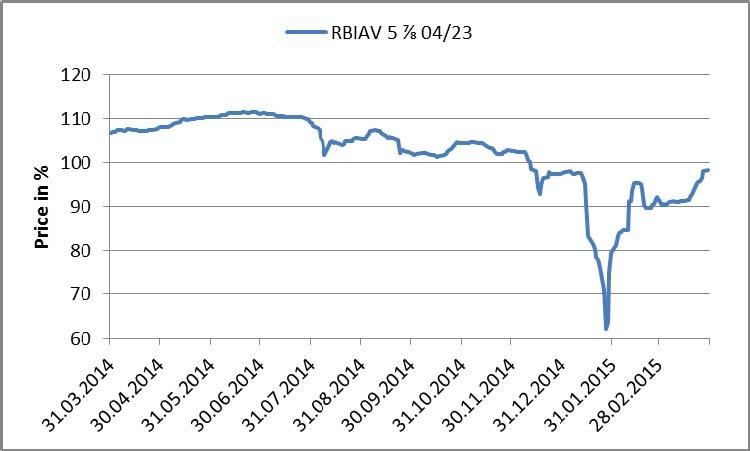

Chart of the Day:

Raiffeisen Rebound: There’s nothing like bad news to boost optimism. CEO, Karl Sevelda, told the press last Wednesday that it may take until 2016 to return to profits as the bank focusses first and foremost on restoring its capital ratios, emphasizing “We’ve said that the overriding goal is to reach the capital ratio of 12% by the end of 2017. All other goals are secondary.” Plans to raise capital ratios fall squarley on a reduction of RWA’s with the sale of Raiffeisen Bank Polska SA a major component of the plan to shrink to health. These statements from the CEO were followed up by comments from Deputy Chief Executive Officer Johann Strobl on Thursday who indicated that RBI will sell additional Tier 1 securities this year. Outstanding sub debt continued its recovery from the January 6th lows on the back of this commitment to scale back business and avoid issuing new equity.

Analysts’ View:

CEE Looking Ahead This Week: The new month is starting this week, which means that PMI indices will be released on Wednesday. For CEE, the question is if we are going to see further positive figures (which would underpin positive risks for the growth outlook), while for Turkey, the question is whether we are going to see further disappointing figures, which could additionally contribute to downside risks there. Before this data, however, on the last day of March, the Romanian central bank is expected to cut the policy rate 25 bps to 2.0%, which should end the easing cycle. Otherwise, as far as data releases are concerned, the week will be mostly packed with data of secondary importance to markets. Maybe the only exceptions from this are the Czech and Turkish 4Q14 GDP releases on Tuesday, and the Slovenian inflation data also on Tuesday. Still on Tuesday, we will see industrial output, retail sales and current account data releases from lots of countries in the region. These data releases should not be extremely important for market movements, but could help analysts ascertain if the currently observable improvement in growth prospects is supported by stable external balance developments in CEE.

Traders’ Comments:

CEE Fixed income: CEE government bond markets remain lackluster as central banks continue to fret over the risk that FX appreciation will derail their efforts to expand monetary policy. Sentiment will be highly dependent on Greece and Fridays US Non-Farm Payrolls this week.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.