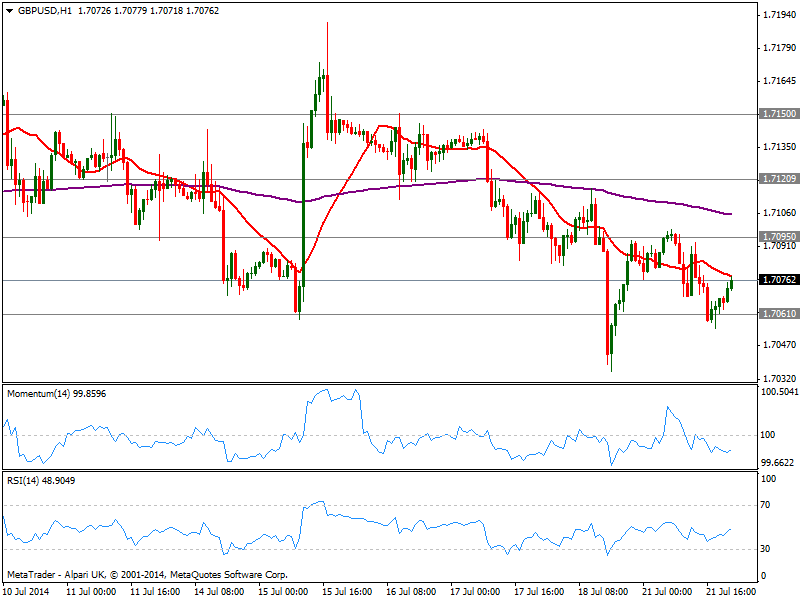

GBP/USD Current price: 1.7076

View Live Chart for the GBP/USD

The GBP/USD has traded lower in range, having tested 1.7060 price zone early US session, and with latest bounce capped by a bearish 20 SMA in the hourly chart, while indicators hold below their midlines in the mentioned chart. In the 4 hours chart a mild bearish tone is also present, but the downward pressure seems limited and moreover corrective, as a top at the multi year high of 1.7190 from this week is far from confirmed. In fact, 1.7060 stands for the 23.6% retracement of the latest bullish run, meaning the correction is quite limited. A break below this last may see the pair approaching 1.7000 area, and even then, risk of a reversal will remain limited, with only a daily close below 1.6985 increasing such risk. To the upside, 1.7150 is the critical resistance to watch as if above, the bullish trend will likely resume.

Support levels: 1.7060 1.7025 1.6985

Resistance levels: 1.7095 1.7120 1.7150

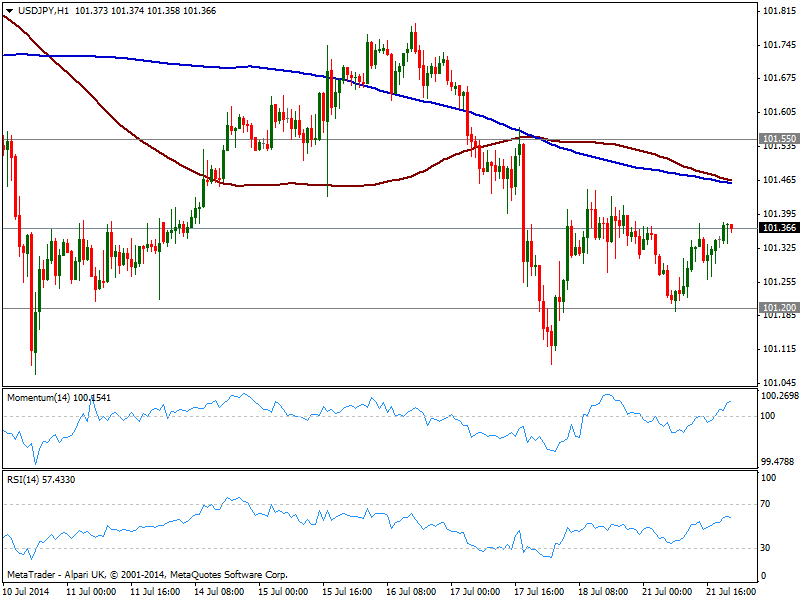

USD/JPY Current price: 101.36

View Live Chart for the USD/JPY

The USD/JPY found short term buyers around 101.20 strong static support area, but remained confined to a tight 20 pips range for most of the day, unchanged from past Asian session opening. The hourly chart shows indicators heading higher above their midlines yet losing upward potential, while 100 and 200 SMA converge around 101.50, acting as dynamic resistance in case of further recoveries. In the 4 hours chart indicators head higher but still in negative territory, while moving averages stand well above current price, all of which limits chances of a strong recovery.

Support levels: 101.20 101.05 100.70

Resistance levels: 101.55 101.95 102.35

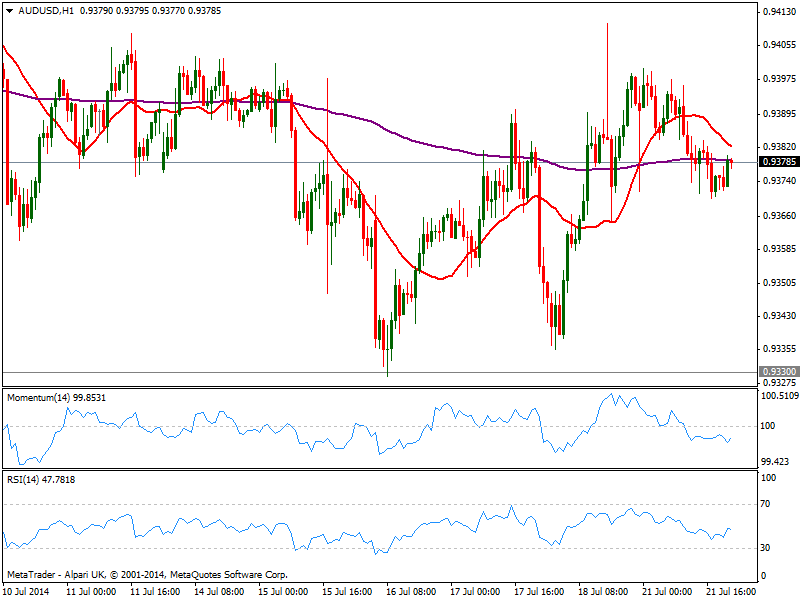

AUD/USD Current price: 0.9378

View Live Chart for the AUD/USD

The AUD/USD closed the day a few pips lower, having been rejected after approaching the 0.9400 figure, but holding above 0.9370 static support. The hourly chart presents a slightly bearish tone, as per price below its 20 SMA and indicators in negative territory, albeit directionless. In the 4 hours chart price struggles to hold above its 20 SMA as indicators turned south and approach their midlines, increasing the downside pressure on a break below mentioned support. Nevertheless, the 0.9330 price zone has proved strong over the past 2 months, and it will be only with a break below it that the pair will be exposed to a stronger slide towards 0.9260 long term support.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.