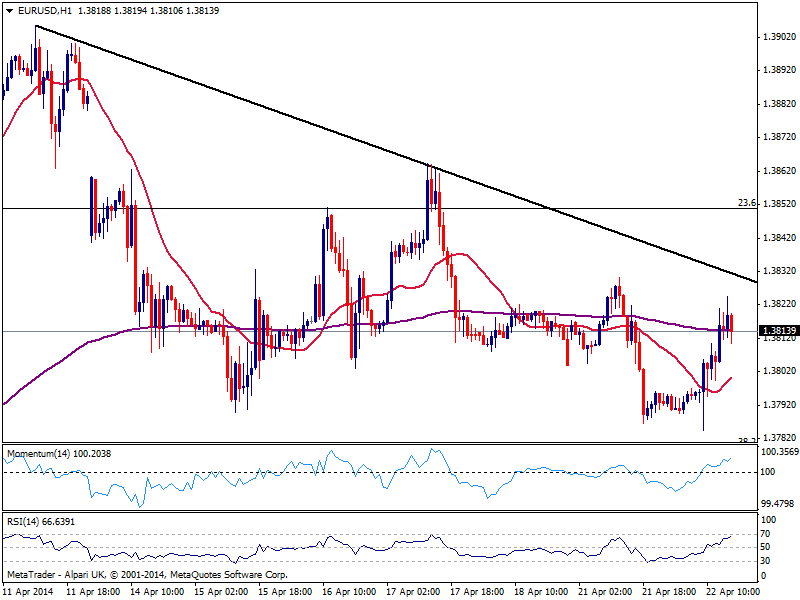

EUR/USD Current price: 1.3803

View Live Chart for the EUR/USD

Tuesday ended up being a more interesting and lively day across the FX board, disregarding of course the EUR/USD, stubbornly confined to its 50 pips range. At this point, seems like while buyers are still defending the downside, they are also reluctant to push it higher amid ECB’s officers jawboning from the past weeks, and there is a good chance the pair will remain range bound until upcoming Central Bank meeting brings light on economic policies. That won’t be the case if Putin strikes and unwinds panic, but that’s something yet to be seen.

Anyway, strong earnings helped US stocks soar along with positive manufacturing and housing readings: immediate market response to the releases saw dollar gain some, albeit movements were quickly reversed. Technically, the EUR/USD keeps finding support in the 1.3780/90 price zone and capped below 1.3825, with technical readings in the hourly chart presenting a quite neutral technical stance. In the 4 hours chart price holds below a slightly bearish 20 SMA, helping keep the upside limited. Nevertheless, only below 1.3730 price zone the pair will increase the risk of a bearish continuation and not before.

