Yesterday the Twitterverse was agog at the likelihood that after 6 down days in the row the Dow was likely to rally last night - and so it came to pass with US stocks up across the board even after the Nasdaq had to suspend trading on its board after some glitches hit its network.

At the close the Dow was up 0.45%, the Nasdaq rose 1.09% and the S&P 500 rose 14 pts of 0.86% to 1657. European stocks were similarly ebullient with the FTSE up 0.88%, the Dax rose 1.36%, the CAC rose 1.09% while stocks in Milan and Madrid rose a pretty solid 2.56% and 1.99% respectively.

Supporting the expectation that stocks were going to bounce was the better than expected data out of China yesterday which saw the release of the HSBC flash PMI print at 50.1 for a massive bounce from the 47's last month. But data in Germany and France which was lower for their manufactiing PMI belied the fact that somehow the EU area manufacturing PMI managed to rally.

Anyway it strikes me that last nights move was more about pessimism fatigue than anything else really and the market came ready to buy because everyone thought after 6 days the Dow should rally - and so it did.

Rates traders weren't so excited though with US 10's a little lower than the highs in overnight Asian trade yesterday but still finishing at 2.89%, Bunds were higher though at 1.92% and Gilts are at 2.72%. This divergent price action just reinforces to me that the stock move was about the recent sell off and nothing more.

Other data released last night showed Initial Jobless claims in the US rose from last week's 4 year low of 323,000 to 336,000 and the US Markit manufacturing PMI was 0.1 higher at 53.9.

On FX markets after some heavy selling yesterday morning the Aussie dollar found a floor jjst before the release of the HSBC Chinese PMI which has me and many others believing that the data integrity needs to be questioned again as it appeared to have leaked into the market pre-release. Indeed iit is my view this was likely the case and certainly the twitterverse seems to conclude that this is the case.

Now of course it could be a lucky guess with some big trader somewhere just deciding the data was going to print better and running a position accordingly. But there is a pattern of trade in Chinese data releases - or should I say pre releease which continues to reoccur and where there's smoke - well you know the rest.

This is not just the view of one grumpy trader who was short Aussie dollars because I was only small short and have taken the rally as an opportunity to go very short once more. But for the sake of market integrity HSBC and Markit must act to ensure that at the very least it is only traders punting on better data that is driving pre-releases not a leak of data which is what old timers like me and the Twitterverse are very suspicious off.

Indeed I reduced my shorts from 5 or 6 units to 2 units by yesterday morning and I was seriously considering squaring up into the HSBC PMI when my TwitterFeed started going a bit psycho about the data being leaked. But I am core short and in a bear market I'm bearish so I left the positions on.

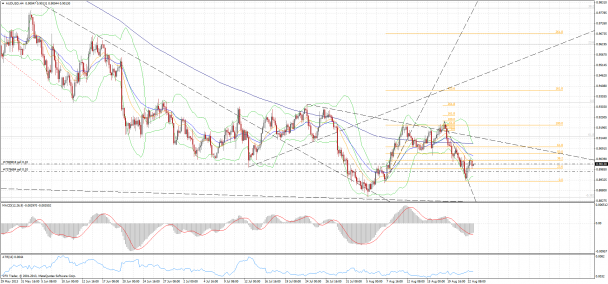

So I'm under water at the moment in both accounts but not worried because the Aussie's rally has clearly been met with some serious selling as the reaction in FX markets has been to recognise that a shift is on and that a knee jerk Aussie rally in the face of Emerging Market ructions and a struggling Australian economy would be a very optimisitic long.

As I tweeted yesterday even though I was short Aussie I was minded of what happened after the last ramp in the Aussie - which was a rally and then a huge sell off. It is as though the half life of Australian Dollar positivity is getting shorter.

The view is still that the Aussie is headed back to the 0.8830-60 region and then we'll see.

In other pairs Euro (1.3355) is largely unchanged after recovering off a 1.3297 low. GBP (1.5585) is down 0.4% but also well off the lows and the Yen is under pressure with USDJPY up more than 1% to 98.73.

On Commodity markets Gold was up to $1372 a rise of almost $20 on the low yesterday, Nymex Crude was up 1.27% to $105.17, Dr Copper was back at $3.33 lb and our friends the Ags were at it again with Corn down 1.91%, Wheat fell 1.37% and Soybeans were 0.83% lower.

Data

On the data front a fairly quiet slide into home plate this week with FDI in China, GDP in Germany, again, GDP in the UK and New Home Sales in the US.

Have a great day

Greg

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.