In short: short speculative positions, $stop-loss at $247, take-profit at $153.

The cryptographic system underlying Bitcoin might be more adaptable to bank needs than could be generally believed, we read in a commentary by Bitcoin Magazine:

“A company like Goldman Sachs or JPMorgan is hesitant to rely or work with a financial network in which the people keeping it alive are essentially anonymous,” says Popper [a NY Times’ reporter] in a Forbes interview. “Banks have to know who’s transacting and flag it if someone suspicious is involved in the transaction. But it’s quite easy in Bitcoin to have an identity tied to an address in a way that would make a bank feel comfortable.”

(…)

Financial operators are attracted by blockchain-based financial networks with no single point of failure, which could keep running even if one of the participating nodes stops working or is taken out. They are also attracted by the relative speed and low cost of blockchain transactions.

(…)

But, according to Popper, Bitcoin remains a thorny issue for Goldman Sachs, JP Morgan and other top financial players. The problems are Bitcoin’s potential for anonymity, and the fact that the Bitcoin blockchain is “powered by thousands of unvetted computers around the world, all of which could stop supporting the blockchain at any moment.”

Popper reports that JPMorgan and other major banks envisaged a new blockchain that would be jointly run by the computers of the largest banks and serve as the backbone for a new, instant payment system without a single point of failure. The new blockchain, decentralized but closed, would offer the benefits of the current Bitcoin network without relying on end-users for its operations.

We wrote about IBM working on a similar non-Bitcoin blockchain some time ago. We also discussed Goldman Sachs and its investment in a Bitcoin startup. It increasingly looks like banks and other financial institutions are thinking on Bitcoin and that they are simply waiting for more technological solutions. If IBM or some other company comes up with an alternative ledger-based system that could be adapted for the needs of the banks, this might be the breakthrough.

Banks themselves are not very innovative institutions, at least not in terms of specific technology solutions. Because of that, they rely on other entities to deliver appropriate technologic infrastructure. The same may be the case with Bitcoin. IT companies might be working on distributed Bitcoin-based systems that would conform to banking security standards and would allow the financial institutions to avoid anonymity. IBM might be the first company working on such a solution – it is still unclear what final form the IBM research will take. We expect further to follow.

For now, we focus on the charts.

Yesterday, we wrote:

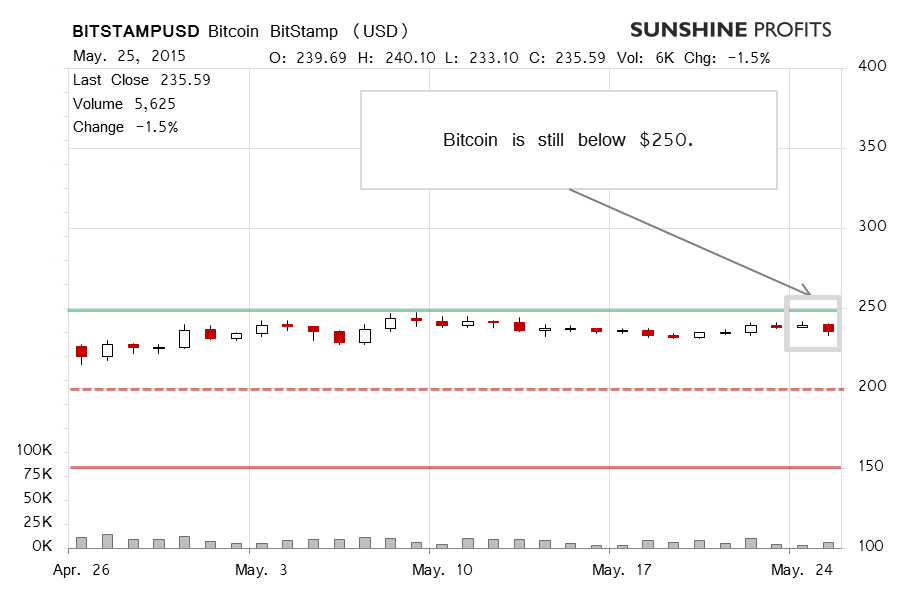

On BitStamp, we saw a move up on Friday. Bitcoin went above $240 and the volume was double the figure we had seen on the previous day. Afterwards, Bitcoin remained relatively stable around $240. Today (…), the currency depreciated, at the very lowest point completely reversing Friday’s gains, before it rebounded slightly. Currently, the currency is still in the red for the day. The volume, however, hasn’t been very strong. What does the Friday’s move mean for Bitcoin traders? Is a new move up underway?

It seems that this is not the case. The currency stopped short of $245 on BitStamp and there has been no more appreciation and no more significant jumps in volume. Quite importantly, part of Friday’s move up has been erased today, so far. Bitcoin is now further away from our $247 stop-loss level. The lack of more appreciation and the price/volume action now seems to support a move back in line with the longer trend, to the downside.

There was depreciation yesterday and on increased volume. Does this mean that the big move has already started? This might not be the case. The situation still looks very much bearish as outlined in our yesterday’s comments. The move, however, hasn’t been strong enough to suggest that a slump has started just now. This might mean that there’s still time to position oneself ahead of the possible move.

On the long-term BTC-e chart, we don’t see many changes compared with yesterday. In our previous commentary, we wrote:

Bitcoin is still below both $250 (green line in the chart) and the possible rising trend line, and the situation doesn’t look all that bullish. Actually, it seems largely unchanged from Thursday

(…)

(…)

(…) Bitcoin has come back since then [Friday], and the most recent move has been to the downside. It seems now that Bitcoin might actually be closer to a move down. The environment remains tense and observing the market particularly closely at this time might be a good idea.

As we haven’t really seen much change, it seems that our previous comments remain up to date and the short-term outlook remains bearish.

Summing up, speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, $stop-loss $247, take-profit at $153.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.