Support levels: 1.3780 1.3750 1.3730

Resistance levels: 1.3825 1.3860 1.3890

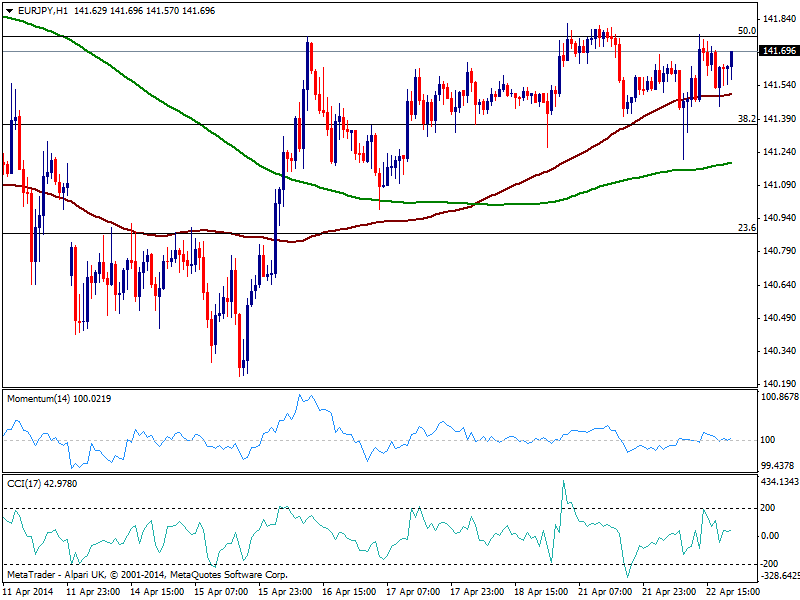

EUR/JPY Current price: 141.69

View Live Chart for the EUR/JPY

The positive tone of US indexes along with rising yields earlier on the day, gave support to yen crosses that rose modestly on the day. For the EUR/JPY price stands near the 141.80 static resistance area ahead of Asian opening, with a mild bullish tone according to the hourly chart, as price holds above 100 SMA and indicators run flat right above their midlines. In the 4 hour chart however, the technical stance is pretty neutral as the pair has been trapped in range for almost a week already. Steady gains above 142.20, 61.8% retracement of the latest daily fall is what it takes to see the pair running higher, eyeing then a retest of the 143.40 highs posted early this month.

Support levels: 141.35 140.90 140.40

Resistance levels: 141.80 142.20 142.60

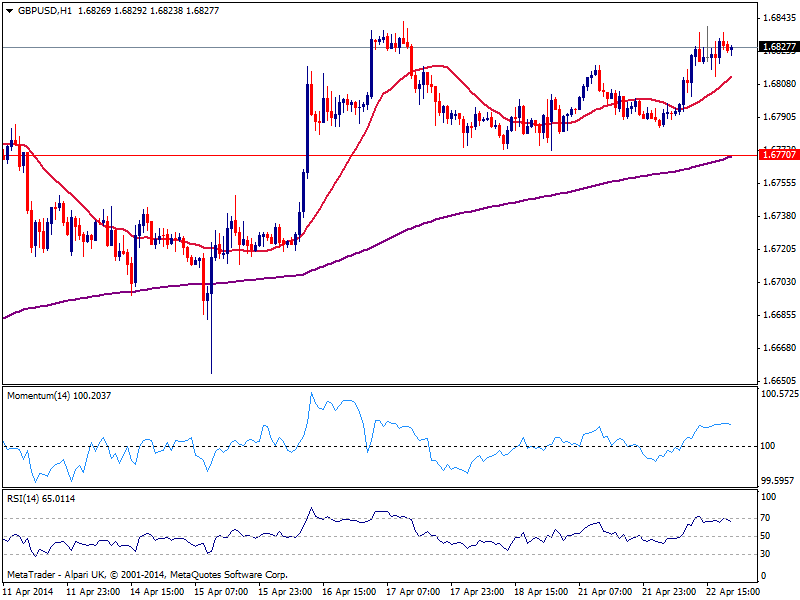

GBP/USD Current price: 1.6827

View Live Chart for the GBP/USD

The GBP/USD advanced up to its year high around 1.6840, establishing for now a short term double roof at the level, with its neckline around 1.6770 static support. With no data coming from the UK, there was little support for buyers, but indeed there are not much sellers around the pair. Technically, the hourly chart shows price above a slightly bullish 20 SMA while indicators stand in positive territory thus not showing momentum at the time being. In the 4 hours chart however, technical readings maintain a strong upward momentum that favors a break of mentioned high in route to 1.7000 for the upcoming sessions.

Support levels: 1.6770 1.6745 1.6710

Resistance levels: 1.6820 1.6870 1.6915

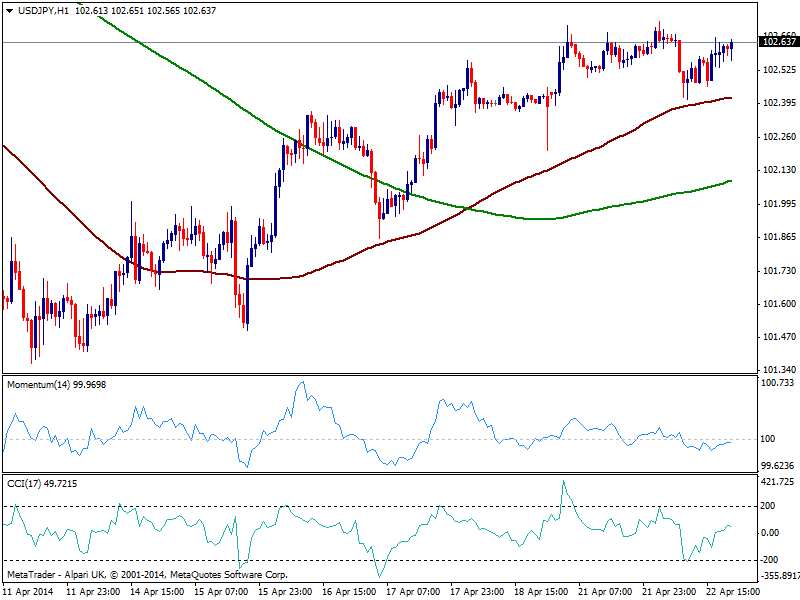

USD/JPY Current price: 102.63

View Live Chart for the USD/JPY

The USD/JPY remains unchanged from past updates, steady around 102.60. As commented before, the pair pressures over the strong static resistance area, but seems unable to advance further: the hourly chart shows price above 100 SMA while indicators hold in neutral territory, losing the mild bearish tone seen early US. In the 4 hour chart, indicators bounce from their midlines supporting a probable test of 103.00 over the upcoming hours.

Support levels: 102.35 102.00 101.55

Resistance levels: 102.95 103.20 103.70

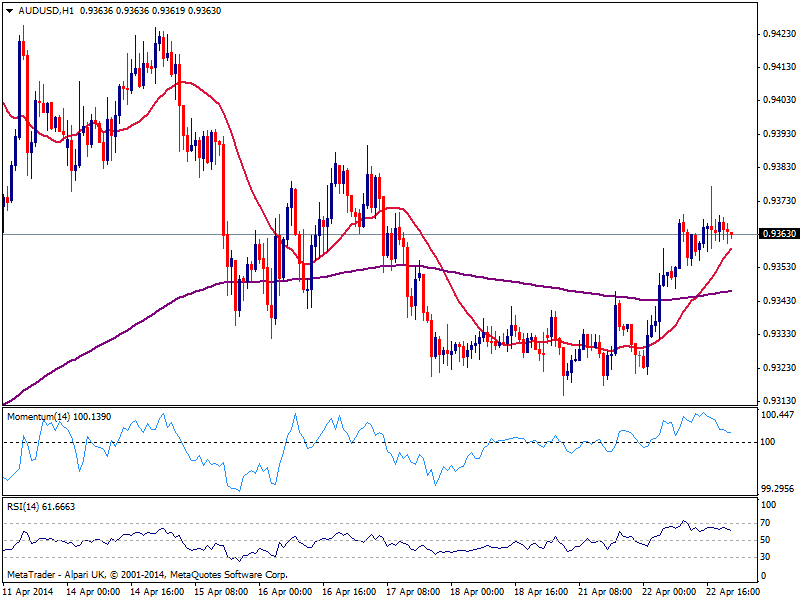

AUD/USD Current price: 0.9363

View Live Chart for the AUD/USD

The AUD/USD holds near the 0.9377 daily high, with the hourly chart showing price steady above a bullish 20 SMA and indicators losing upward strength above their midlines. In the 4 hours chart the technical picture is pretty bullish, which supports a test of the 0.9400 level for the upcoming session, moreover if Australian inflation readings surge above expected.

Support levels: 0.9320 0.9290 0.9260

Resistance levels: 0.9390 0.9435 0.9460

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.